Skift Take

The short-term rental ecosystem is getting bigger, which means many winners are set to emerge from the pack. Expect further brand-driven professionalization, more outside investment, and vendor consolidation. Those getting on board will benefit, but is a backlash in the cards?

Skift Megatrends 2020

We recently released our annual travel industry trends forecast, Skift Megatrends 2020. Download a copy of our magazine here and read on for highlights online.

Airbnb has signaled that this will be the year that it will finally go public. Investors and vendors are jostling for position to benefit from the added spotlight this will put on alternative accommodations. Airbnb itself is also acquiring and investing in companies to ensure a positive outcome.

With the added scrutiny, 2020 promises to see clear winners emerging from this fragmented category.

A booming sector

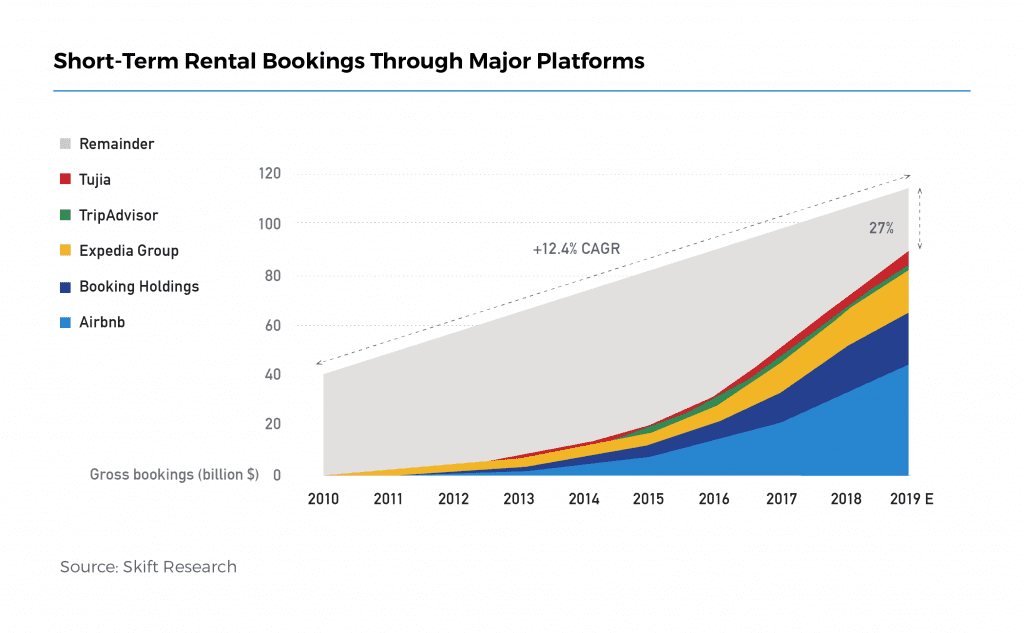

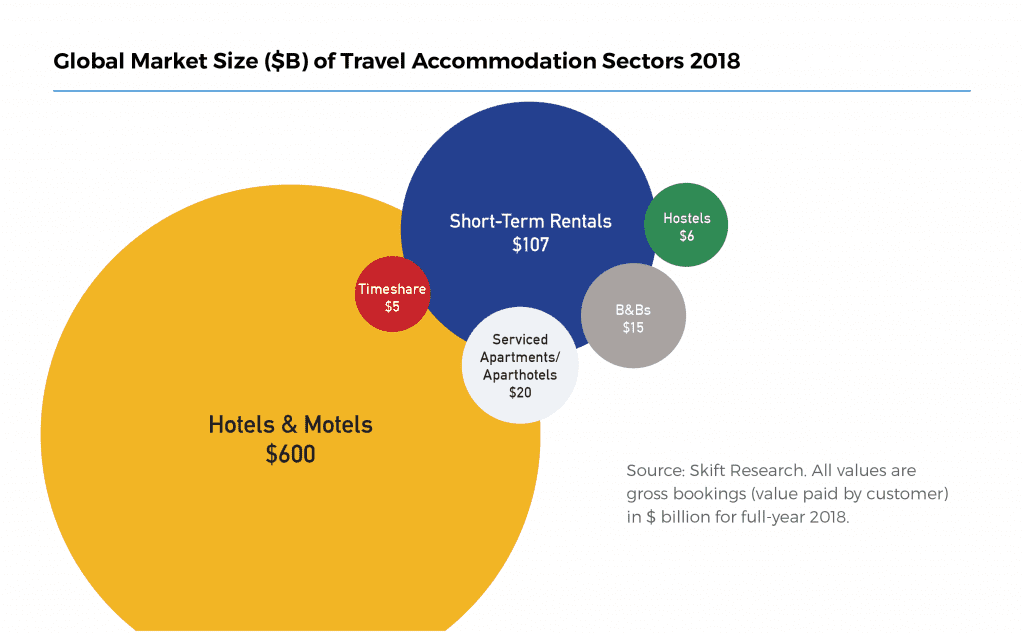

Skift Research estimates that global gross bookings of short-term rental properties grew 7 percent in 2019 to a total of $115 billion. Five companies — Airbnb, Booking Holdings with its Booking.com and Agoda platforms, Expedia Group with its Vrbo/HomeAway, TripAdvisor, and Chinese platform Tujia — registered 73 percent of all bookings, showing how the booking landscape has become highly consolidated.

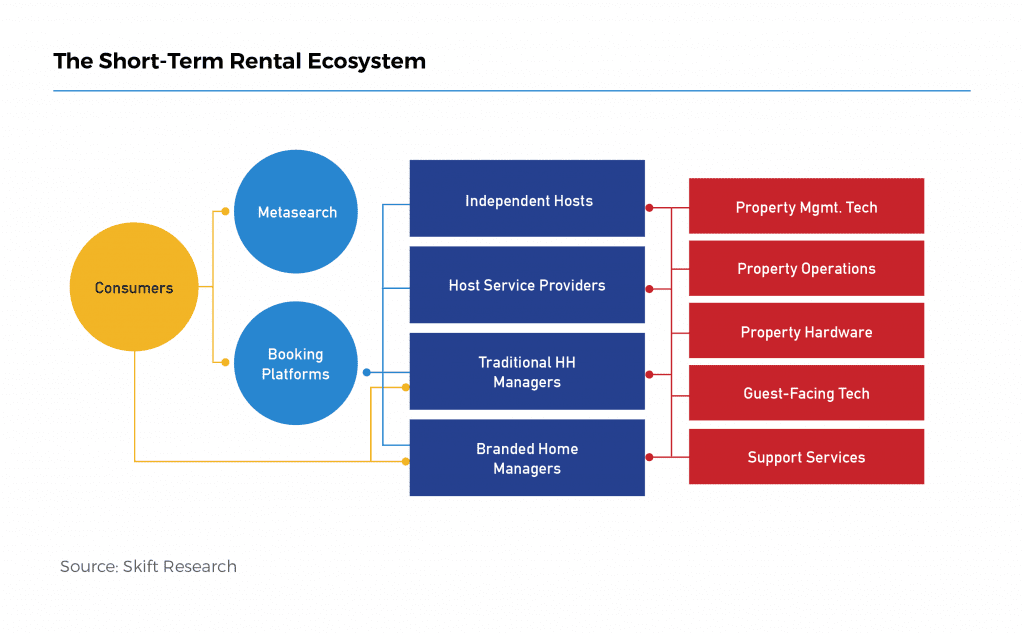

In many other aspects, however, the short-term rental sector is extremely fragmented. There are millions of independent hosts, over 100,000 property managers, and thousands of business-to-business vendors supporting the renting out of first and second homes, villas, houseboats, yurts, and any other type of accommodation imaginable.

Get Your Skift Travel Megatrends 2020 Download Here

STRENGTHENING BRAND IDENTITY

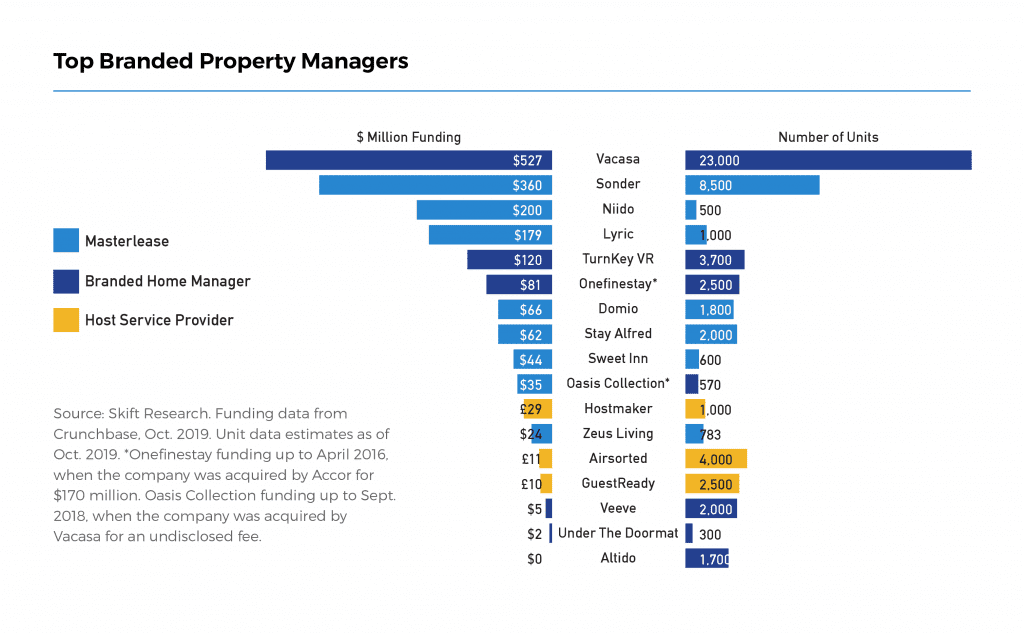

Branded home managers will find rich pickings in 2020 and beyond. Brand recognition is moving from the online platforms, which will continue to push their brands to attract customers, to on-the-ground branding. Property managers like Vacasa, Onefinestay, and Altido are professionalizing the sector by setting hotel-like standards with exemplary guest communication.

Rather than relying on individual hosts, companies like Sonder, Lyric, Stay Alfred, and Domio, meanwhile, are using master leases, where they lease and convert a partial or entire building to branded short-term rentals.

And it’s not just startups and venture capital money driving the growth of branded home rentals. Hotel behemoth Marriott International introduced its own Homes & Villas brand in April 2019.

Dimitris Manikis, president and managing director EMEA of Wyndham Hotels & Resorts, told Skift that “it’s very interesting to see what’s happening in the branded residences space. I believe more traditional players will go in as time evolves.”

Expect more convergence between hotels and short-term rentals as we move into the next decade.

THE OLD GUARD STANDS STRONG

Amid the jumble of venture capital money, it’s easy to forget that short-term rentals have been around for decades — and so have property managers. Especially in traditional holiday destinations throughout North America and Europe, holiday home managers continue to benefit from the growth of the sector.

In fact, according to June 2018 to August 2019 data from AirDNA, traditional vacation rental destinations outperformed their urban counterparts. The company asserted that this is largely driven by a trend toward larger, higher-grossing luxury units.

So while the regulatory spotlight focuses on urban rentals, holiday homes are becoming more attractive, and we are seeing some telling moves in this space.

Much-hyped hotel company Oyo acquired @Leisure Group in 2019 to enter the vacation rental market through full-service property management brands like Belvilla and DanCenter. Hotel company Wyndham went the other way and sold its European division of Destination Network to Platinum Equity for $1.3 billion, before selling its U.S. vacation rental division for $162 million to Vacasa.

Startup Vacasa has been able to scale rapidly by bringing branded home management principles, with a reliance on data and brand identity, to the holiday home space. Through some major acquisitions, and while the competition is focusing predominantly on urban rentals, the company has become one of the largest property managers worldwide.

COUNTER-MOVEMENT TO COMMERCIALIZATION

While regulation remains a major uncertainty, there is little doubt that short-term rental sales will continue to grow. Expect more investment, more funding rounds, and more acquisitions. The biggest change, however, might come out of the opposite corner.

We will go out on a limb and argue that the short-term rental sector will go back to its roots. Not the entire sector, of course, but we are at a seminal moment now where some stakeholders will look at the professionalization and commercialization of the sector as a strong antithesis to its origins. These parties will find a strong marketing ploy in offering the opposite.

As Sonder and other branded home managers professionalize the sector, offering platforms like Airbnb, Booking.com and Vrbo a convenient way to heighten standards, increase commissions, and accelerate supply growth, Airbnb will find it harder to spin its “community” agenda.

Players like Couchsurfing and BedyCasa will pick up the pieces, as there will still be a demand for true peer-to-peer stays.

This might lead the travel industry to come up with a new categorization, looking to distinguish between professional rentals and host-run rentals. Remember, however, that for travelers the lines between hotels, short-term rentals, serviced apartments, and bed and breakfasts are already blurry. It’s not about categorization. It’s about meeting expectations, whether that is on a couch in a New York apartment, a chain hotel room, or a Sonder-branded luxury penthouse.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, booking.com, megatrends 2020, short-term rentals, tripadvisor, tujia, vacation rentals, vrbo

Photo credit: Block of houses in Barra da Tijuca, Brazil Breno Assis / Unsplash