Trivago Courts Booking's Wrath in Move to Boost Repeat Customers

Skift Take

Once again, Trivago is playing a game of chicken with Booking Holdings.

In September 2018, the hotel price-comparison search company launched "significant changes" worldwide to its user interface without offering details. Executives revealed that effort during a call with investors Wednesday when discussing the company's fourth-quarter results.

The company, majority owned by Expedia Group, aimed to keep users on its site and mobile app for longer. It debuted incremental changes that exposed visitors to more content, wooing customers to click around its site more.

The tests delay the moment when Trivago sends people over to an advertiser's site, said CEO Rolf Schrömgens. For a big Trivago advertiser like Booking Holdings, that can be problematic.

The move underscores the delicate balance metasearch sites like Trivago must play between their own interests, and those of their advertisers.

The latest Trivago experiment reverses a longstanding policy. Until now, the general best practice of price-comparison search companies — Trivago and its rivals Kayak, Skyscanner, Qunar, TripAdvisor, and Google — has been to try to refer customers as quickly as possible to advertisers.

Schrömgens has now given his workers new marching orders. He told his team that it's now more important to focus on attracting more repeat customers than referring as many customers as quickly to advertisers as possible.

"When we see high interaction rates, we see higher long-term retention," Schrömgens said.

Trivago's new delay played a role in reducing by 19 percent the unique visitors per day that Trivago referred to advertisers during the last three months of the year, compared to 2017.

Schrömgens attributed the decline to the company's product changes along with a reduction in the number of visitors to Trivago's platform overall during the period. The CEO said he was fine with that downward trend in referrals because higher interaction rates increased "in general" the chances customers would return to Trivago to shop.

The fourth quarter was the company's second consecutive quarter of such a high level of year-on-year declines in the average number of qualified referrals that Trivago generated for every marketing dollar it spent, Mark May, an analyst at Citigroup, pointed out on the earnings call Wednesday. The declines coincided with the new user interface.

Daring Booking Holdings to React

Trivago's move is bold. The last time it tinkered with its display and processes, Booking Holdings pulled sharply back on advertising on Trivago.

Two winters ago, Trivago introduced a “relevance assessment” that had the effect of temporarily costing brands like Booking.com more in Trivago's auctions to get the same number of customer leads until they made "user experience improvements." In the aftermath, Booking Holdings brands — including Booking.com, Agoda, and Priceline.com — reduced their spending on Trivago. The pullback resulted in their ads being less prominent in Trivago’s search results, and it decimated Trivago's revenues and profitability.

On Wednesday, Trivago appeared to be betting that Booking would accept its new changes with less fuss. Booking needs a mix of digital advertising paths, it implied. Trivago may be Booking's most cost-effective for reaching a slice of the customers that it needs to maintain its growth and profitability targets, and it may struggle to find a substitute for Trivago.

For the last three months of 2018, Booking Holdings advertisements accounted for 34 percent of Trivago's total revenue, slightly up from 33 percent in the same period a year prior, executives said. Booking had not conducted significant testing activities as it had in the year-ago period, they added.

Trivago forecast that there would be no significant change to how its advertising partners will spend on its channels in 2019, after customary adjustments for seasonal variations and similar factors.

"We don't think that it would be prudent to assume improving or worsening commercialization levels from what we know today," said Axel Hefer, chief financial officer.

Why Booking Holdings May Balk

Last September at Skift Global Forum, Booking Holdings CEO Glenn Fogel hinted at what irritates him in partners without naming Trivago specifically.

Fogel said, "We very much always want to be cooperative with everybody... But if somebody wants to force us to do things that are first bad for our customers, ...we'll say, okay, ... we’ll just take our business elsewhere."

Time will tell how Fogel and his colleagues will view Trivago's efforts to keep more travelers on Trivago's platform for longer. Adding a wrinkle to the debate will be a broader competitive factor. Its arch-rival Expedia Group bought a 63 percent majority stake in Trivago for $634 million in 2013. Expedia still controls Trivago, but spun it off into a public company in 2016.

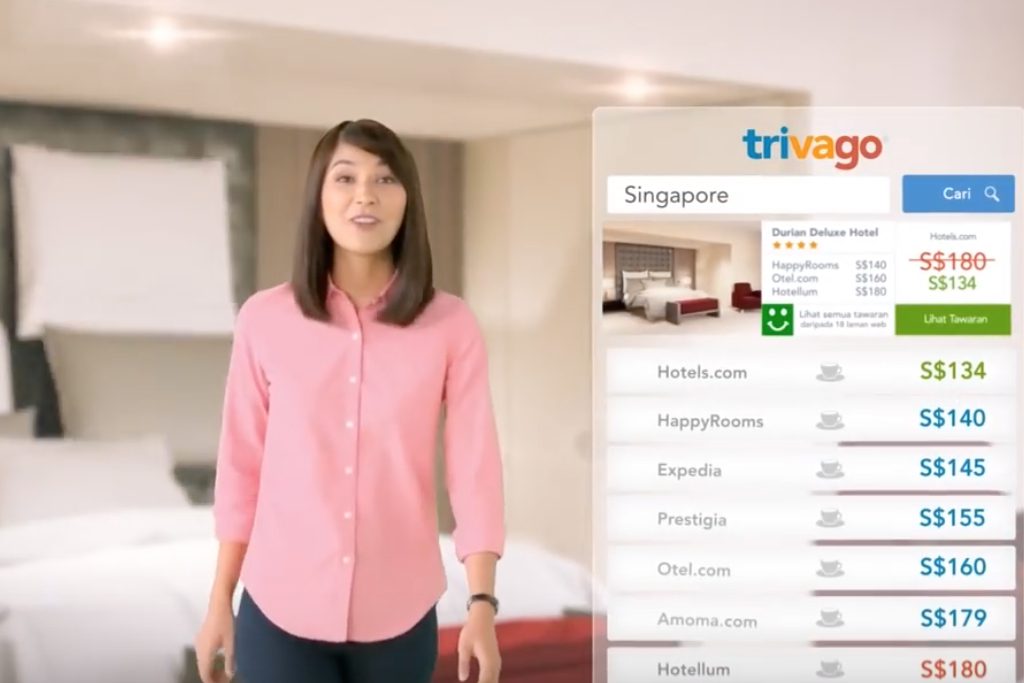

Example of the Trivago's Changes

As ever, Trivago was coy about details of its product changes, though it said the changes came in several "iterations."

Our searches on Trivago turned up one example representative of the others we saw.

Some quick background, first: Trivago used to have a relatively simple model, similar to other so-called metasearch sites. For any hotel, it aggregated rates from several sources, highlighting one rate prominently.

It changed that recently.

In one recent test search, Trivago still gave a more prominent display to one rate, as usual. However, it also highlighted other rates as offering "express booking." By itself, so-called instant booking wasn't new. Trivago, like its rivals, has long let consumers purchase hotel rooms while remaining on its platform, though TripAdvisor was forced to reverse its push to instant booking after Booking Holdings and other brands resisted the effort.

What was new was an in-between step. When a shopper clicked on one of these highlighted deals, Trivago kept the person on an interstitial page with an array of large photos from the property and another set of room rate listings. In the past, it would have jumped to a page to take the customer's payment information.

Trivago forced users to look at a much more elaborate in-between page than we've anecdotally seen before. The page displayed details about the property, such as amenities and location, that a shopper would ordinarily expect to find on an online travel agency or hotel's own branded site instead.

To be clear, this was just one of several changes we noticed that match executives description of an effort to keep consumers clicking around on Trivago's platform longer.

Heavy Meta

As background, Trivago mainly generates revenue from online travel agencies, hotel chains, independent hotels, and alternative lodging providers that advertise on its site and app. The company typically charges advertisers when a user clicks on a hotel rate and is referred to that advertiser’s website to complete a booking.

Trivago's display changes had boosted the profitability per customer, which was partly a function of getting more repeat business, Schrömgens told investment analysts. That is remarkable, given that the product changes are only several months old.

Hoteliers May Start to Worry, Too

In a move a year ago aimed at pleasing Booking Holdings, Trivago changed how advertisers ranked in its auction for sort order in the results consumers see. In the past, Trivago often pressed its thumb on the scale to favor advertisers with the lowest room rate. It spotlit the cheapest rates on the theory that doing so would appeal to consumers even if it sometimes meant lower commissions.

However, for a year now it has been tending to favor whoever bids the highest. Its new policy tends to give the most prominent display to advertisers who can outspend rivals.

That move often disadvantages hoteliers, while pleasing companies with large and sophisticated digital advertising budgets, like Booking Holdings.

Hoteliers might also become nervous about how Trivago might display alternative accommodations, as it doesn't like having to face even more competition in terms of lodging options.

Trivago sees alternative accommodations as a potential source for growth in both revenue and profit long-term. Since late 2017, it has been adding vacation rentals to its listings, primarily from HomeAway — which is also part of the Expedia Group portfolio.

On Wednesday, Trivago said it now had 1.5 million alternative accommodation listings. However, it didn't say how often it presented those listings to shoppers.

Overall, hoteliers will probably wait to see Booking's reaction to Trivago's changes.

Trivago and its advertising partners, such as the hotels and Booking, are eager to have more customers come directly on a repeat basis.

For their part, many hotel groups have pushed cheaper, or more perk-filled, rate offers for customers who book directly. Many hoteliers have not shared these so-called loyalty rates with Trivago.

"Some of these rates are more difficult to implement than others," CFO Hefer acknowledged.

Meanwhile, last August, executives at Booking Holdings said that “approximately 50 percent” of paying customers now come directly to its brands.

Sacrificing Growth for Profits

During the last three months of 2018, Trivago's revenue decreased to $188 million, or €166.8 million, representing a decline of about 8 percent year-over-year.

Net income, a measure of profitability, was about $13 million, or €11.7 million. That compared to a net loss of about $11 million, or €9.6 million, in the same period a year earlier.

Looking ahead, Trivago expected the stay in the black, though revenue growth would remain "negative" in the first half of 2019.

Regulatory Headaches

This year, Trivago will have to change some of its marketing practices in Australia and the United Kingdom due to rulings by competition authorities in those countries. The rules apply to all online travel players in those markets.

On Wednesday, Britain's watchdog, the Competition and Markets Authority, pressured Trivago along with rivals Expedia, Booking.com, Agoda, Hotels.com, and Ebookers to address its concerns around issues such as pressure selling, misleading discounts claims, the impact of commission on search results, and hidden charges.

In Australia, Trivago quietly copped to the allegation that it misled some consumers by highlighting some hotel rate offers as "the best deal" when in many cases the highlighted price was not the cheapest available at that hotel.

For more context on Trivago's overall place in the online travel universe, see this summer’s article, “What Booking Sites Get for Every Marketing Dollar Spent: Skift Research Does the Math.” Subscribers to Skift Research can find more context by reading this summer’s report “The State of Online Travel Agencies 2018 Part I: Advertising.”