Skift Take

Chinese travel startups are innovating, not cloning, these days. For instance, Zanadu is using virtual reality to sell luxury travel in real world shops, Baoku is bringing integrated workflows to corporate travel planners, and Aipinji is applying an Uber-like user interface to an old-school wholesaler model.

Ctrip’s acquisition of Skyscanner in late 2016 highlighted again the torrid pace of growth in online travel in China, despite some economic hiccups in the local economy. The move came after last summer’s decision by Ctrip to buy a “significant minority stake” in Qunar only a few months after they formed a partnership that gave them combined control of about 80 percent of China’s online hotel and airplane ticket sales.

Also in October, Tujia acquired the home-sharing businesses of Ctrip and Qunar and thus shored up its position as a tough competitor to Airbnb, HomeAway, and Booking.com.

All they hype around big name deals sometimes obscures the activity around smaller online travel players in China that have recently gotten funding and that are deserving of attention due to savvy business plans.

Here’s a look at a handful of Chinese online travel companies worth your attention.

Zanadu is an online travel agency that emphasizes luxury travel. This year it received undisclosed investment from Prometheus Capital and a $12 million investment (82 million renminbi) led by Tencent.

This year it has debuted a store in Shanghai that uses virtual reality devices and content to illustrate the luxury adventure travel, safaris, and resort vacations it sells online. It has also created Zanadu Studio, a virtual reality production partner for many of the world’s leading hotel brands like Hilton, tourism organizations like Thailand, and lifestyle brands like Maserati, with content it makes available via its apps and devices.

>>Skift Take: Zanadu quickly realized that selling luxury travel via a standard online travel agency interface only gets you so far. Its experiments in virtual reality kiosks at main shopping areas could work as a clever marketing strategy to supplement its quarterly print magazine.

Baoku, a Beijing-based business travel and expense management company, has recently received an undisclosed Series A funding led by Matrix Partners China, adding to previous funding by its initial investors of $10 million (68 million renminbi).

The company provides web-based travel management tools for corporate users. In the company’s words, Baoku lets a business traveler request a manager’s okay for a trip, make reservations for air and hotel that comply with company policy, and claim and receive approval for expenses in one system. Managers can use the platform to analyze data and improve their decision-making.

>>Skift Take: Baoku is one of the first companies to develop a software-as-a-service solution that brings Western-style efficiency to the travel management process. If it executes well, it has an enormous opportunity. Business travel in China surpassed volume in the US last year by hitting $300 billion.

Huangbaoche aggregates tour packages and tour-guide-reservation services for outbound Chinese tourists.

The booking platform claims listings for more than 100,000 Mandarin-speaking drivers and tour guides in more than 1,500 overseas travel destination cities in 80 countries.

The mobile-first company claims to have processed more than 1.5 million transactions since its start two years ago.

Matrix Partners China and GF Xinde Investment Management invested about $30 million (210 million renminbi) in a recent round that also included Concord Investment and existing investor SSC Fund. The company had previously raised $24 million (168 million renminbi).

>>Skift Take: We don’t envy anyone taking on Ctrip, whose dominance in the volume game of online travel in China is unfathomably entrenched. But we could see a Western company eager to get on-the-ground talent snapping this company up and giving it the resources it may need to scale.

Aipinji, using the web address Apin.com, is an air ticket wholesaler based in Hangzhou. The company says its monthly transaction volume has hit $14 million (100 million renminbi) this winter.

Meridian Capital China and Hangzhou Hongfan Tiansheng Capital recently led a $17 million (120 million renminbi) funding round in it. Also participating were Glory Ventures, Initial Capital, and Guanghe Venture Capital.

>>Skift Take: The Uber-style user interface is consumer-grade and stands out in the marketplace. But the Apin brand may need to branch into hotels. Customer acquisition will be costly for this startup, and the margins on wholesaling tickets won’t be as high as it would be on hotels.

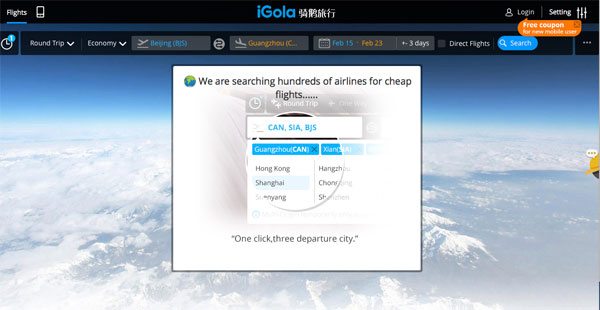

iGola is a travel metasearch startup headquartered in Guangzhou. It says it pulls data from thousands of domestic and overseas airlines and dozens of online travel agencies. In December 2016, it raised $18.7 million (130 million renminbi) in a Series A funding round.

>>Skift Take: Metasearch is a proven model that requires low costs to start, as Dohop, Kayak, Hipmunk, Momondo, Skyscanner, Trivago, and Wego can all attest. While iGola is not as fast as some western companies in returning results, its deals with payment processors WeChat, the domestic leader, and Chinese credit cards, puts it ahead of foreign players who are often dependent on using PayPal.

For all of our startup coverage, check out our SkiftSeedlings archives, here.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: china, skiftseedlings, startups

Photo credit: Huangbaoche is one of many Chinese startups to receive significant funding to improve different parts of online travel. It received $30 million for aggregating tour guide listings. Huangbaoche