Skift Take

The bigger question here is this: Should airlines and their travel peers be investing more in social versus search?

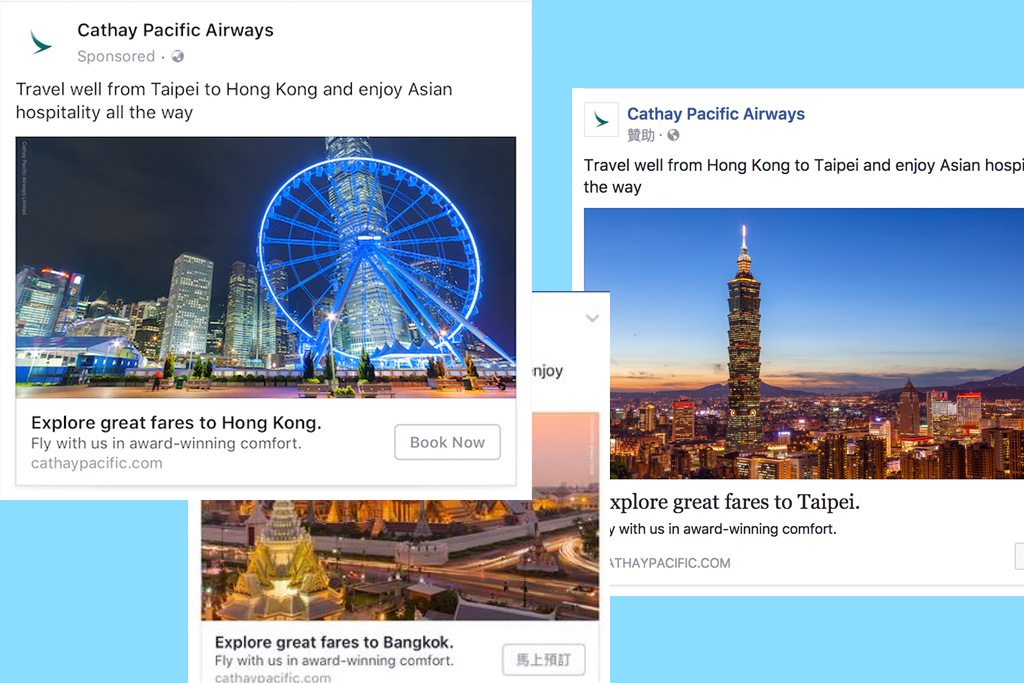

Just as it did last May, Facebook is rolling out new Dynamic Ads for Travel on its platform as well as on its Instagram brand, only this time, instead of being geared toward hotels and destinations, it’s tailored toward airlines.

“It’s fundamentally the same,” said Christine Warner, Facebook’s head of travel. “The only thing that’s different is that we’re able to allow our partners to optimize against route and schedule, which is unique to flights versus hotel remarketing.” For either Facebook or Instagram. the process is the same for advertisers.

If Facebook and Instagram’s early success with Dynamic Ads for Travel for hotels and destinations is any indication, it seems that these advertisements for flights have the potential likewise to be impactful.

Melia Hotels, for example, increased return on investment 6.7X versus its legacy retargeting campaign when using Facebook’s dynamic ads for hotels, for example.

Warner also noted that one of its pilot airline partners, Cathay Pacific, has seen reductions in cost per acquisition of 15 percent using Dynamic Ads for Travel, and has increased its booking volumes 16X.

But what of the complex nature of fluctuating airlines prices and flight availability? Warner said the new dynamic ads for flights have taken that into consideration.

“For pricing, we do it in two ways,” she said. “The first is we can either capture through the pixels the price that was last searched by the individual to then remarket to them against that route schedule with that price. The other way that we allow our partners to do this is by them sharing a ‘price from’ and they can update that every 15 minutes and generally, it is a price from $99 for the next two days.”

Social Versus Search

Given this early feedback, however, is there good enough reason yet for airlines and other travel brands to be looking more at Facebook and Instagram for their ad spend? That’s the bigger question at the heart of this new advertising push from Facebook, especially as it tries to take away market share from Google.

Although Google reaps the benefits of massive ad spend from the likes of the big online travel agencies like Priceline and Expedia, and have the upper hand — for now — products like Dynamic Ads for Travel are making Facebook and Instagram more desirable among travel brands who want to reach the social networks’ more than 1.8 billion monthly users.

“What makes Facebook a lot different from using Google Flights, for instance, is that Google Flights is more of a metasearch product,” said Nicholas Ward, president and co-founder of Koddi, a company that assists advertisers with managing hotel price ads and other metasearch advertising. “You can take your structured data and put the best offer in front of the consumer, and the consumer can decide from there, using all the available tools that Google has available.”

Facebook, on the other hand, Ward notes, is much more targeted in its approach to reaching consumers.

“For example, if American Airlines were to push their data to Google today, there are capabilities to sort out experience. If American makes that connection with Facebook they have the ability to say, ‘With this segment of users we want to have this experience, etc., based on the customers who have been to our site and we want to treat them differently.’ You can slice and dice the audience in a much more granular way and even offer different deals. The targeting of the user is that much more refined.”

Another reason why Facebook hopes more travel brands will consider upping their ad spend with the social platform versus other providers has to do with increasing usage of mobile, something Warner has spoken of at length previously with Skift.

Warner said that data from summer 2016 showed that 93 percent of conversations on Facebook and Instagram were taking place on mobile, with travel being one of the top topics discussed. Facebook IQ research has also demonstrated how 85 percent of travel is planned on a mobile device, and when people start planning their trips, 50 percent reach for their phones first.

“Consumer behavior and travelers’ behaviors have shifted to mobile,” Warner said. “They’re going to 56 travel-related touch points, but during that same timeframe, they’re also spending five times more time with Facebook and Instagram than they are with any one travel-related site. We, at Facebook and Instagram, are with people one out of every five minutes, every single day, on their mobile device.”

As for what travel brands should be doing to leverage the full capabilities of mobile advertising on social, Warner said, “It’s imperative to not only retarget people but to actually go and meet travelers where they are, to inspire them to take their next trip through mobile-first video. Don’t forget about the creative.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airlines, facebook, google

Photo credit: Facebook is hoping to attract more airline advertisers with its newest product, Dynamic Ads for Travel for flights, which is geared toward mobile users. Pictured here are images from Cathay Pacific's Dynamic Ads for Travel. Facebook