Skift Take

Booking.com now wants to sign up all types of alternative accommodations, even short-term rental apartments that face increased regulation in many cities. CEO Glenn Fogel seems to think that the ultimate winner of the online travel game will be whoever has the most beds in the end.

Booking.com has significantly stepped up its solicitation of urban apartment and condominium owners. A new blast of email marketing is inviting owners to use the travel company to rent their properties.

The subject line of one recent email was “1138 people earn €1,403 in Amsterdam with us – isn’t it time you joined them?” The message referred to 1,138 people in Amsterdam having listed their places for rental with Booking.com, and added that such “homes in Amsterdam earn a weekly average of €1,403.”

Until now, Amsterdam-based Booking.com has focused on signing up whole-home properties and has shied away from the short-term rental market where Airbnb has had the most inventory. Urban, short-term rental markets have been mired in regulatory battles.

Is the company only onboarding in jurisdictions where short-term rentals are kosher? A spokesperson said, “We always obey all local laws and regulations.”

Will company representatives sit down with regulators as a party alongside competitors like Airbnb to help shape the regulations that are evolving? The company said it already has made its position on this clear but will update in the future if it has more to share.” Parent company Booking Holdings is one of several industry players to be a member of the Washington, D.C.-based lobbying group The Travel Technology Association, which has been involved in some of the regulatory discussion.

In September, Booking.com claimed 721,000 alternative accommodation properties — fewer than the 1 million that HomeAway claimed. Airbnb had 1.9 million instantly bookable listings. Note that “properties” can have multiple “listings.” Airbnb had a couple million listings that are not instantly bookable, while Booking.com only offers instantly bookable listings.

In its fourth-quarter earnings call, Booking.com claimed it had 1.19 million homes, apartments, and other alternative accommodations as of the end of last year — a 53 percent year-over-year growth rate. Airbnb’s latest figures are that it has 2.2 million instantly bookable listings, plus many that aren’t instantly bookable.

Driving that growth is a push to sign up alternative lodgings that can be instantly bookable.

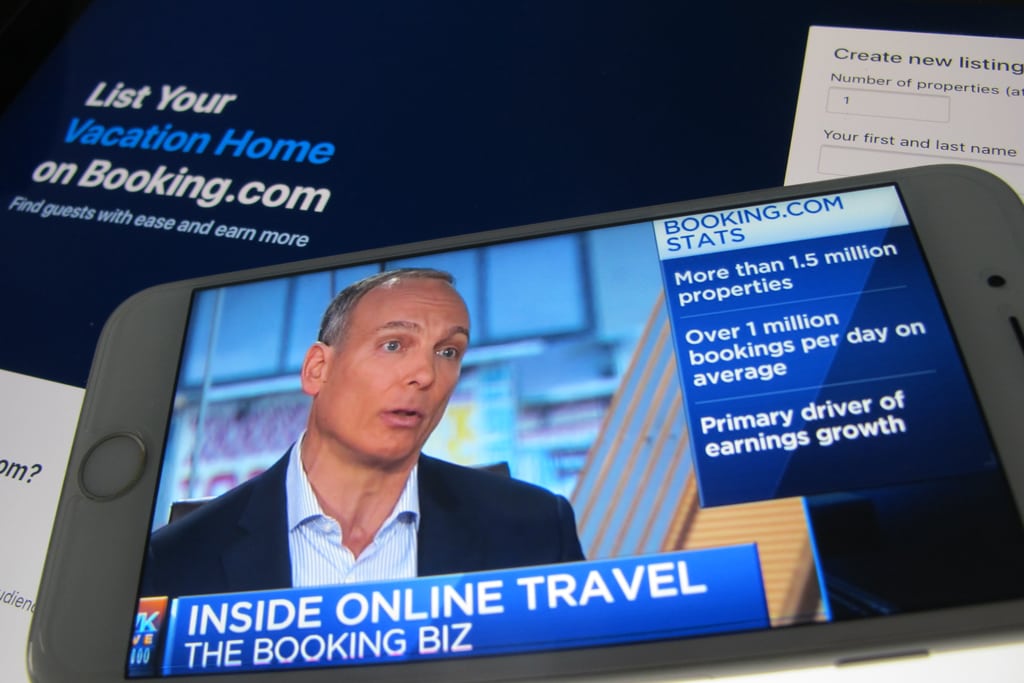

Booking Holdings CEO Glenn Fogel answered questions on CNBC on February 28 about competition with Airbnb to say it expected to be a leader in the alternative accommodations space.

Fogel complained: “[Airbnb] talks about 4.5 million listings, while we talk about 1.2 million properties. Sometimes we have a lot of listings in those properties. Comparing apples and oranges. So we’re going to come forward with some new numbers in the future to compare them [fairly].”

“That being said, we recognize we need to go out and get more properties, including the classical villa and home on the beach that customers want.”

Airbnb is not resting on its laurels, though. In February, Skift reported how Airbnb has been striking deals with hotels to list their properties on its platform as part of the startup’s broader push to win over hoteliers.

The company also publicized last month a quality assurance program that “identifies more than 2,000 Airbnb home listings in 13 cities worldwide as having particular amenities and meeting a lengthy checklist of standards for both quality and safety,” as we reported.

Meanwhile, Expedia has been redirecting revenue at its rental brand HomeAway back toward investments, including for marketing, hiring, and technology, officials said last year.

Expedia plans to focus on “adding new rental units to the platform and spreading brand awareness” despite investor worries about overall marketing spending at the parent company.

For now, one of Booking.com’s main moves will be to add inventory.

During the fourth-quarter earnings call, Fogel said, “Regarding inventory, a good way to start is more is better. I agree with that. We’re nowhere near at the level where, one would start thinking, ‘Do we have enough?’ — particularly in some areas.”

“We have a large number of alternative accommodations around the world,” Fogel continued. “But there are areas where I look, I know we are not complete at all, which is why we’re spending additional money to get that additional inventory in it.”

So consumers who already are used to Booking.com’s email marketing related to hotel bookings had better get used to even more messages, especially about urban apartment sign-ups.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, alternative accommodations, apartments, booking.com, homeaway, short-term rentals, vacation rentals

Photo credit: On February 28, 2018, Glenn Fogel, Bookings Holdings CEO, poke with CNBC's Seema Mody about the online travel company's move into alternative accommodations. His company uses emails and online promotions to sign up more apartment rentals. Skift