Skift Take

Booking sites are offering more types of travel products and services on their platforms. Of these verticals, alternative accommodations are a highly contested space where Booking and Airbnb lead for now.

While online marketing has become more accessible over the years, it remains difficult to acquire both a breadth and depth of travel inventory. Therefore, Skift Research believes one way to build a competitive moat in online travel is to be the go-to platform for anything and everything travel.

Our newest Skift Research report, The State of Online Travel Agencies 2018 Part II: Supply takes a comprehensive look into the supply platforms of Expedia Group and Booking Holdings. We specifically focus on these two companies as they generate the highest revenue among online booking sites in the world and both have publicly available filings.

As part of our research, we examine the expansion of online travel agencies into new product verticals. From a supply perspective, Expedia leads in hotel properties and airlines, but Booking Holdings dominates in alternative accommodations (excerpted below), car rentals, and restaurants. Among the two companies, Expedia has the relative lead in tours and activities for now.

This is the second part of our summer research series on online travel agencies. The first part of the series examined the advertising spend of these same sites while a forthcoming piece will look at emerging market booking platforms.

Last week we launched the latest report in our Skift Research service, The State of Online Travel Agencies 2018 Part II: Supply.

Below is an excerpt of the report focusing on just one supply vertical, alternative accommodations. Get the full report here for our full analysis of other sectors such as traditional hotels, airlines, rental cars, tours and activities, and restaurants. As well as a proprietary breakdown of accommodation properties by geography.

Preview and Buy the Full Report

Becoming a One-Stop Travel Shop by Moving Into New Verticals

In addition to building depth in traditional product offerings — hotels, airlines, and car rentals — the online travel agencies are now adding supply by pushing out into new verticals as well. The idea is to become a one-stop shop for all consumer travel needs. Increasing offerings on the platform should lead to greater customer value and engagement. Or at least that’s how the theory goes.

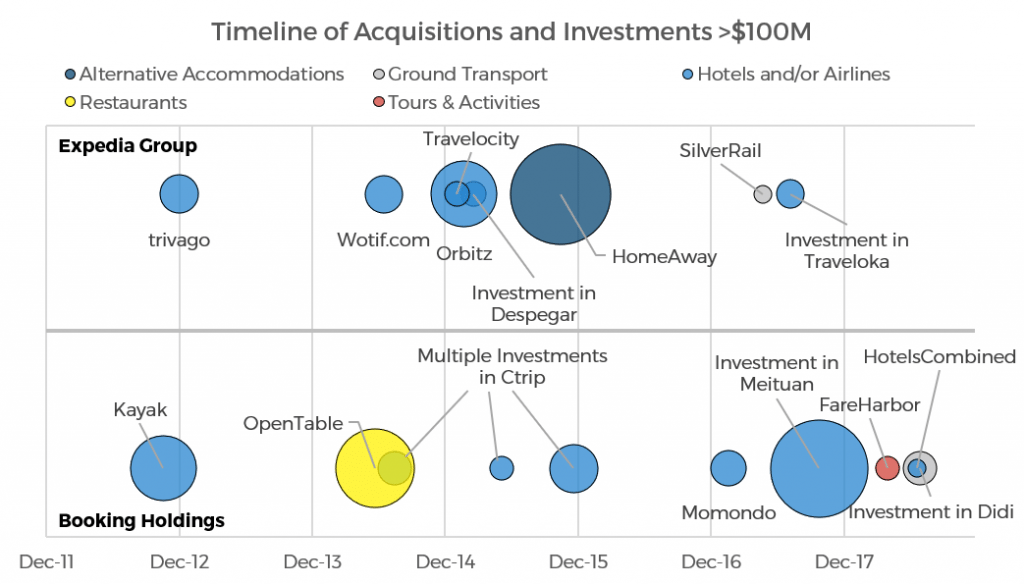

A quick look at acquisition and investment in the space seems to confirm this shift away from the core business and towards supplemental offerings. The early 2010s started with consolidation in metasearch and traditional online travel agencies. This period saw deals for Kayak, trivago, and Orbitz, among others. But starting in mid-2014, the pace of activity shifted toward deals that added new addressable markets for parent platforms including spaces such as restaurants, alternative accommodations, and tours and activities. Recently, when deals have been inked to add hotel and/or airline inventory, they tend to be equity investments in new geographies — such as in China or Indonesia — rather than outright acquisitions as was the case in the past.

Source: Skift Research, Capital IQ.

Bubble size corresponds to estimated deal size. Investments are sized to the total amount raised in that round, which in the case of syndicates is not the exact amount Expedia and/or Booking directly invested.

Alternative Accommodations

Though Airbnb gets much of the credit for popularizing alternative accommodations, Booking.com is at the point where it can reportedly match Airbnb in scale. As of its latest filings for the period ending June 30, 2018 Booking.com claims that the site has about 5.5 million alternative accommodation listings. That is on par with Airbnb, which as of July of 2018 claims “over five million” listings.

As Booking.com and Airbnb duke it out for first place, it’s clear that Expedia was caught off guard by the popularity of alternative accommodations. In order to catch up, Expedia executed a large M&A-driven pivot, purchasing HomeAway in November 2015 for $3.9 billion.

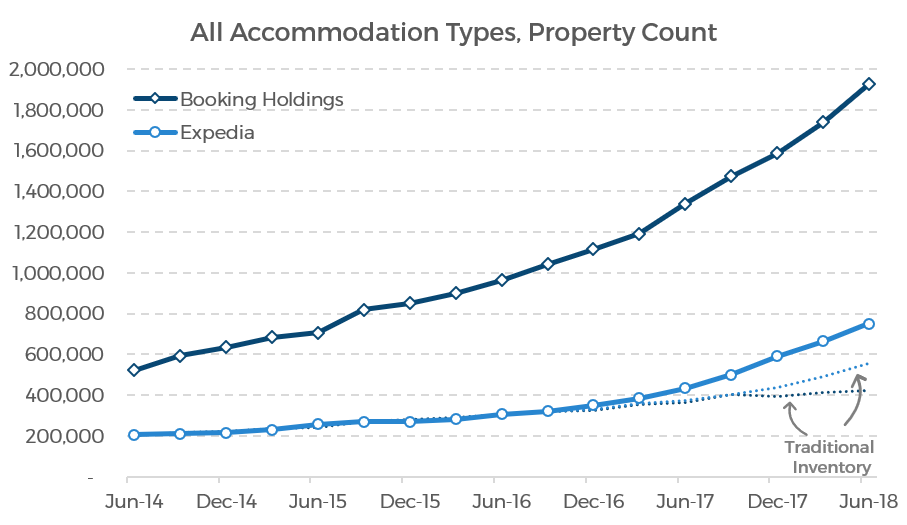

But even with this deal, Expedia is still clearly behind. It has 1.7 million listings on HomeAway and has ported over 195,000 of these alternative properties to Expedia.com. The difference in total accommodations, traditional plus alternative, offered on Expedia versus Booking Holdings is clear in the below charts.

Exhibit 12b: Expedia growing overall property inventory faster than Booking Holdings as it pushes to increase its alternative accommodation count

Exhibit 12b: Expedia growing overall property inventory faster than Booking Holdings as it pushes to increase its alternative accommodation count

Source: Skift Research, company filings. Data as of 6/30/2018

For Booking Holdings, both property counts refer to instantly bookable properties on Booking.com. For Expedia, traditional properties refers those available to book on Expedia’s global websites such as expedia.com, hotels.com, orbitz.com, and others. Alternative accommodations refers to HomeAway inventory available for immediate booking on select Brand Expedia, Orbitz, Travelocity, CheapTickets and ebookers websites. Expedia figures exclude inventory on eLong.

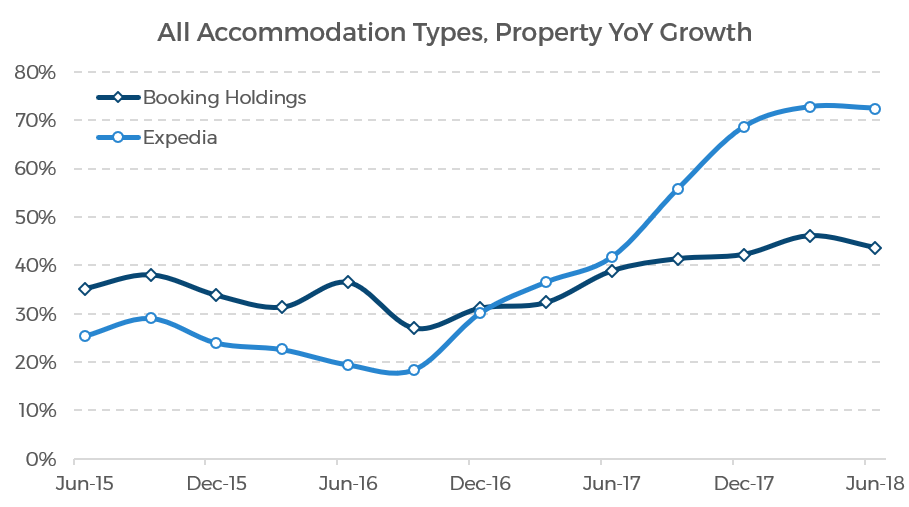

We note two crucial distinctions between the full accommodation and traditional accommodation series. The first is the substantial head start that Booking Holdings has over Expedia on an absolute basis, with nearly 2.5x the total inventory count. Secondly, while Expedia is now growing at a faster rate than Booking Holdings, there has been no deceleration on the latter’s part.

Expedia is growing its overall inventory at a 72% year-on-year rate versus 44% at Booking. But, to demonstrate just how far behind Expedia is, if both companies continued to add inventory at these respective rates, it would take until 2023 for Expedia to catch up with Booking’s absolute inventory count.

Finally, it should be noted that it takes time for Expedia Group to “turn on” HomeAway inventory on its flagship Expedia.com website, because the alternative accommodations must first be made instantly bookable. Rental homes and apartments were traditionally negotiated on an individual basis and that is still how many property managers operate. A crucial distinction with Booking.com’s inventory is that it is entirely instantly bookable. This makes the properties look and feel like traditional hotels, at least when viewed online. Booking.com even displays alternative properties alongside hotels in its online search results, placing the two stay types on a near-even footing. This perhaps boosts bookings of alternative accommodations but may also confuse inattentive customers.

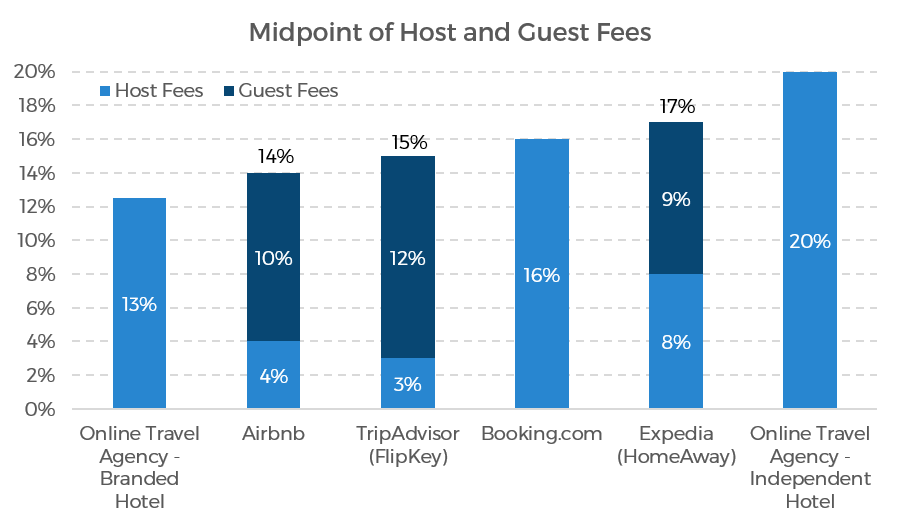

Alternative accommodations can be quite profitable with take-rates often exceeding commissions charged to branded hotels. The combination of dollars and growth means that alternative accommodations are sure to remain a hot space. We expect to see many future developments, potentially including M&A and technical software innovations. Expedia is rapidly expanding here, but for the time being Booking Holdings remains well in the lead.

Source: Skift Research, company data.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: alternative accommodations, booking holdings, booking.com, expedia, hotels, m&a, online travel agencies, skift research

Photo credit: Online travel agencies make many hotels and tours and activities, such as those in Honolulu, shown here, available to book online. AussieActive / Unsplash