Skift Take

Professionally-managed and do-it-yourself rentals are two very different types of hospitality businesses. Airbnb lit the spark, but there's still plenty of room to grow and to gain market share.

Today we are launching the latest report in our Skift Research Reports service, The State of the Global Vacation Rental Market 2017.

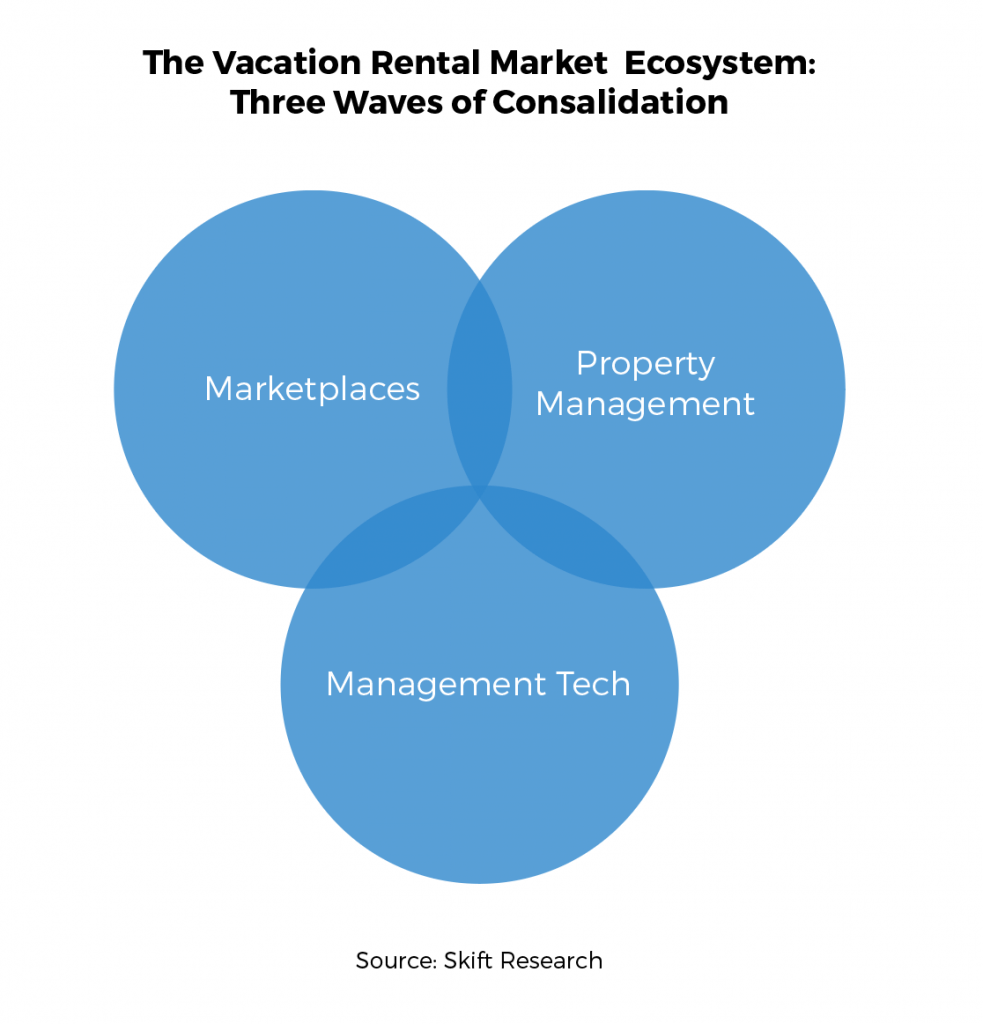

In the shadow of all the hype and momentum that Airbnb has attracted in recent years lays significant business opportunity in professionally-managed vacation rentals. To say that the market is growing may not be entirely accurate. Inventory is tight and there’s plenty of change and consolidation now taking place, as these properties go online and leverage tech to squeeze further efficiencies and value-add for the end consumer. This report takes a holistic look at the vacation rental ecosystem, examining the property management groups, marketplaces, and technology that are changing the face of accommodations as we know it. It’s what Skift Research is calling the three waves of consolidation in the vacation rental space:

Preview and Buy the Full Report

Technology has allowed the traditional vacation rental market to grow and move into the consumer and travel industry mainstream. Airbnb popularized apartment sharing and managed-by-owner rentals, which has consequently done wonders for the professionally-managed rental market. On the demand side, this so-called “Airbnb effect” fostered consumer awareness and appetite for non-traditional accommodations, i.e. apartments, homes, etc. On the supply side, it generated investor interest in the way of acquisition and venture capital, in just about everything that touches the vacation rental market.

Many of the inherent challenges associated with estimating the total VR market opportunity stem from the lack of consistency in stock; ownership structure; and relationship between owner, manager, and distributor. Geography is another challenge. Most estimates cover Europe and the U.S., while other markets including Latin America and Asia remain nascent for the larger turnkey property management groups.

Clearly, the opportunity in brokering primary residence rentals is very real. Airbnb built a thirty-billion dollar brand on it. But home-sharing platforms, including Airbnb and HomeAway, have faced consistent hurdles both in competing against traditional hospitality players and in navigating municipal government tenancy regulations. When it comes to marketplace models, the real opportunity might be somewhere between fully-serviced and self-managed.

On the supply side, we note constrained growth dynamics. Here we consider both primary and secondary residence rentals. Airbnb exploded on the scene by essentially creating a new rental category: the owner-occupied primary residence rental. These are units rented out while the resident is away or has a free room available and include private rooms but also entire apartments in geographic areas that property managers and platforms (including HomeAway) had not previously penetrated, most notably in urban markets where local regulations kept these types of single-unit rentals from propagating.

Subscribe to Skift Research Reports

This is the latest in a series of twice-monthly reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, alternative accommodations, distribution, gds, skift research, vacation rentals