Skift Take

Despite recent gains, Google Flights is still the price-comparison tool of tomorrow, and not today -- unless its scale makes the instant booking of flights a standard way of doing things.

One in 10 frequent flyers on average in North America start their airfare shopping on Google Flights, according to a survey of nearly 2,500 frequent travelers by airline data firm OAG.

But frequent travelers between ages 18 and 32 years old are more than twice (21 percent) as likely as the average traveler to start their search process with Google Flights, says OAG’s research.

Users were asked: “When starting your search process, how do you start your search?”

The multiple choice options included Google Flights, airline website, OTA (online travel agency), travel agent, Bing/Yahoo, discount travel site or app, or other.

Since last summer Google has added some online booking sites to the Flights results. These moves — plus others, like expanding instant booking — may help explain why Google’s price-comparison product is gaining traction with the next generation of travelers.

OAG’s survey isn’t perfect. It isn’t clear whether respondents meant they started their flight searches specifically with Google Flights or in the Google search box.

For instance, the survey found that only one out of four travelers use Google Flights at some point during travel searches. Yet the respondents likely meant they search Google for flights, and don’t necessarily start at Google Flights per se.

North American users of OAG’s Flightview flight status mobile app for iOS and Android were invited this winter to answer questions, and 2,474 replied.

The survey results were not adjusted to reflect a statistically representative portion of the U.S. population. For example, the types of people likely to download such an app will tend to fly more frequently than the national average does. About a third of the people surveyed were traveling for business, and the rest for leisure, but national averages are different.

OAG says the respondents drew from a broad pool. Flightview had the second-most highest average monthly active users of flight status apps for all of 2016, following FlightAware which was the most-used, according to analytics firm App Annie.

Adding Agencies Beyond Orbitz

One handicap Google Flights has faced is that its marketplace has not offered as many options as are provided by metasearch rivals like Kayak and Skyscanner. Most of the Google Flights results have been direct links to airlines. A search for flights between Chicago and London would typically only show results from, say, a few airlines, like American, Iberia, and Finnair, plus one online travel agency (often Orbitz), while Kayak or Skyscanner would show results sourced from dozens of online travel agencies as well.

Surveys such as OAG’s show that customers are more likely to book when they feel they’re looking at a full list of the possible options. But that isn’t likely the only factor. It could also hinge on Google getting more aggressive with using the real estate near the top of its pages for Google Flights.

It can’t hurt, though, that Google appears to be expanding the supply available on its Flights product.

In recent test searches, Skift has seen a significant increase in the breadth of online travel agencies participating. While it has always had online travel agency partners, the prevalence has risen on average in recent months.

In the past, U.S.-based users often only saw Orbitz as an online travel agency option. Now, competitors like Expedia, Priceline, and CheapTickets are all present. In Europe, online travel agencies like eDreams and Vliegtickets.nl are now participating frequently.

Instant Booking

In the survey, majorities of travelers of all ages said they would be comfortable booking directly with airlines through Google Flights without leaving the Google Flights interface, OAG found.

Google Flights has been slow to offer so-called facilitated, or instant, booking, despite modest testing since 2013.

At the Skift Global Forum in New York City in 2016, Oliver Heckmann, a Google vice president of engineering, said Google was offering instant booking only with Lufthansa, Virgin America, and Westjet.

Lufthansa made the big push on Google for U.S. users in November 2015. Travelers on some U.S. searches see the option to book a flight on Lufthansa while remaining within Google’s interface. This “instant” booking option, described as “Book with Lufthansa on Google” is listed along with booking tickets on various airlines (like “Book with Lufthansa” and “Book on United.”)

Since then, Lufthansa has added a direct instant-booking offer with Google on searches for users based in Canada, Denmark, France, Norway, Poland, and Sweden.

An Experience Like an Online Travel Agency

In Skift Research’s recent analyst screencast, our editors and analysts concluded that Google will not become an online travel agency in the next few years because it does not have an interest in travel fulfillment, distribution, and customer service.

One key reason? Google doesn’t want to lose any of the advertising money it makes from travel brands. According to a Skift Research analysis, in 2016, Google generated at least about $12.2 billion in revenue from travel advertisers, with about $6.2 billion of that coming from just four travel advertisers, namely the Priceline Group, Expedia Inc., TripAdvisor, and Airbnb.

Yet some shoppers might be forgiven for confusing Google with an online travel agency. That’s when they give their credit card information to Google to complete their bookings and when Google is, in the U.S., collecting and passing along passenger information for the U.S. Transportation Security Administration, just as if Google were Expedia or Priceline. (Customers who book within Google pay with their credit card, which is saved in the Google Payments wallet to enable fast, “one-click” bookings in the future.)

Still, as Skift Research says, there is a clear red line. Flight buyers receive a booking confirmation from the suppliers, such as Lufthansa.com. Customers would make any changes to the reservation through the airline.

Instant booking isn’t new. It is something other metasearch sites have been experimenting with for years. In the past 18 months, Skyscanner has been offering instant booking for British Airways, Scoot, and Finnair. For a few years, Kayak has been offering it with a few airlines, particularly in Europe.

Advantages for Airlines

Google charges more for leads that come through its Google Flights tool than for leads from general AdWords that are promoted when users search on certain keywords. Its pitch to airlines is that the marketing cost per booking is still less than the average cost for advertising campaigns, which may not always result in sales.

In other words, Google says the Flights widget is a more cost-effective marketing channel compared to other online travel agencies and metasearch sites.

As Skift Research has noted, Google appears eager to continue to improve its advertising products to better qualify leads for airlines and online travel agencies and to continue to shrink free traffic in favor of prompting visitors to click on advertisers’ links.

As we’ve noted greater awareness is being driven by Google’s move to intercept consumer searches for the trademarked names of specific airlines.

For example, a user might type “United flights to Chicago,” and Google might showcase Google Flights at the top or near the top of the search result page, rather than deliver a direct, free link to, say, United.com or an online travel agency selling United tickets. Google Flights behavior has a side effect on the price, placement, and performance of advertisements placed by airlines and online travel agencies.

The complex cat and mouse game continues. Competitors are eying Google carefully. Perhaps coincidentally, after having renewed its contract for flight data from the ITA Software by Google division in 2014, Kayak let the deal elapse at the end of 2016.

Overall we expect consumer awareness of Google Flights to keep rising, as the OAG survey suggests is happening.

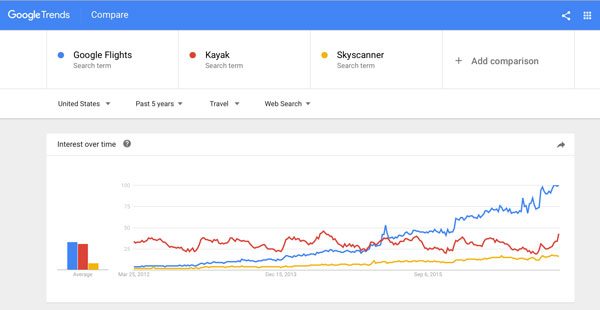

In January, Skift looked at Google Trends data. We compared Google Web searches related to travel in the U.S. for search terms “Google flights,” “Kayak,” and “Skyscanner.”

A fresh look at data up until today shows that the underlying pattern of rising Google Flights awareness has continued. And not just among millennials.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: google, google flight search, lufthansa, metasearch, oag

Photo credit: Google has been expanding its Flights search tool to new markets, such as Brazil and Indonesia, in the past couple of months. A new survey shows it is gaining in popularity. Google Flights