Are Trivago's Brand Awareness Numbers Inflated?

Skift Take

How effective are all of those Trivago commercials, which seem to permeate television in the United States?

With the Germany-based hotel-metasearch site tentatively poised to price its initial public offering today, according to a source, in anticipation of potentially trading on Nasdaq starting Friday, we decided to dig a bit deeper into the brand-awareness assessment for the U.S. that Trivago shared with investors in its road show materials. [The timing of Trivago's IPO, of course, could be subject to change.]

In other words, just how well-known is Trivago, which broadcast its first TV commercial in the U.S. in 2012, compared with competitors and frenemies such as Kayak, parent company Expedia, TripAdvisor, Priceline.com, and Booking.com?

Trivago's Internal Research

In the U.S., which in 2015 became Trivago's largest market in the world, the company claims a 63 percent aided brand awareness mark compared with Expedia (80 percent), TripAdvisor (69 percent), Priceline.com (68 percent), metasearch rival Kayak (62 percent) and Booking.com (39 percent).

Aided brand awareness is when consumers are asked in a survey about whether they have knowledge of particular brands. One of the issues in Trivago's self-described 63 percent aided brand awareness mark in the U.S. is that the company stated that the figure came from internal research -- there was no information provided on how large the sample size was and or how the research was conducted.

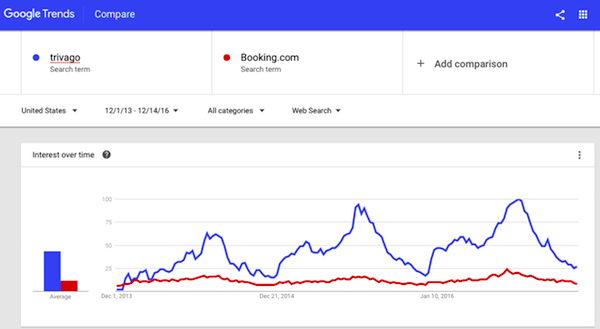

To broaden the picture, in the following two charts we looked at Google Trends data, which represent consumers' search interest, for Trivago, Kayak, Expedia, TripAdvisor, Priceline.com, and Booking.com in the U.S. over the last three years.

Trivago Vs. Competitors

Trivago Vs. Booking.com

Rather than depicting awareness about Trivago in the U.S. during the period as basically being on par with metasearch rivals such as TripAdvisor and Kayak, the Google Trends charts show "interest over time" in Trivago being far below that of Kayak and TripAdvisor, for example. Trivago, though, attracted more interest from consumers than Priceline.com and Amsterdam-based Booking.com.

Comparing Trivago's self-articulated, aided brand awareness through internal research against consumer interest as measured by Google Trends data is an apples to grapefruit exercise but it shows that the consumer reality is not as clear-cut as Trivago depicted it on its IPO road show.

And Trivago, which spends 88 percent of revenue on advertising, may not actually be getting the reach that it wants investors to believe it is accruing. This is important because investors may be concerned about the depth of Trivago's advertising spend and its effectiveness.

Another point that isn't really being addressed is that Trivago's reliance on TV advertising may not be the answer to signing up cord-cutting Millennials.

Marketing and Branding Experts Chime In

We asked some marketing and branding experts about the seeming disparity in Trivago's numbers versus Google Trends in the U.S.

"Assessing the value of a brand and measuring brand awareness is really difficult, and while Google Trends gives you a sense of whether someone is searching for a term, it only provides a sliver of information among a vast array of data available," says Peter Petralia, managing director of digital strategy for brand engagement firm Sullivan.

"In Trivago's case, to evaluate what its brand awareness is, we'd have to look at consumer sentiment data, the Harris Poll (where Trivago appears in the top 10 this year), as well as data on app searches and app downloads through the Apple App Store or Google Play. Trivago also advertises aggressively so people may be aware of them as a search engine but wouldn't necessarily visit the site unless they're looking for more or better information than they can find on their usual booking engine resources."

Investors considering whether to buy into the Trivago IPO would have to weigh a lot more than its brand-awareness quotient.

"Ultimately, whether Trivago’s brand awareness is high in the U.S. or not isn’t an indicator of whether they can succeed here post-IPO," Petralia says. "You only need to look at a few examples of European players -- Spotify, Downton Abbey, Nokia (back in the day) all come to mind -- that became overnight sensations in the U.S. It’s a crowded space for Trivago, but the opportunity is there if they can offer a better customer experience."

Au Contraire on Google Trends and Brand Interest

Another digital marketing expert, who declined to be identified, disagreed with Petralia, arguing that brand interest, as expressed in Google Trends data, can be a major factor in a company's fate.

"Searching for a brand on Google is the single best measure of true brand interest," the digital marketing expert contends. "A standard portion of people use Google instead of typing the URL. This isn't searching for a brand, it's navigating to a brand.

"I agree aided brand awareness [what Trivago put in its IPO registration statement] absolutely is not an indicator of whether they will succeed. Brand interest absolutely is -- this is the Google Trends data. The question of success also is how much does their top line growth lose if they take operating leverage by spending less."

As for factoring in the Harris poll, this digital marketing expert dismissed it as "just another crappy syndicated poll. Does anyone have confidence in poll data? Trump crushed Hillary in Google brand interest, for your information."

Peter Shankman, founder of Shankminds, a network of entrepreneurs, expressed skepticism about Trivago's brand awareness numbers. "Of course Trivago is going to scream uptick," Shankman says. "I know the [Google] Trends numbers are real, but no company is going to call attention to that at this stage in their game."

Mims Wright, co-founder and managing partner of travel advisory firm Black & Wright, says it's hard to tell whether Trivago painted an overly favorable picture of its aided brand awareness since the company provided little detail on its research.

"Trivago is referring to what it calls 'internal data' so it's anybody's guess how they're arriving at that conclusion," Wright says. "Sure, it's possible they could be overstating, but based only on these two sources [Trivago and Google Trends] it's really hard to confirm that."

Trivago's over brand awareness is considerably higher in Europe, where it started. Citing the same internal research, it claims the leading aided brand awareness over competitors in leading markets, including Italy (92 percent), Spain (89), Germany (86) , France (79), as well as in Australia (77).

As part of its road show, Trivago tentatively stated that its shares would sell for $13 to $15 per share, although this could change.

Anything can happen with an IPO and it's always possible that the pricing could be delayed beyond today or the offering could be abandoned altogether if the company determines there isn't ample demand for its listing or market conditions aren't optimal.

But one thing is clear: If Trivago's stock soon begins trading on Nasdaq, it would have a lot more resources to ramp up advertising even further and could be on its way toward becoming a coveted, household-name brand.