Skift Take

Consumer sentiment towards the majority of hotel loyalty programs has been improving over the past five years and the breadth of programs is also growing, but the path to real customer loyalty isn't that simple.

The road to real customer loyalty is not a straightforward path. Today, there are completely contradictory data points as well as ongoing debates regarding the overall success of loyalty programs, the value they create, and their ability to drive true loyalty.

Our latest research report, Perspectives on Hospitality Loyalty Programs 2018: A Challenging Road for Real Customer Loyalty, attempts to reconcile all of the differing perspectives of three key stakeholders: hotel brands, hotel owners, and consumers.

Here, we offer two analyses evaluating the success of hotel loyalty programs. The first ranks the programs according to seven quantitative metrics, while the other takes a look at consumer sentiment according to commentary posted on various online platforms. Both analyses rank Marriott as the most successful loyalty program currently, but, after that, differences arise, suggesting there is definitely room for improvement among all of the programs.

We launched last week the latest report in our Skift Research service, Perspectives on Hospitality Loyalty Programs 2018: A Challenging Road for Real Customer Loyalty.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

From the hotel brand perspective section:

The seven metrics we included in our Loyalty Brand Matrix are as follows:

- Loyalty Members: Brand chains with the largest loyal followings theoretically have the greatest population to target versus having to rely on OTA customers. Note: We are likely overly punitive in this category towards Hyatt, as Hyatt only discloses its active loyalty members.

- Loyalty Contribution: Either disclosed in the company’s 10-K filings, investor presentations, or other various filings, this is the percentage of room nights or occupancy (depending on how the brand defines it) that comes from loyalty members.

- Rooms per Member: A Skift metric that attempts to demonstrate the breadth of the portfolio offering available to loyalty members. The higher the metric, the greater the breadth.

- Rooms per Country: This is defined as the total number of rooms divided by the number of countries and territories that the major brand chain operates in. This is another metric to demonstrate the breadth of a portfolio.

- Direct Traffic: SimilarWeb estimates the percent of desktop traffic that comes via direct. Although this is not a perfect metric for the percentage of direct bookings, we assume the more direct activity on a website, the better the brand loyalty.

- Social Following Rank: We took the average rank of Facebook likes, Twitter followers, and Instagram followers for the company’s main corporate account, the loyalty account, and a couple concierge-type accounts for those that offered one. A stronger social following not only suggests that the brand has a loyal customer base, but that the company recognizes the importance of having a social media presence with guests.

- Average Consumer Sentiment 2013-2017: Discussed later in this article, we worked with Crimson Hexagon, an AI-powered consumer insights company, to perform an analysis of online consumer sentiment towards loyalty programs. We ranked the companies by the highest average sentiment over the time period of January 1, 2013, to December 31, 2017. Marriott’s average includes 2017’s average ranking for Starwood’s program, as the company was acquired by Marriott towards the end of 2016.

Based on the average of each individual rank, we found the brand that ranks the highest across all seven metrics is Marriott, followed closely by Hilton, IHG, AccorHotels, Choice, and then Hyatt and Wyndham.

Preview and Buy the Full Report

From the consumer perspective section:

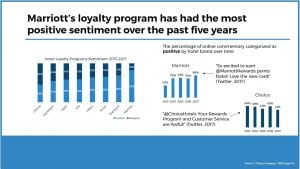

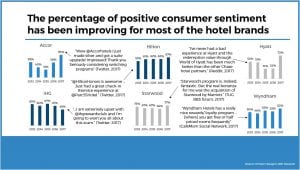

Skift Research worked with Crimson Hexagon, an AI-powered consumer insights company, to perform an analysis of online consumer sentiment towards these loyalty programs. We assessed consumer sentiment for eight hotel loyalty programs (Starwood was separated out as it has not been joined fully with Marriott) during the time period of January 1, 2013, to December 31, 2017. The sites or programs monitored included Twitter, Facebook, QQ, Reddit, Blogs, Comments, Forums, Tumblr, and Instagram, and the search was performed so that the commentary had to include terms such as “loyalty” or “loyalty program.”

Based on this analysis, we found that Marriott’s loyalty program has had the most positive consumer sentiment on average over the past five years, while Choice had the lowest. The majority of hotel companies’ loyalty program sentiment has been improving over the past five years, particularly for Hyatt and Accor. This is perhaps due to some of the enhancements all of the companies have been making. Given our view that consumers tend to post publicly when they have strong opinions (either negative or positive), this trend appears to indicate people’s view of loyalty programs is, in general, improving.

In the exhibits below, we provide the percentage of online commentary that was categorized as positive and negative for each hotel brand on average over the time period 2013 to 2017 (Left hand side chart). We then provide the percentage of online commentary that was categorized as positive for each individual hotel brand over time (Negative sentiment would be the inverse) to show how each brand has been trending over the past five years.

Finally, we also include one quote from an online source as an example of what an individual consumer said online about the corresponding hotel brand’s loyalty program in 2017. If positive sentiment was trending up, we included a positive quote. If positive sentiment was trending down, we included a negative quote to help readers better understand what individual consumers were saying about the corresponding program.

Preview and Buy the Full Report

Performing various analyses can be very helpful in assessing how successful loyalty programs. However, in our view, real customer loyalty occurs when brands establish such strong relationships with consumers that consumers choose that brand over others and refer it to friends and family. In order to do this, hotel brands must drive deeper emotional connections via a strong branding strategy, better utilization of online review sites, improvements in technology, better usage of data, and stronger personalization. At the same time, relations with owners need to be continually improved so that they recognize the full financial benefit of being affiliated with your brand. Finally, hotel brands should look outside the industry for emulation on winning loyal customers.

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Have a confidential tip for Skift? Get in touch

Tags: affluent traveler, business traveler, hotel brands, hotel owners, hotels, loyalty, millennial, skift research

Photo credit: Analyses can attempt to determine which loyalty programs are the most successful, but the road to true customer loyalty is not a straightforward path (Furka Pass, Switzerland). Nigel Tadyanehondo / Unsplash