Skift Take

With Snapchat's move towards becoming advertiser-friendly, it may be an opportunity for the travel industry to adapt to the new content-heavy platform.

Last week we launched the latest report in our Skift Trends Reports service, Snapchat and Instagram Strategies for Travel Brands.

In this report, we look at Snapchat and Instagram, their user base, and the advertising opportunities the platforms offer. Whilst Instagram is owned by digital advertising expert Facebook, Snapchat is in it on its own. Trying to lure more advertisers to the platform Snapchat has taken some significant steps to improve the advertising experience on the platform.

Below is an excerpt from our Skift Trend Report. Get the full report here to stay ahead of this trend.

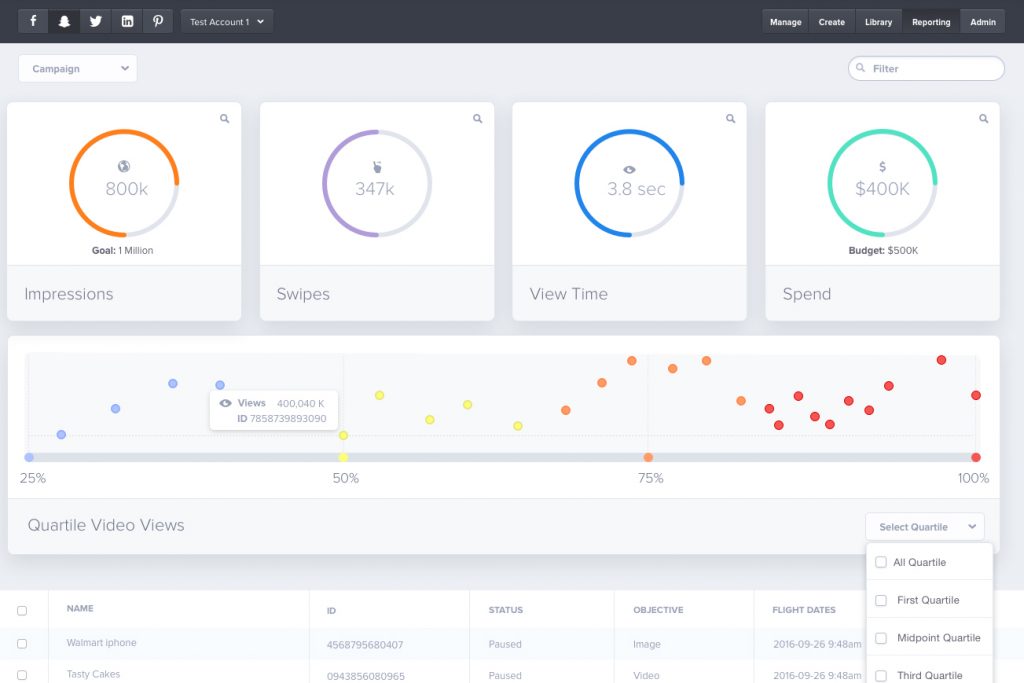

Just a couple of weeks ago Snapchat released their Ad API in beta phase, allowing adversities to bid on ads, and introducing basic targeting features such as age, gender, location, and device.

Rejecting multiple acquisition offers from Facebook, Snapchat lacks advanced targeting features which Facebook’s Power Editor provides. Its new API marks the first step towards a more advertiser-friendly platform.

Before the announcement of Snapchat’s ad API, targeting was an issue among some advertisers, as filters and video ads were displayed to all app users, unlike on Instagram which had the fully integrated Facebook Power Editor, allowing for vastly specific targeting. The only targeting Snapchat offered was based on location.

Preview and Buy the Full Report

Due to the high entry cost, many companies started creating organic advertisement through normal profiles. Just like regular channels, they create an organic following and then advertise within their own channel. One of the major limitations of organic accounts is getting analytical insights into the success of running the account. Snapchat doesn’t provide users with counts or audience insights, for that people “should switch to ads.” A further peculiar term set by Snapchat for filters is that they are not allowed to include URLs, hashtags, or social media handles.

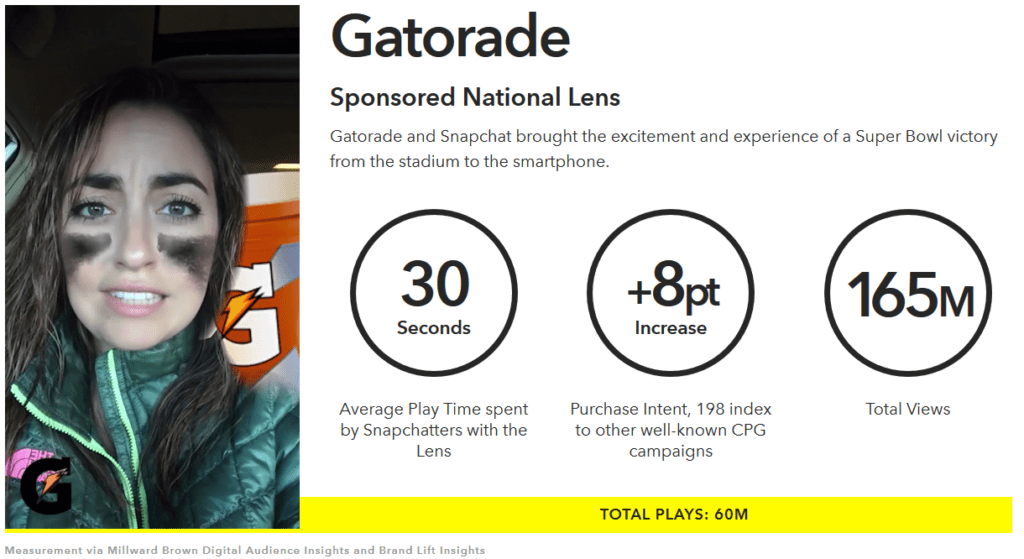

Some of the major partners of Snapchat are McDonald’s, Unilever, and Gatorade, who are all part of the beta access to Snap’s new Ad API. One of the first travel companies to experiment with Snapchat was Marriott back in 2014. W Hotels, Starwood, and Hilton later followed their footsteps. However, Snapchat is not yet widely adopted throughout the travel industry.

Preview and Buy the Full Report

Subscribe now to Skift Trends Reports

This is the latest in a series of twice-monthly reports aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 100 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: instagram, snapchat, social media

Photo credit: Can Snapchat create opportunities for travel brands trying to reach the social network's highly engaged users? AdamPrzezdziek / Flickr