Skift Take

This week in digital news, we thought about new beginnings. Expedia's new CEO wants to chip away at Google's dominance and Expedia-supported Despegar successfully launched an IPO.

Throughout the week we post dozens of original stories, connecting the dots across the travel industry, and every weekend we sum it all up. This weekend roundup examines digital trends.

For all of our weekend roundups, go here.

>>While some may disagree, we believe that Google is not becoming an online travel agency. It certainly could do so, but its travel business is already massive and highly profitable. We estimate it will generate around $14 billion in revenue in 2017, and will grow at over 20 percent per year for the foreseeable future: Google Travel Is Worth $100 Billion — Even More Than Priceline

>>Booking.com has long experimented with vacation rental inventory. Its inventory has been growing rapidly, but vacation rentals still remain a small part of Booking.com’s business: Booking.com Could Narrow the Gap In Vacation Rentals

>>U.S. business travelers want the technology tools to make their trips easier. The rest of the world, however, doesn’t necessarily see technology as the solution to service problems: U.S. Business Travelers Embrace Technology but Also Fear Its Impact

>>The new Skift Travel app, optimized for our paid Research subscribers, is now available. Free users get access to the last 24 hour of stories: Launching: Skift Travel App for iOS and Android

>>Booking.com is pulling back from its advertising spend on Expedia-controlled Trivago. But we must await third-quarter financial data and any company pronouncements on the topic to know all of the implications: Priceline May Be Spending Less on Trivago and Changing Hotel Metasearch Dynamics

>>Expedia would own 14 percent of online travel agency Despegar post-IPO. But contemplating the odds of an Expedia takeover is a “rompecabeza,” or a head-breaker: Expedia-Supported Despegar Prices IPO at $26 Per Share

>>Agents may be placing more hotel bookings through global distribution systems, but the fact remains that hotels would like to move away from expensive distribution channels like these: Travel Agents Are Increasingly Using Global Distribution Systems to Book Hotels

>>With its IPO on Wednesday, Despegar became the world’s seventh-largest online travel company by market cap. Its bosses talk a good game. But its major markets may have near-term hiccups ahead: Despegar Hints at Its Latin American Travel Strategy After Successful IPO

>>The online travel environment is transitioning at a hectic pace when you consider mobile and artificial intelligence. Expedia’s new CEO, Mark Okerstrom, will have to find a way to chart his company’s evolution at an appropriate speed to keep up. It won’t always be smooth sailing: Interview: Expedia CEO Sees an Opening With Chatbots to Loosen Google’s Grip on Travel

>>With this funding, Le Collectionist ramps up its marketing of luxury vacation rentals. But Airbnb and other tech and lodging brands may not let this profitable segment be siphoned off by this and other young startups for long: Home Rental Platform Le Collectionist Raises $10 Million: Travel Startup Funding This Week

>>With privacy and data protection becoming bigger issues for consumers, it’s not a surprise to see the European Union step up its regulation. Travel companies all over the world should be paying attention: The European Union Is Preparing to Get Tough on Data Protection

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: despegar, digital, expedia, Travel Trends, trends roundups

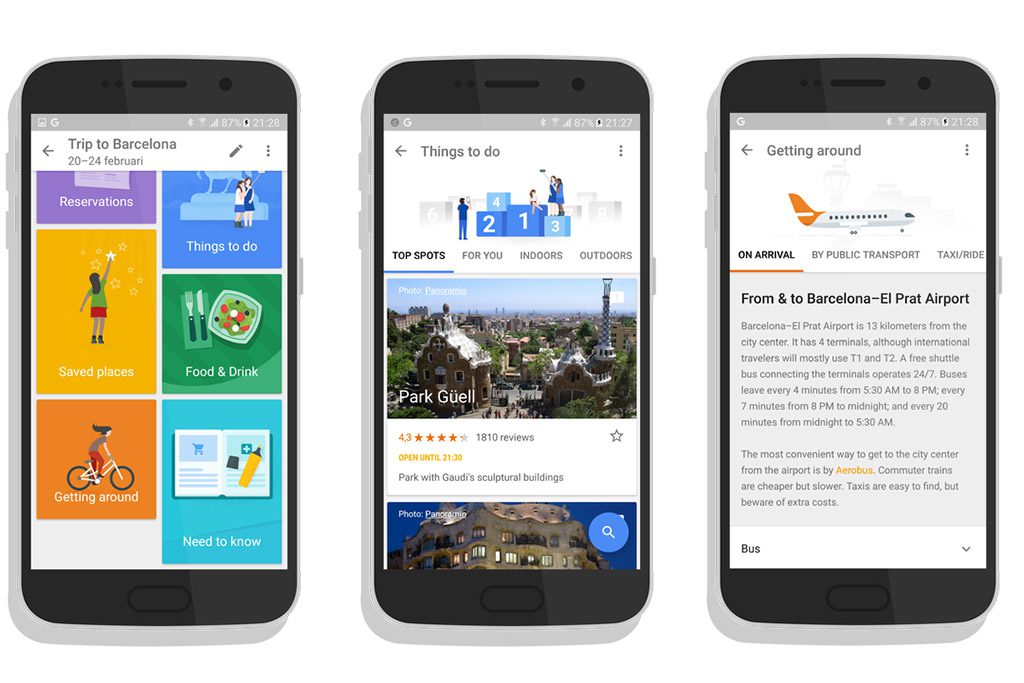

Photo credit: The online travel environment is transitioning at a hectic pace. Pictured is the Google Trips app. Android World