Skift Take

Priceline Group executives say their relationships with the major hotel chains are good and the impact of their direct-booking campaigns isn't acute. Then why is Jeffery Boyd, the Group's executive chairman, talking about taking remedial actions?

What’s good for the goose is good for the online travel agencies, too.

Commenting on major hotel chains offering exclusive loyalty rates to their members in an effort to undercut online travel agencies, Priceline Group executive chairman Jeffery Boyd said his company has the “muscle and technology” to do something similar for its own customers.

Boyd, speaking along with CEO Glenn Fogel at the Bank of America Merrill Lynch Consumer and Retail Technology Conference in New York City Wednesday, said hotels have opened these sorts of loyalty tools for their guests, and online travel agencies likewise are capable of enticing customers to register on their own sites and make prices available that are lower than the published rates generally available to the public.

Booking.com has been experimenting with a loyalty program, Booking.com for Business, but hasn’t emphasized it in marketing.

The Priceline Group is “doing better” with major international hotel chains and has a “solid position,” Boyd said. Prevailing wisdom has been that Expedia would be hurt more by the hotel-direct initiatives than Booking.com because the latter is more Europe- and independent-hotel focused.

Muscle and Technology

Boyd said the Priceline Group, which includes Booking.com and Agoda among its accommodation brands, has the “muscle and technology” to “ultimately” show consumers the “benefit of using an online travel agent.”

He characterized the company’s relationships with major chains, which have drilled down on driving direct traffic through loyalty-member only rates on their websites, as “good and growing.”

The hotel chains realize that the Priceline Group has more international scale than any other competitor and can offer customers a wide gamut of independent properties.

“Those are assets the even the biggest international hotels don’t have,” Boyd said.

The Priceline Group grew its hotel room nights 31 percent year over year in the fourth quarter of 2016 but must be feeling some impact from the hotels’ direct-booking efforts.

Key Competitive Advantage

Boyd and Fogel made several remarks at the investor conference about the Group’s scale advantages.

For example, Boyd said that the Priceline Group wants to be at both the top of the funnel — with Kayak and Momondo — and the bottom with its booking sites.

He argued it would be impossible for a metasearch competitor — such as TripAdvisor — to aggregate the reach of independent properties that Priceline/Booking.com has. Even companies such as TripAdvisor, which Priceline competes and partners with, rely on online travel agents to provide inventory, Boyd added.

Better Than Anyone?

Also referring to the Group’s size, Fogel said Priceline’s scale, including its roster of engineers, developers and marketing gurus, enable the company to deal with disruptive changes, experiement and “course-correct” faster than anyone else.

He cited the transition from desktop to mobile as an example, and argued that this scale advantage will bode well in the future.

Regarding changes of direction, Fogel said the Group will experiment with adding flights, rental cars, and tours and activities, which Priceline.com previously offered, to accommodation sites such as Booking.com and Agoda.

The Group’s DNA is testing such things, Fogel said. “Over time there may be some changes or not,” he said.

The litmus test would be whether these inventory-type additions would enhance loyalty for the Group’s hotel sites, which would retain accommodations as their core businesses, Fogel said.

TripAdvisor Will Do It

Boyd gave his vote of confidence to TripAdvisor and its co-founder and CEO Steve Kaufer.; Boyd said he has great respect for Kaufer and his team.

Acknowledging that TripAdvisor’s Instant Booking rollout has not been “in a straight line” and has had “hitches,” Boyd said: “I would expect their results will improve over time and inure to our benefit because we have the great potential to grow with them.”

The Priceline Group’s Booking.com, Agoda and Priceline.com are TripAdvisor Instant Booking partners. Boyd said TripAdvisor, which has “tremendous brand equity,” gives the Group access to its customer base at reasonable ROIs (returns on investment). As Tripadvisor and other metas add partners, the Group will monitor how the additions impact ROIs.

TripAdvisor recently added Expedia Inc. as an Instant Booking partner although there are limitations on its exposure that haven’t been detailed publicly.

Partner and Compete With Ctrip

Fogel said trust is an essential element in forging partnerships in “different parts of the world,” and the Priceline Group and Ctrip began building their relationship in 2005.

Priceline’s investment in Ctrip, which has a ceiling of 15 percent ownership, is currently worth more than $2 billion, Fogel said, adding that the two companies are partners, sharing hotel inventory as well.

Fogel said he respects the way Ctrip has executed and it wasn’t certain at all when their relationship kicked off years ago that Ctrip would rise to be the dominant online travel player in China.

Said Fogel: “We will continue to vigorously compete in some areas. Hats off to them.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: booking.com, direct booking, hotels, priceline

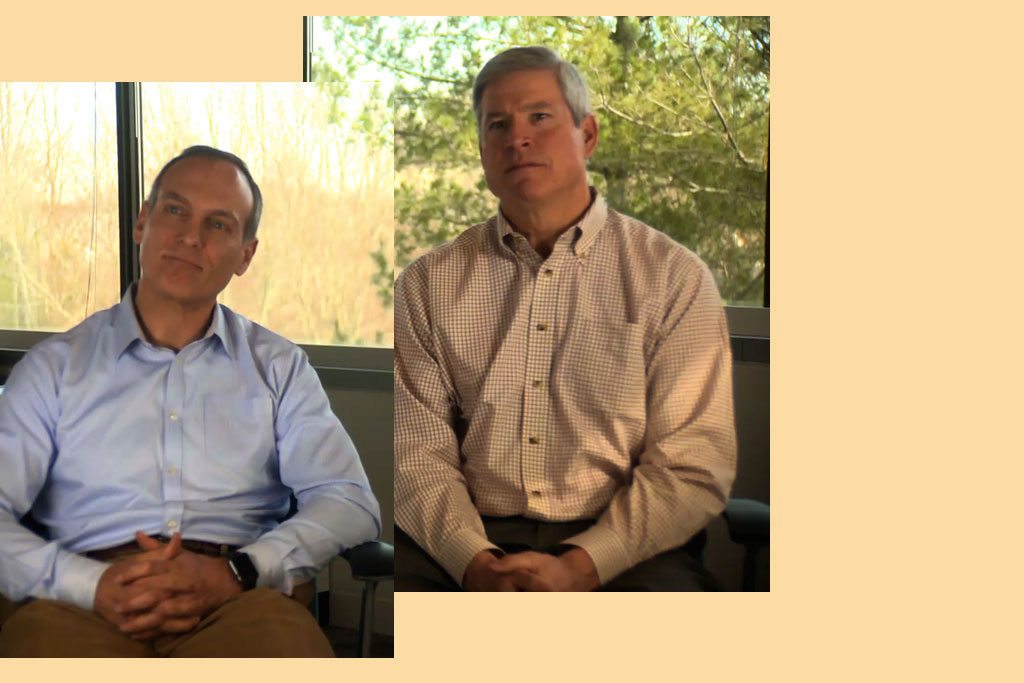

Photo credit: Priceline Group CEO Glenn Fogel (left) with executive chairman Jeffery Boyd at the company's Norwalk, Connecticut headquarters in December 2016. The Priceline Group