Skift Take

The battle over airline distribution costs has been fought from boardrooms to courtrooms to the press. Though each airline is in a unique position, we examine the industry-wide data to take a cold look at the facts as best as possible.

Airline distribution is a complex web of intermediaries, each evolved to best fit its niche of customers. This broad distribution network includes online travel agencies, metasearch sites, traditional offline travel agencies, and travel management companies.

Our latest Skift Research report examines the complex, and at times intimidating, world of airline distribution. This network is an essential part of how airlines transport their passengers across the globe.

In this report, we review the long, and at times contentious, relationship that the GDS have had with the airlines they serve.

We also define four key questions through which we can better understand the future of airline distribution: 1) Does the world still need the global distribution systems? 2) What is the new distribution capability and how will it impact air travel? 3) Can airlines really de-commoditize bookings? and 4) Does Silicon Valley have a role to play in airline distribution?

Last week, we launched the latest report in our Skift Research service, The State of Airline Distribution 2018.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

Preview and Buy the Full Report

Airline Distribution Costs Are Less of a Cause for Panic

One factor that has contributed to the recent détente between airlines and their global distribution partners in the U.S. is that overall airline distribution costs, have fallen, as a share of overall expenses, in recent years.

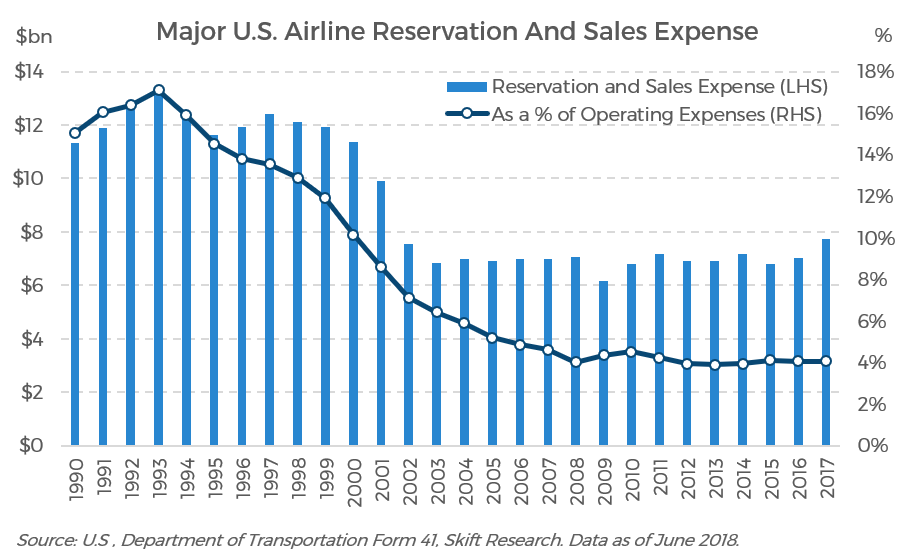

In the U.S., where the Department of Transportation collects detailed statistics on airline operating performance, the peak year for distribution expense was 1993. In that year, major U.S. airlines spent $13.2 billion on reservation and sales expenses, representing 17 percent of industry operating expenses.

But the last two decades have ushered in a dramatic improvement in distribution costs. Reservation and sales expenses at major airlines now consistently make up 4 percent of operating expenses; the absolute dollar figure fluctuates between $6 to 8 billion a year.

Looking at this data, one might assume that the transition to direct channels would simply shift costs from one expense line item to another. Yet, in 1993, airlines spent 2 percent of operating expenses on advertising budgets, and today that figure is 1 percent. That advertising expenses have not risen despite the move toward more direct distribution has been a net windfall for the airlines. This means that airlines are holistically finding it cheaper to acquire customers today, making GDS costs less of a sticking point in the big picture. That said, ask any airline if they would rather pay less to the GDS and the answer is going to be “yes.” But it changes the rank priority of which costs need to be tackled and when.

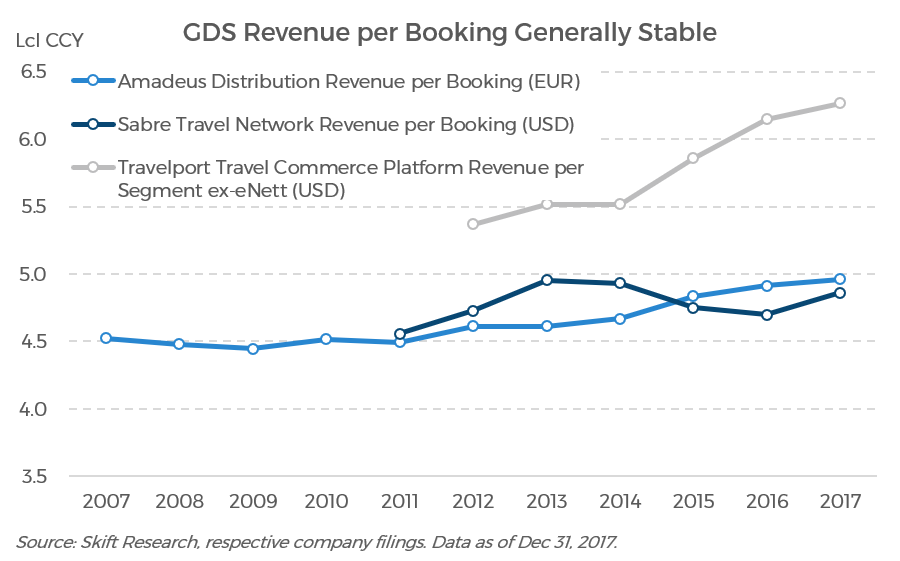

Further, average GDS fees run from $4 to 6 per booking, and the latest DoT data tells us that average domestic airfares are $350. That implies GDS fees represent between 1 to 2 percent of that ticket price. When looking at the effective average fee an airline pays, this figure could be even lower. That’s because we did a back-of-the-envelope calculation based off of domestic airfares whereas GDS are in practice likely to be booking higher value international and business class fares (then again, the spread could be higher than 1 to 2 percent in cases were a single transaction contains multiple segments as most GDS charge per segment, not per ticket).

In this light, GDS commissions are in line with charges by similar interchange networks like Visa and Mastercard which charge from 1 to 3 percent depending on the customer. And GDS even compare favorably with certain marketplace platforms such as online travel agencies’ hotel room listings (10–25%), ridehailing apps (20 to 25 percent), food delivery sites (15 to 30 percent), or the Amazon sellers’ marketplace (6 to 20 percent).

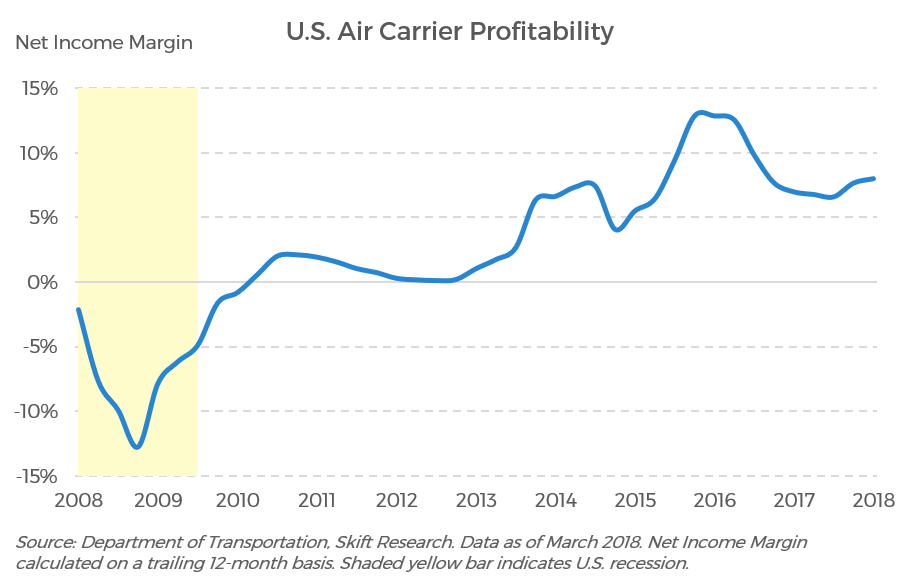

Taking a broader view, airlines are feeling healthier for a whole host of additional reasons, including consolidation, a record number of U.S. airline passengers, rationalized capacity, lower cost structures, and (until recently) benign oil prices. The net result is record high levels of industry profitability.

Preview and Buy the Full Report

These newly found profits substantially alter the risk-reward equation for an airline looking to confront the global distribution systems. When the airlines were losing money, management was desperate for cost savings and it was a lot easier to view the distribution game as zero-sum.

But today, when the sun is shining, the focus is less on cost reductions and more on revenue growth and optimization. Is it really worth it to go to war with global distribution systems and risk losing market share in that environment?

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airline distribution, gds, skift research

Photo credit: Relationships between the Airlines and Global Distribution Systems are constantly evolving. Dan Lohmar / Unsplash