Skift Take

The intent to grow Facebook advertising is clear from both the hotels and online travel companies. As conversion continues to improve, Facebook will grow its market share within a strongly growing digital advertising pie.

Last week we launched the latest report in our Skift Research Reports service, A Deep Dive Into Facebook’s Impact on Travel.

Below is an excerpt from our Skift Research Report. Get the full report here to stay ahead of this trend.

Visual ads that can be targeted at a very specific portion of the population should be effective for the travel industry. The ability to retarget a person with lodging options who recently searched a travel site for flights to Rome in October should facilitate high conversion on ads and better return on investment for the clients. We have seen broader acceptance of Facebook as an effective ad platform, but the travel industry tends to move cautiously in approaching change.

Dynamic Ads for Travel Should Facilitate Further Acceptance

By having an ad format specifically designed for the travel industry, we expect to see adoption increase. Bidding and ad optimization are complex so we see many companies utilizing third parties to run the campaigns, build software, or offer consulting services. The largest online travel companies possess incredible resources on the technology and personnel side and are more likely to bring the ad optimization process in-house.

Preview and Buy the Full Report

Retargeting Is a Unique and Powerful Tool for the Industry

Google’s advertising platform is highly effective, but more pragmatic than aspirational. Travel companies need to be present in search results to drive traffic to their own sites, but there is nothing inspirational in the way that Facebook offers. This does not diminish Google’s role nor its importance in driving traffic, but simply highlights a key difference for Facebook. That difference makes Facebook a complementary advertising tool to Google. Of course, both compete for ad dollars, but it’s not an apples-to-apples comparison.

Facebook’s ability to retarget across devices is crucial for the travel industry where a person may search on mobile, but then book later on a laptop or desktop. Facebook has an advantage here where the tracking is done at the personal identification level rather than through cookies that approximate an identity. Facebook is powerful enough to track both in-app and browser behavior.

Facebook’s Larger User Base Continues to Grow

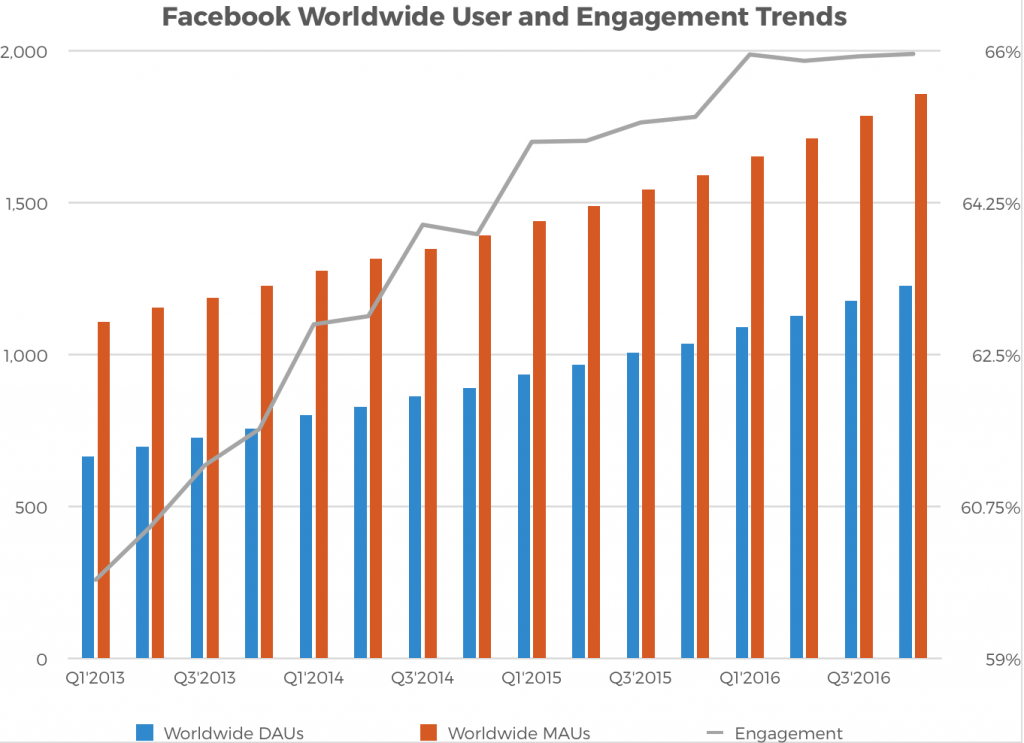

Despite its large size, Facebook’s user base has continued to grow 15 to 20 percent per year, surpassing 1.2 billion daily active users in December 2016. For travel companies, this gives them a huge audience to advertise to where branding can be done at scale and targeting can be done at a much more granular, targeted level.

Engagement Remains High

Despite its large size, Facebook’s engagement level (daily active users divided by monthly active users) has remained strong at 66 percent. What this means is that two out of every three of the 1.8 billion monthly users is using Facebook on a daily basis. For a travel company, it means that ads retargeting a consumer soon after a flight is booked or hotel site is searched is likely to be viewed quickly after the initial event. “Recentness” is crucial for better conversion in travel ads. Facebook’s high engagement level increases the likelihood of viewership and conversion, and that in turn increases prices travel companies will pay for ad space on Facebook.

Preview and Buy the Full Report

Facebook Will Increasingly Take Advertising Marketing Share

We walk through our findings in great detail later in the report, but broadly, Facebook should see its share of travel dollars in digital advertising accelerate from the low single digits to potentially over 10 percent in the next few years. Across the board, online travel companies and hotels have told us that spending is increasing for Facebook. The gains in travel will be meaningful for Facebook’s growth path, but the headwind for Google will be quite manageable.

We Do Not See Google-Like Levels for Facebook Advertising in Travel

While Expedia has noted that we could see ad spend on Facebook reach “Google-like” stature, we do not believe Facebook can match Google’s share. Google remains incredibly important to drive traffic to the online booking sites. It is much more likely that Facebook takes perhaps a few percentage points of share spend from Google and much more from other smaller digital platforms, television, and print.

Preview and Buy the Full Report

Subscribe now to Skift Research Reports

This is the latest in a series of twice-monthly reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: advertising, facebook, travel

Photo credit: Facebook's growth among travel brands remains strong. Marcio Jose Sanchez / Associated Press