Skift Take

Overall guest satisfaction with hotels in North America is at an all-time high. Still, that doesn't mean the hotel industry should be congratulating itself; there's still work to be done.

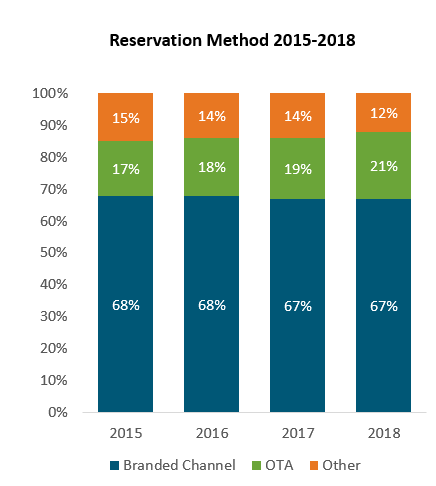

New data shows that hotel guests in North America aren’t necessarily booking direct more often than in years past, according to the latest annual J.D. Power and Associates North American Hotel Guest Satisfaction Survey.

The annual survey of 55,000 hotel guests who stayed at a hotel between May 2017 and May 2018 found that direct booking numbers for hotels are flat — despite the fact that guests are more satisfied with their hotel experiences than ever before in the survey’s 22-year history.

In this year’s study, 67 percent of respondents noted they had booked their hotels direct via a branded hotel channel. By comparison, in 2015 and in 2016, that number was 68 percent.

Data from the annual J.D. Power & Associates North American Hotel Guest Satisfaction Survey shows that North American hotel guests aren’t necessarily booking direct more than before. In this chart, “other” refers to non-branded and non-online travel agency channels such as a travel agent, a corporate booking site, a credit card company, or an airline website. Source: J.D. Power & Associates

“It’s not going anywhere,” Jennifer Corwin, J.D. Power associate practice lead for global travel and hospitality, said of hotels’ efforts to encourage more direct booking. “Hoteliers are spending a lot of money to drive direct bookings but we don’t see that going up.”

J.D. Power said it is seeing the percentage of online travel agency bookings rising very slightly year over year, which is coupled with stagnant direct bookings. It said it doesn’t have data surrounding exactly why guests are continuing or rather increasing their frequency of OTA bookings despite direct booking campaigns. But guests who do book utilizing OTAs cite the favorable pricing they receive when booking there as well as previous good experiences as the top reasons for choosing an OTA booking channel, said J.D. Power.

This new J.D. Power data contradicts findings from a 2017 report by Kalibri Labs, which noted a significant shift in consumer behavior toward hotel company sites versus online travel agencies such as Booking.com and Expedia. More consumers than before chose to book direct versus using a third-party site, according to data compiled from more than 12,000 hotels in the upper midscale/upscale/upper upscale segments from May to December 2016.

Regardless J.D. Power’s Corwin said that the biggest takeaway from this year’s rankings are that hoteliers should pay more attention to the services they are offering to their guests.

Whereas last year’s study emphasized the importance of mobile — either via mobile apps or improved mobile functionality during a hotel stay — this year’s survey demonstrated the importance of service or staff touch points such as check-in and check-out or food and beverage options. These particular attributes of the hotel experience improved the least compared to guest satisfaction with guest rooms and hotel facilities.

“(They) need to shore up the services area and make sure that’s still a focus,” said Corwin. “(They) can’t forget about what makes the industry what it is.”

While hoteliers could focus more on service interactions or touchpoints with guests, this year’s findings demonstrate that guests are generally happier with their hotel stays than ever before: overall satisfaction for the entire hotel industry rose eight points to 825 on a 1,000-point scale from the previous year.

Guest Satisfaction Rankings

To measure guest satisfaction on a 1,000-point scale, J.D. Power looked at eight different hotel segments: luxury; upper upscale; upscale; upper midscale; midscale; economy; upper extended stay; and extended stay. Factors that determined satisfaction included reservation; check-in/check-out; guest room; food & beverage; hotel services; hotel facilities; and cost & fees. Brands included in the survey have to have at least 66 percent of market share in their respective categories.

“The top winners have, mostly, been at the top for a while,” Corwin noted. “Nothing really surprising here, but The Ritz-Carlton’s score of 902 was one we’d never seen before. We’ve never seen someone break the 900 mark so that’s quite an accomplishment.”

The following hotel brands ranked highest in guest satisfaction in their respective segments:

- Luxury: The Ritz-Carlton (for the fourth consecutive year)

- Upper Upscale: Kimpton Hotels

- Upscale: Hilton Garden Inn (for the third consecutive year)

- Upper Midscale: Drury Hotels (for the 13th consecutive year)

- Midscale: Wingate by Wyndham (for the fourth consecutive year)

- Economy: Microtel Inn & Suites by Wyndham

- Upper Extended Stay: Staybridge Suites (for the second consecutive year)

- Extended Stay: Home2 Suites by Hilton

Have a confidential tip for Skift? Get in touch

Tags: direct booking, jd power

Photo credit: The Ritz-Carlton Bacara, Santa Barbara. For the fourth consecutive year, The Ritz-Carlton hotels brand was ranked No. 1 in guest satisfaction in North America by J.D. Power. Marriott International