Skift Take

TripAdvisor hasn't abandoned letting customers book on TripAdvisor but it has dramatically downplayed the feature in favor of the more lucrative metasearch option. With Trivago and Google making gains in a hyper-competitive sector, TripAdvisor couldn't stick with a strategy that wasn't working.

TripAdvisor indeed appears to be downplaying hotel booking on its own sites, giving more preference to metasearch links to partners in a dramatic reversal of its initial strategy for its so-called Instant Booking feature.

Skift picked up on the feature change April 27 when I reviewed a small sample of 30 TripAdvisor hotel results in New York City and found that all of my results highlighted metasearch links, not the book on TripAdvisor option, in the primary View Deal box, and a TripAdvisor spokesman said the Instant Booking option would mostly be given primacy in cases where it is the lowest rate or for hotels that the customer has previously booked on TripAdvisor.

The presentation of booking on TripAdvisor versus links to partners could thus vary depending who is doing the searching.

We wrote last month: “On TripAdvisor today, it appears that changes in its hotel search algorithms have moved the site away from an earlier approach when it seemed to be giving preference at times to its own Instant Booking, or Book on TripAdvisor, feature over metasearch and its links to partners,”

But, in a research note May 4, Kevin Kopelman and Emily DiNovo of Cowen and Co. put the changes into context, characterizing them as a “dramatic rollback of Instant Booking” that would boost TripAdvisor’s revenue $50 million to $100 million annually because TripAdvisor metasearch has the conversion advantage over Instant Booking.

The Cowen and Co. analysts also found that the rollback of TripAdvisor Instant Booking on mobile is even more dramatic than on desktop.

“Instead of Instant Booking, TripAdvisor has reverted to its more traditional meta-search price comparison ads that re-direct hotel shoppers to its partners’ sites — usually Priceline and Expedia brands (i.e. a return to a Trivago-like business model),” the Cowen and Co. note said.

“We estimate the changes could drive [approximatley $50-100M annualized benefit to TripAdvisor revenue, adding approximately 5 percent to total revenue growth and approximately 10 percent to growth in the flagship meta/IB revenue line, most of which would drop to EBITDA (earnings before interest, taxes, depreciation and amortization).”

In a new note to investors Monday morning, Cowen and Co. reports that TripAdvisor is expected to soon debut a website redesign that keeps the same trajectory with metasearch emphasized but cleans up the user interface.

“With Instant Book now heavily rolled back on both desktop and mobile, we no longer view IB as a meaningful headwind,” Cowen writes.

Investors Key In On Potential Return to TV

From an investor standpoint, the TripAdvisor strategy change and potential revenue boost must be tempered by the fact that the company could shortly be announcing that it will be returning to TV advertising, a maneuver that would cut into profits — in the short term.

TripAdvisor’s earnings announcement is slated for Tuesday night after market hours. Cowen and Co. estimates that there is a 60 percent chance that TripAdvisor could announce a TV branding campaign that would cost more than $200 million through the end of 2018. There is also a chance that TripAdvisor could reveal its intent to mount a smaller campaign or none at all, for now.

What Does It All Mean?

In a search for a new business identity, TripAdvisor management has apparently decided that it doesn’t want the company primarily to become a hotel- booking site, per se. Instead, it will tilt toward metasearch for now.

If consumers prefer booking on TripAdvisor, then based on their past behavior on TripAdvisor they will see this option most prominently. If they prefer to navigate to third-party sites for booking, then those are the options that TripAdvisor will highlight.

Two years ago, Kayak CEO Steve Hafner was out-front warning TripAdvisor that facilitated bookings like Instant Booking aren’t such a big deal and that TripAdvisor would eventually scale back its aggressive effort. As TripAdvisor has struggled getting revenue per hotel shopper back into a positive growth trajectory following the rollout of Instant Booking, Hafner’s prognosticating appears to be borne out — so far.

The downplaying of TripAdvisor Instant Booking — and it’s still an option for TripAdvisor customers — is likely a positive for Expedia, which is a TripAdvisor Instant Booking partner but has been prohibited from all-out participation because of apparent provisions in the TripAdvisor-Booking.com Instant Booking agreement.

TripAdvisor’s strategy is evolving — as it should — and these changes are obviously not the end of the story. TripAdvisor management is likely to have much more to say about some of these issues when the company releases its first quarter earnings statement Tuesday afternoon and officials speak to analysts Wednesday.

Read More

TripAdvisor Instant Booking Gets Very Personal

Can a TripAdvisor TV Campaign Be a Game-Changer? Two Views

Can TripAdvisor Turn Things Around? The Debate Rages

TripAdvisor Is Being Massively Outspent by Its Biggest Rivals

TripAdvisor Instant Booking: Testing, Learning and Confusing

TripAdvisor CEO Kaufer Defiantly Vows to Stay Committed to Instant Booking

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: instant booking, metasearch, tripadvisor

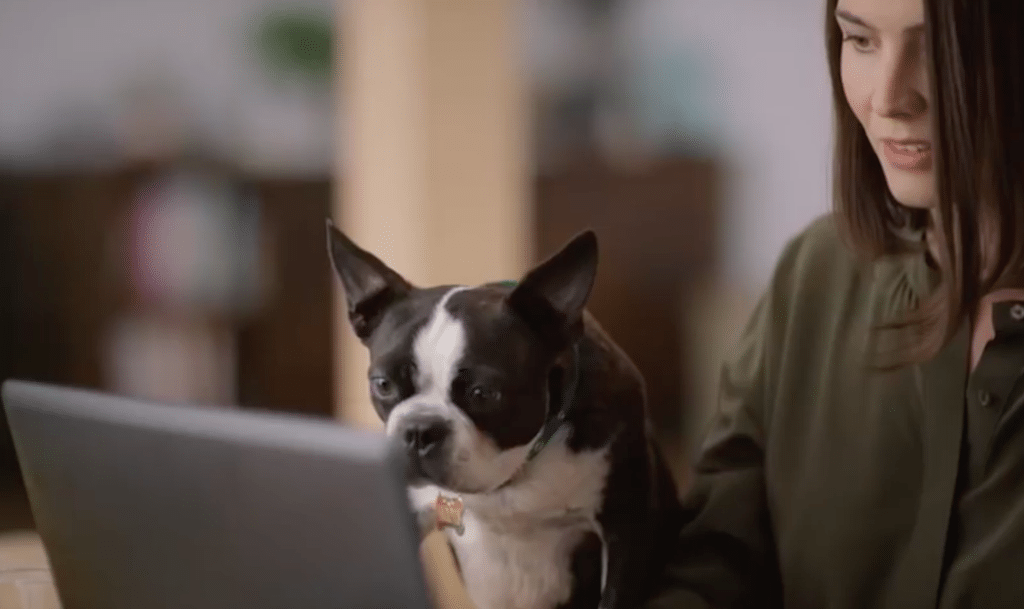

Photo credit: The dog barked something that resembled "book, book, book" in a TripAdvisor TV commercial a couple of years ago. TripAdvisor has revised its booking strategy, favoring links to hotel and online travel agency websites. TripAdvisor