Skift Take

The online travel agencies — as the Apex Predators and beneficiaries at the top of the current distribution scheme — aren't likely to rush in to invest in a technology that democratizes access to travel content.

Glenn Fogel, CEO of the Priceline Group, has brushed off the threat of Blockchain to his business.

Fogel’s commentary, which took place on stage at the Skift Global Forum last month,

felt a lot like the early onset of the Innovator’s Dilemma, which sees market-leading companies usurped by new technologies and competitors. The CEO of a $94 billion public company has many things that keep him up at night, and a relatively nascent technology, BlockChain, which is arguably at the peak of inflated expectations, should not be particularly worrying for him over a two-to three-year horizon.

Don’t expect online travel agencies to necessairly rush into any decentralizing technology such as Blockchain. The reality is the online travel agencies sit at the top of the 50-year-old distribution-food chain like Apex Predators (and innovators). They are beneficiaries of the barriers to entry that the modern distribution environment places on access to content. This is compounded by an increasingly expensive customer acquisition landscape.

Viewed within the context of greater historical decentralization that has been driven largely by the Internet, Blockchain — or future iterations of the technology — feels like an inevitable progression. It’s a technology that allows for the dispersal of functions, powers, people or things away from a central location or authority, while importantly maintaining trust.

Startup barriers to entry

A common belief among Silicon Valley investors is that travel startups (with very few exeptions) are radioactive, and are best-approached with extreme caution. History has not kind to the travel startup ecosystem: Many have tried, most have failed, and the select few that succeeded have been especially well-capitalized or incubated by airlines or hotels.

While founders must take the blame for me-too, hammer-looking-for-a nail-type thinking that permeates the travel-startup ecosystem, the reality is there are plenty of talented developers, designers, and entrepreneurs who have faced significant barriers to entry imposed by the modern distribution environment. That’s to the potential detriment of consumers.

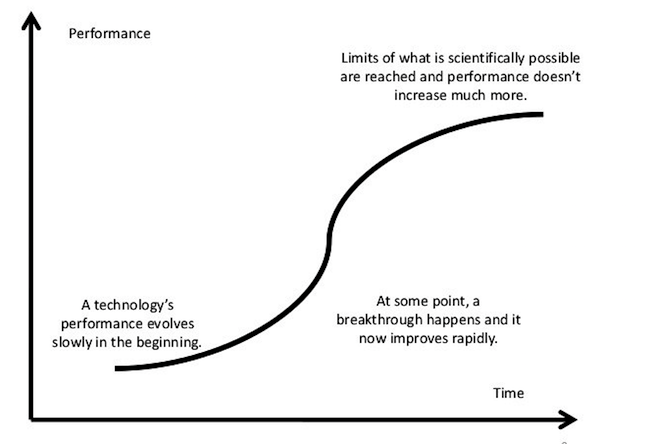

Many will counter that there has been a tremendous amount of innovation, and it’s never been easier to book travel across the globe — and they’re right. If we plot the industry’s performance over time, we appear to be on a fairly typical, if elongated, S curve, what might be thought of as Distribution 1.0.

The global distribution systems delivered significant transformations in content access and booking ease, followed by a wave new entrants such as the online travel agencies piggybacking off of Internet and mobile disruptions. Fundamentally, however, they’re built off of the base of the Distribution 1.0 model that provides significant incentives to online travel agencies and along with it market power that makes it extremely difficult for new players, under the current system, to break in.

The reality is we may be approaching, or in fact may have reached the limit, of what is possible using this platform.

My belief is that future customer-booking experience innovations or multi-mode travel use cases may only be delivered on the back of Distribution 2.0 and new standards environments. This is a transition that is similar in scale and benefits to the current migration from internal combustion to electric vehicles.

hIstorical arc of decentralization

Blockchain, like other transformational technologies before it, creates the perfect breeding ground for a Travel Distribution 2.0. That’s assuming the community of developers can figure out scalability, and other technological barriers.

On one hand, it has the potential to enable democratized access to travel content, including availability and pricing, while simultaneously facilitating a new generation of targeted, demand-side agency models and players.

Given the rapidly iterative nature of the technology and the community of developers that will be activated, I expect a few travel Blockchains, or markets, will be developed. The healthiest of these will be the market-makers, which will nurture and provide the right incentives and standards for suppliers, agencies, and travelers alike.

The new CEO of Expedia, Mark Okerstrom, said at Skift Global Forum that the measure of Blockchain technology is going to be whether it will be “cheaper or better.” As of now, it is simply too early to tell.

However, the online travel agencies — as the Apex Predators and beneficiaries at the top of the current distribution scheme — aren’t likely to rush in to invest in a technology that democratizes access to travel content.

Other scenarios, too, may take place. A likely starting point in the Blockchain for both the agencies and the distribution-system providers is the creation of private Blockchains —think of it as the Intranets versus the Internet — to facilitate global transactions and settlement between them and their partners. These could be useful, although not transformational.

Mohammad Gaber is senior director, marketing and digital strategy at Air Canada, and a Winding Tree advisor. These opinions are his own.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: blockchain, distribution, expedia, otas, priceline