Skift Take

The short-term rental ecosystem, from property managers and platforms to business-to-business vendors, is rapidly expanding. As this continues, there is a fine balance to be struck where the sector professionalizes — without commercializing beyond recognition.

What will Airbnb do next? It’s a question heard a lot in company boardrooms and at travel conferences these days. The company has transformed the hospitality industry. This impact goes beyond its business of consolidating and lowering barriers to a whole new stock of “rooms”.

The new Skift Research report The Short-Term Rental Ecosystem and Vendor Deep Dive 2019 highlights how the major short-term rental platforms have consolidated the sector, but then goes much deeper. It discusses the different types of property managers we see today, and new business models that will grow over the coming years. The wider ecosystem also exists of a myriad of tech, operations and support vendors, all discussed in this report.

As the vendor landscape expands, and the sector continues to converge with other sectors like hotels and the residential market, there are real implications for its place in the travel industry and wider society. Some tough questions around the professionalization and commercialization of the sector need to be asked. Let this report be a starting point.

We launched the report The Short-Term Rental Ecosystem and Vendor Deep Dive 2019 in our Skift Research service last week. Below is an excerpt from this report which sets the stage for a deep dive into the short-term rental ecosystem and its many vendors.

Preview and Buy the Full Report

Growth of Mammoth Players

The convergence of accommodation sectors has helped the short-term rental sector grow after its initial boom into mainstream in the first half of the 2010s. As Henrik Kjellberg, CEO of Awaze, points out, that today “it’s more about the type of trip the guest is taking, rather than ‘I’m a hotel kind of guy.’” As consumers are no longer exclusively “hotel people” or “rental people”, major short-term rental players are benefiting from increasing demand, while simultaneously looking to offer options from all sectors on one platform or through one brand.

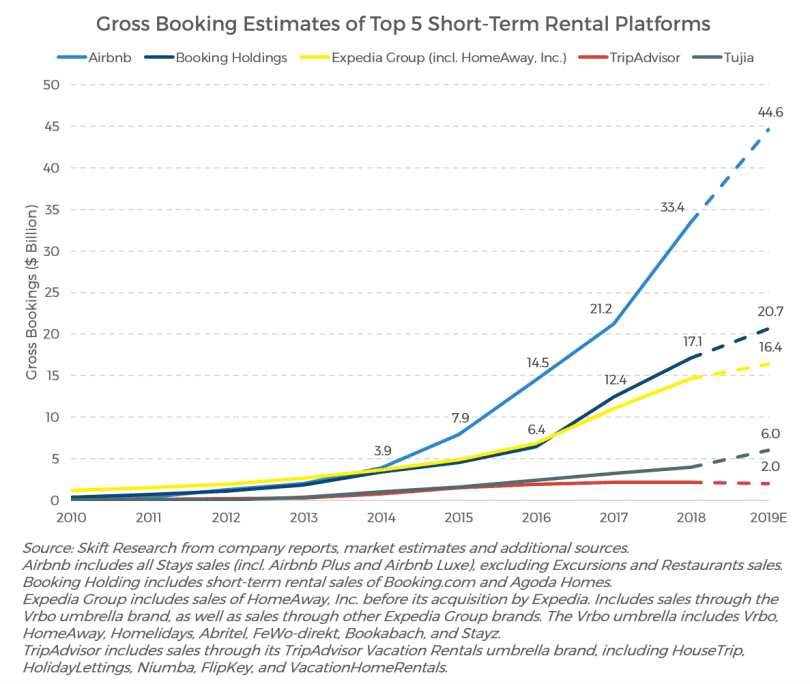

Skift Research estimates that Airbnb is the main beneficiary of the growth in short-term rental demand, with gross bookings for rentals estimated to total over $33 billion in 2018, and further rising to more than $44 billion in 2019.

HomeAway, now owned by Expedia, used to be the largest player, but Expedia Group was overtaken by Airbnb in 2014, and has since also been overtaken by Booking Holdings’ Booking.com and Agoda Homes brands in 2017. The TripAdvisor Vacation Rental umbrella brand is seeing declines in gross bookings in 2018, and it is likely that Ctrip will overtake it over the coming years as it ramps up its short-term rental offering.

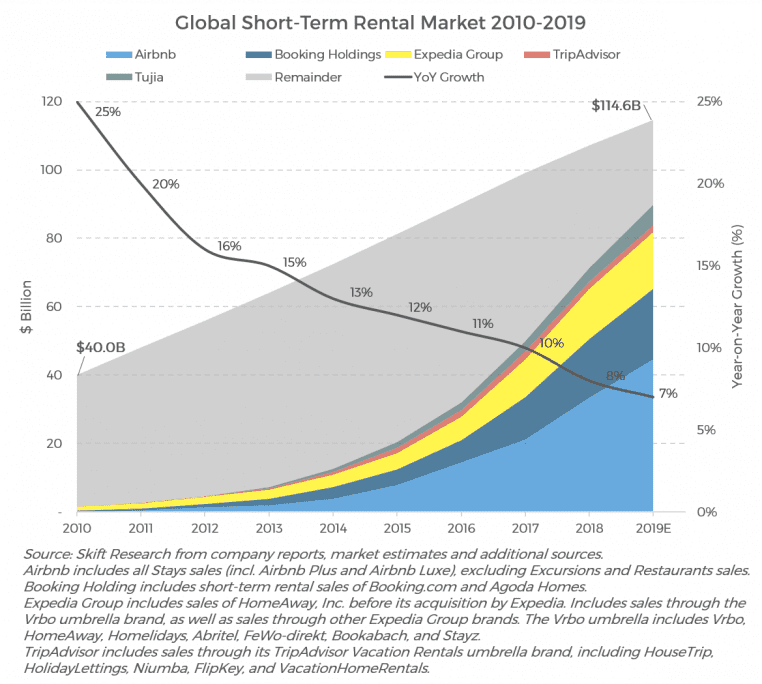

Skift Research estimates that the total consumer market for short-term rentals totaled $107 billion in 2018, and is set to grow 7 percent to total $115 billion in 2019. In 2010, the five largest companies accounted for only 4 percent of gross bookings, as offline bookings, travel agents, and local connections accounted for the vast majority of business. In 2019 we estimate these five players account for 73 percent of all gross bookings in the sector.

COMPETITION GRAPPLES TO FIND RIGHT RESPONSE

The response of the competition, mostly hotels, to short-term rentals has evolved over the past years. It has been largely three-pronged: in the early years, hotel CEOs would often argue that short-term rentals were not impacting their business and played down the sector’s importance; hotels have lobbied for increased regulation for what they call unfair competition; and they have jumped in and acquired or launched their own short-term rental brands.

The first response, feigning ignorance of short-term rentals impact has largely disappeared over the past years as especially Airbnb has continued to encroach on hotels’ core business. Skift Research estimates that Airbnb’s total revenue has overtaken that of Hilton in 2018, and will overtake Marriott in 2019.

Preview and Buy the Full Report

Subscribe now to Skift Research Reports

This is the latest in a series of research reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, alternative accommodations, booking.com, homeaway, short-term rentals, skift research

Photo credit: Luxury holiday home in Costa Blanca, Spain. iAlicante / Unsplash.com