Skift Take

Some entrepreneurs and scammers are treating initial coin offerings like get-rich-quick schemes, and the travel distribution ecosystem isn't immune. Beware of people who say they can totally disrupt the travel industry, especially if they don't even understand how the industry works.

Sure, you’ve probably heard of Bitcoin or Etherium. There’s also a good chance you’ve heard of Ripple or Litecoin, if you’ve been reading the news the lately.

People around the world are becoming newly minted millionaires, and the cryptocurrency craze is in full swing. There are coins and tokens aiming to revolutionize almost every industry, and travel is no exception.

Could Travelcoin, OjutCoin, TravelChain, PallyCoin, or Lockchain redefine the travel industry? Well, no. They could make their creators rich, of course, if enough people who don’t understand the travel industry decide to invest.

As cryptocurrency mania has hit the mainstream, the travel industry has been a target for companies launching initial coin offerings and blockchain solutions.

A recent Skift Research survey of startups found that the travel industry is caught up in this exuberance, as well; respondents cited blockchain or distributed ledger technology as the biggest innovation happening in travel, as well as the second most likely technology to change travel (just trailing artificial intelligence).

Winding Tree, the most legitimate of the current travel blockchain players, is slated to begin its token sale on February 1 after spending the last few years getting ready and forming partnerships with airlines like Lufthansa.

“A lot of people are asking me whether the online booking sites or GDSs [global distribution systems] have to go, and the answer is no,” said Maksim Izmaylov, a co-founder of Winding Tree, last summer when we looked into the sources of disruption challenging the deeply entrenched players in the travel industry. “They don’t have to. What has to go is the rent-seeking business models, the abuse of power that they’re exercising and that they are able to exercise today. The path between the ability to exercise monopolistic power, and actually doing that, is very, very short.”

This is a nuanced, and accurate, way to describe the existing dynamics in travel distribution, and how a decentralized solution might drive a wedge between established distributors and travel providers.

While the Winding Tree token sale gives a high percentage of tokens to the founders, 20 percent, the organization’s partnerships and goals are aligned with a forward-looking vision for the travel industry that is echoed by many, excluding people within the traditional distribution giants, that is.

Less Than Legit

The other players pitching a blockchain revolution in travel, however, have less to say about the transformative power of this new technology. They’re more focused on the reasons why people should invest in their coins and tokens than creating a business case for their existence in conjunction with travel providers.

(A bit on the lingo: Tokens, essentially, let you access and participate in a marketplace or network, while coins hold value as digital currency; there are also tokenized securities, which are under scrutiny from financial regulators around the world. Coins ensure it’s worth it to participate in a project by incentivizing those involved, and tokens let their holder perform tasks on a network, although they also tend to have a monetary value as well.)

There are more than a dozen travel-related blockchain-based startups that have an initial coin offering either completed or in the offing.

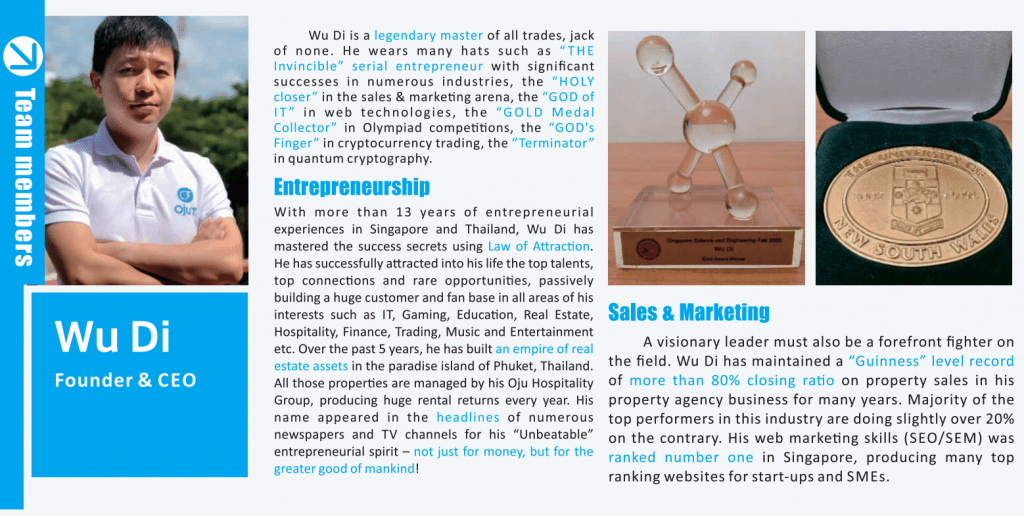

Perhaps the most bizarre is OjutCoin, which bills itself as poised for “Global Market Domination!” The company’s cryptocurrency would have two uses: as a global replacement for traditional currency, and as the backbone of a growing “tourism real estate empire” that is now comprised of 105 owned or managed properties totaling 300 rooms in Phuket, Thailand.

Humble beginnings for a global empire, to be sure, with a master plan that forecasts that its marketplace will be worth nearly $9 billion in the next five years. Digital currency and payment solutions, of course, already exist. The plan seems to be to use the proceeds from the startup’s initial coin offering to buy up hotels around the world and ensure guests can only pay in OjutCoin.

Ojut founder and CEO Wu Di bills himself as not just a “legendary master of all trades” but the “Terminator” of quantum cryptography who has achieved his massive success “using Law of Attraction [sic].” Take a look at his biography; we wish him luck.

Beyond the Beyond

Beyond Ojut, there are a handful of other crypto companies with outlandish goals for the travel industry.

PallyCoin bills itself as a combination of social network and travel booking service, powered by its own cryptocurrency, of course. Travelers can find others nearby, chat, and meet up. Take a look at the Instagram-aesthetic promotional stock footage video the company created.

It’s unclear why any of this needs to involve blockchain, but the company claims it has raised more than $2 million through its initial coin offering so far. So good for them.

TravelChain, which appears to have paid for positive coverage by bloggers on Entrepreneur and the Huffington Post, seems to be following the Winding Tree model for the most part, except with an app.

ExploreCoin is a currency play, as is BitAir. TrafficX is gearing up to disrupt maps and ridesharing using Ethereum blockchain, for some reason, while Fujinto is a decentralized booking market for tours and rides. Fujinto’s promotional video looks straight out of the TV show South Park.

LockChain wants to launch a vacation rental and hotel marketplace on blockchain, but its team took a whopping 50 percent of token allocations, not boding well for it turning into a competitive marketplace, despite earning its founders about $9 million at its current valuation.

PocketInns is a marketplace that has launched a token auction, although the existing version of its lodging search product has very little vacation rental content on it.

TravelFlex is another payment blockchain project that is giving away free vacations to some investors. There are other companies out there we haven’t mentioned, as well.

Besides companies looking to cash in on initial coin offerings, there are sites that accept cryptocurrency as payment. CryptoCribs accepts bitcoins in exchange for vacation rental stays, for instance, and could stick around as an alternative to traditional booking sites for those flush in crypto assets.

What’s the Point

After reading through the whitepapers of a dozen companies looking to build a travel ecosystem on blockchain, a few trends have emerged.

People are looking to make money from selling these tokens and coins, even if they don’t have a viable product or understanding of what makes a compelling travel product. Money is indeed flowing into these companies, to the tune of $3 billion in the fourth quarter of 2017, according to Crunchbase, growing from about $30 million in the first quarter of 2017. A gold rush is on.

Crypto trading is complex, but many investors choose to buy up numerous cheaper coins hoping they will increase in value. Then, in theory, investors can sell them, and buy more established coins with the proceeds. These coins and tokens sold with the intention of creating new travel products will quickly get sucked into this cycle of speculation and sell-offs.

These companies each tap into the myth that disrupting an industry can make investors rich, creating a group of elite rebels outside the status quo. The Instagram-aesthetic of nearly all the marketing from these companies shows that they are also looking to prey on those who want to feel cool and savvy.

The travel trade media isn’t immune from this frenzy, often penning stories that feed the craze by buying into the hype and speculation while ignoring the risks of investing in one of these unregulated startups.

Separately, it’s also extremely simple and cheap for one of these companies to pay a blogger to write a story on a reputable news outlet and claim legitimacy from the coverage.

Finally, it’s easy to detect elements of past technology crazes when surveying these companies. Pundits use words like disruption and transformation without an obvious use case for these marketplaces.

Wacky Versus Reality

The reality is that the core of blockchain technology has powerful implications for the travel distribution ecosystem. A reduced cost of distribution for travel providers, along with increased security for travelers, may have a transformative effect if more companies sign on to use a public blockchain marketplace.

It will take years, but it could happen. There’s also the potential for blockchain to reimagine how loyalty programs operate and travel payments get handled.

Regardless of how strange this sector is now, it will likely become even more crowded as the crypto craze grinds on.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: bitcoin, blockchain, distribution, winding tree

Photo credit: A promotional image for OjutCoin, one of the many cryptocurrencies out there in the travel space. OjuTcoin / Facebook