China's Luxury Travelers Are Young and Spending More Than Ever

Skift Take

The Skift New Luxury Newsletter is our weekly newsletter focused on the business of selling luxury travel, the people and companies creating and selling experiences, emerging trends, and the changing consumer habits around the sector.

The Skift New Luxury Newsletter is our weekly newsletter focused on the business of selling luxury travel, the people and companies creating and selling experiences, emerging trends, and the changing consumer habits around the sector.

In addition to providing this weekly digest with stories that are relevant to the sector, Skift is expanding its coverage of the sector with stories like you find below.

Chinese millennial travelers are the future of luxury spending: They’re well-traveled, affluent, and eager to spend on on luxury goods and experiences that show off their wealth.

This is great news for the travel and luxury retail sector, but let’s break down where the opportunities actually lie.

Globally, the share of luxury goods spending that comes from purchases made while traveling internationally is increasing and currently accounts for 40 percent of the global spend on luxury goods, according to the Deloitte report Global Powers of Luxury Goods 2016.

[signupform id="91580e75-6c0e-4e11-8df7-7f1dd2376b1f" text="Interested in more stories like this? Subscribe to Skift's New Luxury Newsletter to stay up-to-date on the business of modern luxury travel." class="purple"]

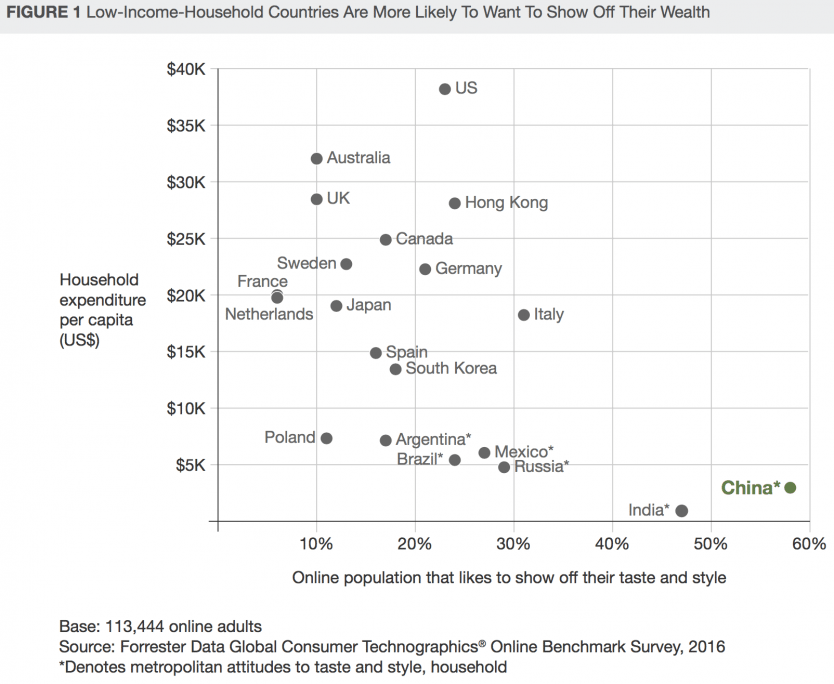

The rise of the Chinese traveler is nothing new and outbound travel from China continues to grow with most recent statistics indicating a 17-percent increase in 2015. Growth in spending on foreign travel by Chinese of all age groups and income status grew in 2016 to levels never seen before, hitting $261 billion for the first time. Half of Chinese travelers are millennials, age 15 to 29, who are less price-sensitive and more willing to spend money on indulgences than previous generations.

More than half, or 66 percent, of these Chinese millennials are high-income earners, but societal norms have as much an impact on their spending as their salaries, according to new Forrester Research.

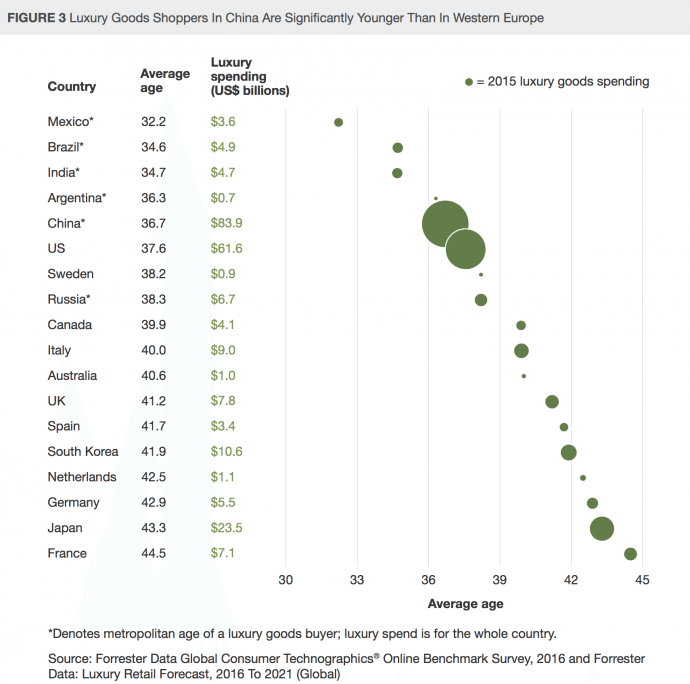

Millennials living in major urban areas in China, more than any other emerging or developed nation, agreed with the statement, “I like to show off my taste and style,” regardless of their income.

More than half of Chinese millennials are likely to buy luxury goods while traveling, but their luxury spending extends beyond handbags and jewelry to travel and dining experiences, according to the research.

This is a shift mirroring much of what we’ve seen across the travel industry in which younger consumers spend more on experiences than products. Validating that change is data showing that the Chinese retail sector posted just 10-percent growth in 2015, almost half the 17-percent increase in outbound travel.

Smart travel and luxury brands have the opportunity to transform millennials, who are just developing their consumer habits, into loyal customers for decades to come although the question of exactly how to engender loyalty continues to fluster companies.

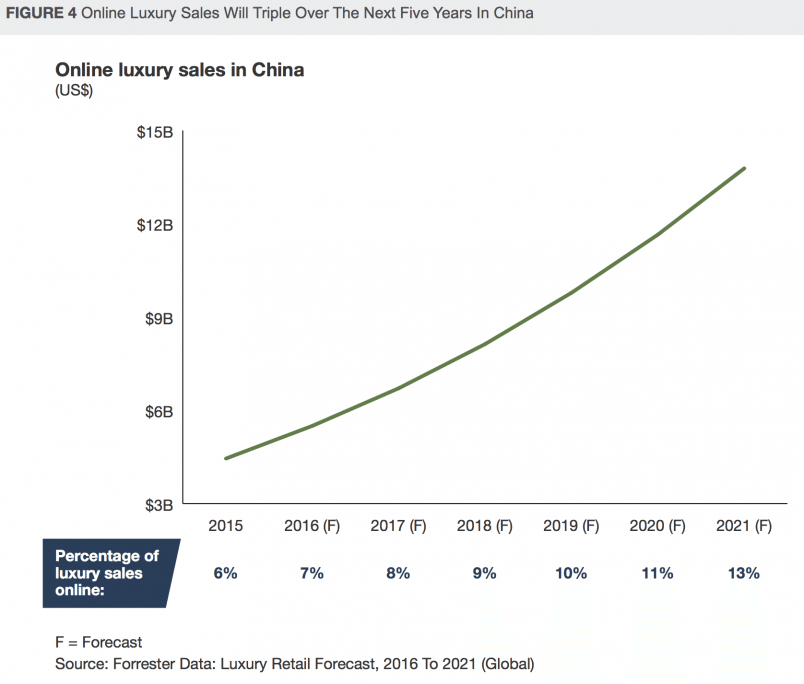

In addition to ever-growing luxury spend from traveling Chinese millennials, the Forrester report also suggests that eCommerce will be an important strategy in capturing luxury spend with cross-border eCommerce sales set to triple over the next five years.

Online purchases will capture market share from personal shopper services as consumers seek product authenticity and return guarantees. This shift is yet another opportunity for retailers to form more direct relationships among Chinese shoppers.

Forty-four percent of the online population in China were between the ages of 18 and 34 in 2015 — compared to just 27 percent in the U.S. - suggesting retailers that can foster loyalty among consumers will benefits for decades to come.