Skift Take

A data dive into the habits of U.S. high-income travelers. What do they value and what expectations do they have from their travels?

Today we are publishing the full results from our 2017 U.S. High-Income Traveler Survey. Travel demand is booming and with the global economy on an upswing, travel brands are looking to build relationships with consumers that can afford a bit more when it comes to transport, accommodations, in-destination activities and other travel products and services.

To address this segment, Skift Research designed and fielded a comprehensive 50-question survey aimed at the top 20% of income earners in the United States. With more than 1,300 responses, we segment and cross-tabulate results to identify travel trends based on income, education, accommodations preferences, .

This comprehensive data series rolls up the data costs and the value-added insight from our seasoned bench of analysts.

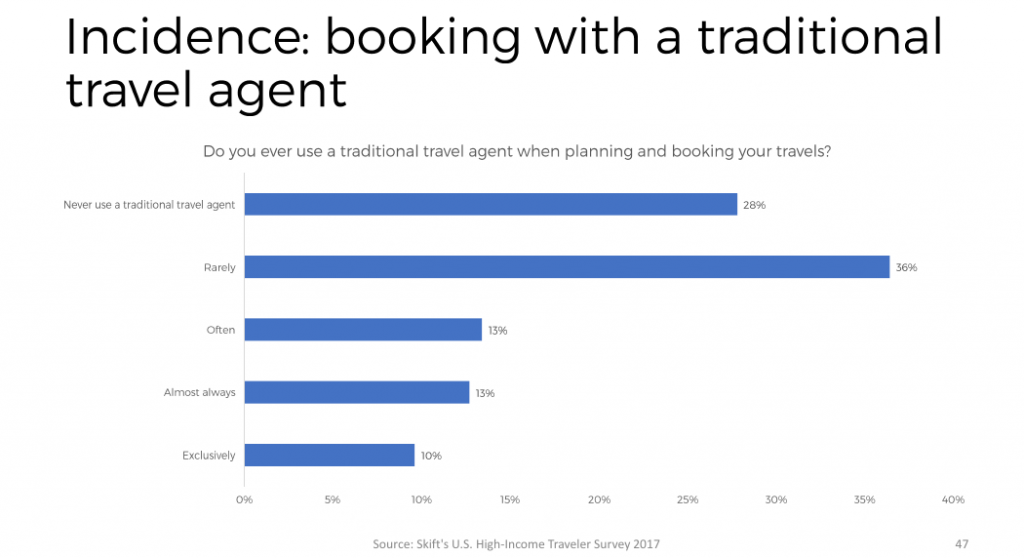

The majority of U.S. high-income travelers rarely or never used traditional travel agents to book their travels.

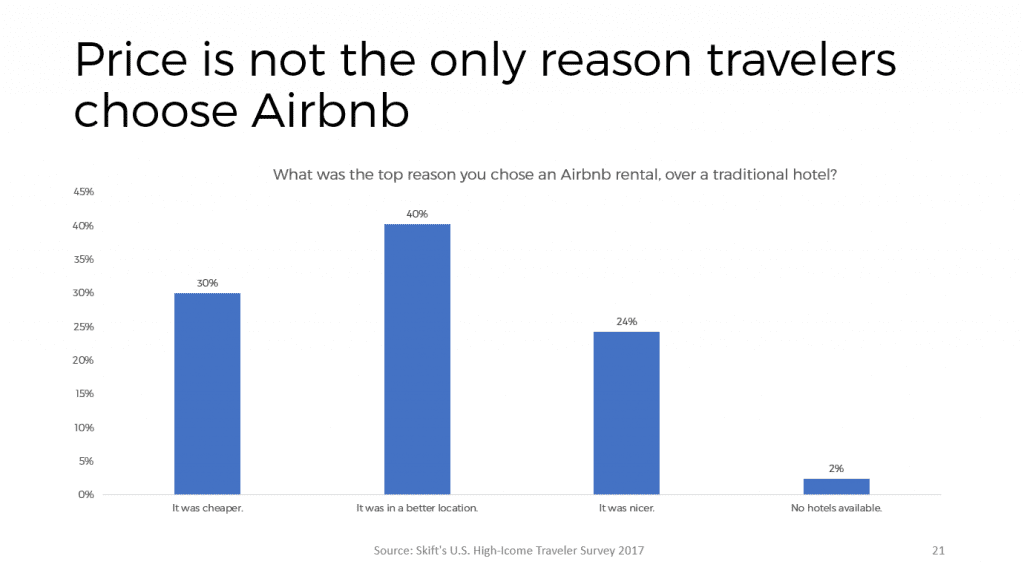

Price was not the only reason for choosing an Airbnb listing over a hotel room.

Price was not the only reason for choosing an Airbnb listing over a hotel room.

Subscribe to Skift Research Reports

This is the latest in a series of monthly reports, data sheets, and analyst calls aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Have a confidential tip for Skift? Get in touch