What South Africa's Virus Protocols Tell Us About Balancing a Travel Economy With a Nation's Health

Skift Take

The coronavirus crisis is exposing flaws in South Africa’s corporate travel sector, and looks set to hit suppliers in an already fragile travel industry.

South Africa is playing the waiting game. Like many other countries across the continent, it quickly reacted to the threat of Covid-19. Borders were closed early on, and strict measures put in place for the public.

But its peak has yet to come. It expects the infection rate to be at its highest between July and September, coinciding with its traditional winter flu season. Scientists warn of up to 50,000 deaths and 3 million infections by the end of the year.

Get the Latest on Coronavirus and the Travel Industry on Skift's Liveblog

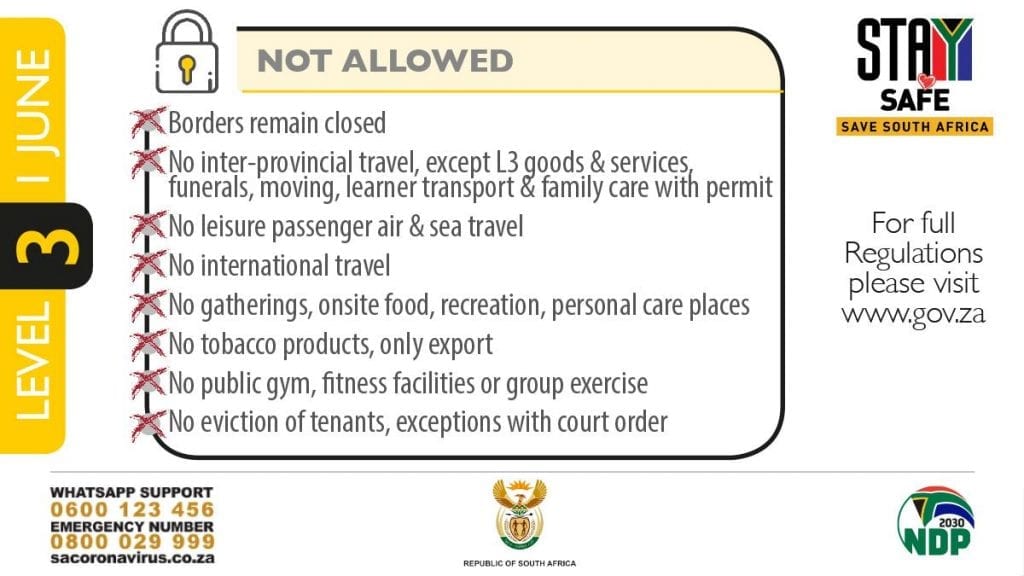

On Monday, South Africa downgraded to phase three of its five-step lockdown plan. But its international borders will remain closed. Domestically, though, some airlines are preparing to fly again as business travel only will be permitted.

As the lockdown continues, corporate travel industry players there are concerned many suppliers won't be able to survive for much longer. There’s no equivalent of a $2.2 trillion CARES Act, or job retention schemes that pay high percentages of furloughed employees' salaries.

“Covid-19's effect has been tremendous. It has magnified the inequality and the ills of our society including the structure of the economy. Tourism all round — including business tourism — is probably one of the most hit sectors,” said one commercial manager at a global travel management company, based in Johannesburg, who wished to remain anonymous.

“This is exacerbated by the fact that the National Command Council is using untested and unscientific theories to keep the sector shut, which is sad. Many hotel chains, travel companies, airlines and other providers in the value chain have resorted to retrenchments as the government assistance is inadequate and unsustainable.”

Monique Swart, founder of the African Business Travel Association, agrees. “For corporate travel agencies and hotels, there have been a lot of retrenchments. The big brands we work with have seen 30, 40, 50 percent retrenchment rates, which is insane. We don’t know if a lot of these companies will rehire staff,” she said.

She added the government limits aid to just $3,000 per company, with most of these grants directed towards the accommodation sector.

“A lot of companies are at risk and need to open up as soon as possible,” added Chris Mears, CEO of the African Travel and Tourism Association. “We’re talking about how we can de-risk travel. Most tourism businesses are small companies, it is what feeds the family unit,”

Under Pressure

Corporate travel agencies face a double shock. As well as the lack of bookings, an unorthodox practice is piling the pressure on.

When it comes to the extent of how much corporate travel has disappeared, one agency’s predicament paints the picture.

Club Travel Corporate said it recorded 51 transactions in April. Typically it would expect 20,000 bookings. That decline followed around 6,000 transactions in March, which also used to see 20,000 bookings made.

“Our travel is dead,” said CEO Kananelo Makhetha. “It picked up in May, but it’s still insignificant."

Like many companies, Makhetha placed most of the workforce on temporary layoff, which allows him to recall them when things do pick up.

The agency manages travel for various government departments, and has clients in the banking and retail sectors, where it was particularly affected. “My retail clients travel mostly to China. There’s a merchandising team that always flies there,” Makhetha said.

“There is a strong link between China and a lot of African countries,” the African Business Travel Association's Swart added. “It’s going to hurt. In a recent survey of our members, we asked if there were any specific regions you’d extend travel bans to, and the majority said China, for the next six months. It’s damaging.

“Part of what this speaks to is traveler readiness as well. It’s OK to say that once the bans are lifted, we’re all going to hop onto planes, but there’s a concern around whether travelers want to do this. From a duty of care perspective, companies will want to limit exposure.”

Meanwhile, like many agencies in the UK, travel management companies will need to rethink their business models following a common tactic where corporates were offered lines of credit to win their business.

“One of the challenges for agencies in Africa is around payment,” said Jo-Anne Lloyd, partner at Johannesburg headquartered consultancy Nina & Pinta. “A lot of travel agencies still work on credit, and in terms of their short-term cashflow management that’s causing them significant problems, especially with refunds and cancellations. The agency will be carrying the burden. It’s quite special to this market."

Swart agrees. “Across Africa, some agencies will just literally take the most unhealthy piece of business. That whole concept is being re-looked at, because the agencies that are going under, or on their way to going under, can attribute some of that to poor cashflow, and carrying their customers’ debt,” she said.

“It’s been something we’ve tried to educate them on for years and years. In Nigeria, some agencies extend 90 days’ credit to their clients. One of the blessings in disguise from this crisis is that people need to get healthy business practices together.”

On top of this, many African countries still prefer to do business in cash when dealing with agencies, Swart added.

Playing By The Rules

Several global travel management companies have a presence in South Africa, including BCD Travel, which works with Rennies Travel, and FCM Travel, part of the Flight Centre Travel Group.

American Express Global Business Travel’s partner is Tourvest Travel Services, which is one of the country’s biggest players. “We’ll have to rethink everything," said CEO Morne du Preez. "From a corporate travel agency perspective, we’ve been hit hard. A lot of the suppliers don’t adhere to the regulations, regulations that are strictly enforced on agents by IATA and the airlines."

He added that Tourvest operates exactly as Amex GBT does, in terms of working by its principles, policies, codes of conduct and compliance. As a result, it benefited globally from account management and customer relations, which proved useful in refund talks with the airlines.

"Throughout this lockdown, we’ve never stopped working and engaging with our customers," he said. "Everybody always has a little bit of a negative connotation about Africa, and what Africa is about. There are negatives around corruption, those things, so we always try and be more cautious, and comply 110 percent with any compliance requirements that we’ve got from Amex GBT. We’ve got a responsibility to look after our employees, our travelers. If you don’t look after those two, we’ve got no business."

Battling Headwinds

Many airlines in the region were in financial difficulty before Covid-19, and renewed questions over their survival is hindering travel buyers’ confidence in sending employees back out across the continent, according to Swart.

Flag carrier South African Airways on Monday received a $1.2 billion state rescue package, but had effectively become a domestic carrier over the course of last year, according to Mears. While other airlines could pick up any slack if it were to collapse, he added this would impact South Africa’s economy as it's a significant employer.

Air Mauritius entered voluntary administration last month, but it plans to fly from June 30, while smaller carriers are also in perilous situations.

Comair is under “business rescue” (South Africa’s equivalent of Chapter 11) and is unlikely to start operating again before November. It operates British Airways’ franchise in South Africa, as well as low-cost carrier Kulula.

Various states also appear to be taking a hard line on safety, which is far from the case in Europe. “Governments are getting involved with things like social distancing on aircraft,” said Nina & Pinta’s Lloyd. “They’re getting involved in commercial dealings with airlines in a way they never had before, and that’s challenging."

However, there are green shoots. Fastjet recommences flights June 30, while FlySafair restarts operations on 15 June, and says business travel is permitted if passengers can produce a document illustrating this. It will fly between Johannesburg, Cape Town and Durban.

“Cape Town has done a lot around air access,” notes Mears. “Air Portugal announced it was launching Lisbon to Cape Town, while there’s also Delta Air Lines’ triangle route between Johannesburg, Cape Town and Atlanta. We’re also hearing Kenya Airways is to start operating soon.”

Profitable Ethiopian Airlines could also look to step in and partner with struggling carriers, while Emirates already has a good reputation within South Africa and could boost international airlift.

Hotel Knock-on Effect

All of the market uncertainty is set to weigh heavily on the nation's hotels. Many business travelers will rely on smaller properties, such as B&Bs, in a fragmented market. Although many hotels have accessed government grants, their lack of regular income is starting to bite — a problem that will only be worsened if travel agencies do go out of business.

"I’d estimate 20 to 30 percent of local hotels won’t open again," Swart predicts. "Trying to keep track of suppliers, who’s open, who’s closed, and are they business ready, all of this is up in the air. There’s nothing particularly standardized and again, it’s a waiting time for people."

“The smaller guys are going to find it tough to survive,” added Tourvest’s Du Preez. “The government forgets that if they don’t support the bigger players, the smaller players can’t operate. It’s guys like ourselves that fill those smaller properties and guest lodges. The likes of Marriott and Sun Hotels are going to survive.

“We own several properties, and we’ve been lobbying government to relax some of the protocols and to assist financially. The assistance from the government’s Temporary Relief Fund has been on a very limited basis.”

Du Preez also believes more than 30 percent of accommodation suppliers could go under: “If things don’t change very quickly in the South African market, and we can operate soon, that night number might escalate really quickly. We might not open some of our properties until February next year. It’s cheaper for us to keep them closed.”

Putting Safety First

South Africa is confronting coronavirus seriously, and Nina & Pinta’s Lloyd said she respects the government on this front, which uses its Facebook page efficiently to communicate efforts around virus prevention.

“They have been impressive, considering their resources, lack of cash, and the current economic situation they were in when they went into this," she said. “The early lockdown was to ensure hospitals were ready to deal with the crisis. You can slow down the infection, but you can’t stop it. If they hadn’t done this, the rate would have spiked a lot sooner.

"The challenge is, now that we see the rest of the world coming out of lockdown, and South Africa isn’t, that’s where we’re going to feel it a bit more, as people are starting to move around.”

Tourvest’s Du Preez adds: “We went into lockdown sooner than a lot of our American and European compatriots. That gave us the opportunity to prepare. Our lockdown was serious, and in terms of infections we are very low. We hope they won’t rise. It hasn’t hit us yet, and hopefully it’s not going to."

Where Next?

While the rest of the world navigates complex air bubbles, bridges and corridors, industry observers predict South Africa isn't likely to reopen until the end of the year, or early next year.

"What we see in India and Brazil suggest the worst is still to come," said Andrew Stark, managing director at FCM Travel Solutions and Corporate Traveller, MEA/South Africa. "We are prepared for the worst case scenario in terms of booking levels and our people working from home for an extended period. We are mitigating costs and are in a semi-hibernation phase in line with the fall in demand for travel. We're prepared to fulfil 10 percent of the volumes seen pre Covid-19."

The African Business Travel Association's Swart said her members expect their travel volumes to stay low in the long term, with a poll showing 80 percent said this wan't due to health concerns, but the fact they’ll need to keep costs down.

For Club Travel Corporate’s Makhetha, he admits there are challenging times ahead but he'll use that time to plan ahead. As part of South Africa’s biggest online travel agency group, Travelstart, which part-acquired the agency in June last year, he aims to launch a new booking tool, called "NEXCT", for corporate clients in September.

This will also leverage Travelstart's inventory. "Sometimes there's distressed inventory from airlines, so we'll be able to enhance our product proposition for corporate travelers," Makhetha said.

FCM's Stark is thankful South Africa is at least permitting business travel. "There are now 8 million people back at work," he said. "Local airlines started taking to the skies as of June 5 for essential business travel, which is an encouraging sign for the outbound travel industry and our corporate customers.

"South Africa as a nation is in a very precarious position right now. The dilemma for government is balancing the need for safety and controlling the effects of Covid-19 via lockdown, but also it's an emerging economy which desperately needs job creation."

One industry expert also cautions against underestimating the country's resilience. “If there’s one thing I’ve learnt about the South African business travel community, it’s that they have an ability and a habit of leapfrogging the more mature markets when it comes to development and practices," said Paul Tilstone, managing partner of corporate travel consultancy Festive Road.

He launched the Institute of Travel Management in South Africa 15 years ago, and organized its annual conference for 10 years. “As a collective, they would most likely say that they are behind the more mature markets like Europe and the U.S.," he added, "but that modest nature of the South Africans sits alongside a passion and drive to create innovation and the willingness to face challenges head on."