Interview: How Marriott Will Position Its 30 Hotel Brands

Skift Take

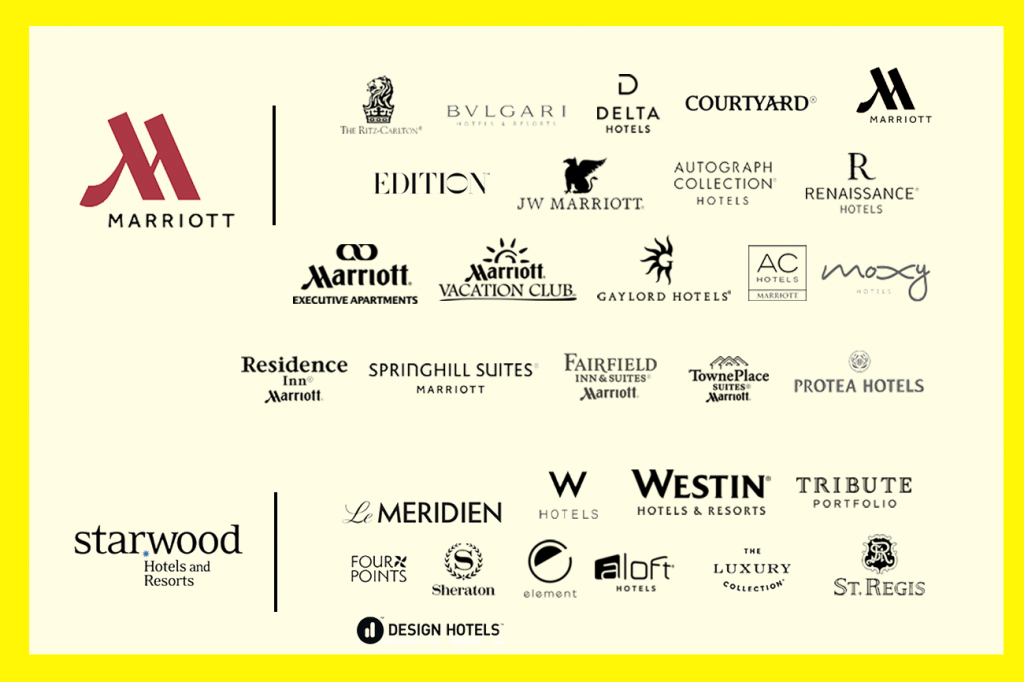

When Marriott’s acquisition of Starwood officially closed last month, making it the world’s largest hotel company by number of rooms, Marriott inherited 11 hotel brands to add to its portfolio of 19, for a grand total of 30 brands.

That’s a lot of hotel brands for one company but, even so, Marriott CEO Arne Sorenson has been adamant in saying that all 30 will be sticking around, at least for the foreseeable future.

So now comes the hard part: Just what is Marriott planning to do to make sure each one of those 30 brands is distinct enough from one another, and all the other hotel brands out there?

Skift interviewed Tina Edmundson, chief global brand officer for Marriott International at the company’s grand opening of the M Beta Hotel in Charlotte, N.C., to ask her just that.

Edmundson’s branding and hospitality experience puts her in a uniquely qualified position to oversee this personally. She worked at Starwood Hotels & Resorts for 18 years, and then joined Marriott eight years ago. She’s also been through a major merger before, having worked for ITT Sheraton when it was acquired by Starwood in 1998.

While she said, admittedly, the Starwood and Marriott teams are still figuring out the nuts and bolts of how to differentiate each and every brand exactly, they’re already working on it, only a little over two weeks into the merger.

Edmundson also dropped a few hints about some upcoming technologies, initiatives, and possible new brands we may see from Marriott in the future.

Editor’s Note: This interview has been edited for clarity and length.

Skift: We’d love to learn more about the specifics about how you plan to differentiate all 30 brands. What happens next?

Edmundson: Sure. I'd start by saying with the merger we are in a place where we feel like our portfolio of brands has really filled out quite nicely. Starwood's skews towards luxury and lifestyle, and Marriott's skews toward convention, business, resort, and select service. That together makes this complementary — it’s quite the perfect marriage, if you will.

But in any industry, when you have 30 brands, you're bound to have brands that occupy the same swim lane, if you will. We are doing work as we speak to solve some of those riddles. The Ritz-Carlton and St. Regis, or Sheraton and Marriott, or Le Méridien and Renaissance. We're very aware of what they are and some are easier to solve than others.

As an example, W and EDITION are both in the luxury lifestyle space, but quite a different offering.

Skift: They seem to have very different vibes.

Edmundson: Very different vibes. That is much more clear to the consumer, because you go into an EDITION and it's sophisticated and it's modern and refined luxury, whereas W is bolder. It’s about having this lust for life, and it's bolder, it's provocative, it's witty — all of those things.

There are brands that are easier to push apart and say, "Yes, they are in the same swim lane, but they are very different propositions."

Then there are other brands, like Renaissance and Le Méridien, that are both in the discoveries phase. They're both going after, really, the same consumer, and so how do we think about those?

We are toying with how to actually — now, understand it's only 17 days since the deal has closed — but we're toying with what should we do? Should we, in fact, reposition one of the brands? Today, both brands bring discovery to life in a very different way. With Le Méridien, it's much more Parisian. The offerings are European and their signature is around a master barista, whereas with Renaissance it's about discovering the neighborhood and it's a little bit more gritty. Their programming is around a Navigator that helps you discover the locale.

Is that enough of a different take on discovery, or do we really need to go off in a different space? Those are the things that we're grappling with.

When you think about the [soft-brand] collections, like Autograph Collection, Tribute, and Luxury Collection, again, some of it is easy to explain to customers, to explain to our guests that the whole Luxury Collection is a five-star experience. It's really about the destination, and these are rare, iconic hotels.

Autograph Collection is between four- and four-and-a-half stars, and they're about really providing a very immersive experience. It's also for the independent-minded traveler, but it's a different experience at a different tier. Then you have Tribute Portfolio, which is quite new, actually. Where should that play? Those are the specific questions that we're grappling with.

I think that we are committed to keeping and growing all 30 brands. Some of these riddles will get answered in the next few months as we get more information. Important to this whole exercise is being collaborative with our owners and being collaborative with the developers, and really understanding, in each market, what is the need? The way that we even think about our brands and their positions is sizing the market.

Skift: What about Marriott and Sheraton, or Marriott and Westin? Sheraton seems to be most positioned directly to Marriott. How will you define the two, especially as you work on the M Beta Hotel here? What's really going to define a Marriott hotel in the future?

Edmundson: We've done a lot of work over the last many years to get Marriott to this point. We launched this campaign called "Travel Brilliantly." We've done all of this work, including this hotel, as the beta, to say, "Hey, this is the new Marriott. This is how we want you to think about Marriott. You've always thought about us as comfortable and reassuring, and you knew you'd get great service, and we're warm and inviting, but you've never thought of us as design forward and you've never thought of us as innovative and really a brand for a Gen X-er and Gen Y-er. We are."

We're not planning on disrupting any of the work that has been done on Marriott. That will go forward, and in fact has gone forward, as we continue to roll out the new Marriott worldwide.

As far as Sheraton is concerned, Sheraton had recently launched a 2020 plan; you remember that. We are in the process of looking at all of the things that have been committed, and evolving that.

Again, we’re only 17 days into it, so it's a little bit hard to say definitively, but Sheraton is a huge focus for us, because it's a very global brand. It has huge, very high brand awareness. Brand awareness and the brand perception outside of the U.S. is very positive, and so we want to capitalize on that and we want to continue on the journey that Starwood had started on for Sheraton. The specifics in the next few months will be revealed, but that's our intention. It's not to stop anything, but to keep the momentum going, but then tease them apart so that they are, in fact, quite different propositions.

Sheraton's proposition is about effortless travel or going beyond. It's a service proposition, and we will define more clearly what the product proposition is on a go-forward basis.

Since you asked about Westin, I’ll say this: Although it is in the full-service space, it is very much a brand about wellness and this feeling of, "You're going to leave better than when you arrived." The brand facilitates that with their healthy menus and their gear lending and their Westin runs and all of the programming that I think they've done a really excellent job with.

Skift: Agreed. It seems like Starwood did a much better job in carving out a distinct brand identity for Westin than it did for Sheraton. You didn't really know how to define Sheraton and maybe, in some respects, you could say the same for Marriott: It was hard to really define or pinpoint exactly what the Marriott brand was, either.

Edmundson: Yes, I think that's fair. I think, actually, when Sheraton and Westin came together with Starwood back in 1998, there were so few Westin hotels that it was a bit easier to distinguish it. The Heavenly Bed really started this movement of tying that brand together because, prior to that, it was quite disparate as well. Then from the Heavenly Bed came the Heavenly Bath and the Westin Workout and all of the programming that went behind that. Yeah, and all of those pieces built up into this brand that actually hasn't moved from a positioning standpoint. It had been about wellness and continues to be about wellness.

A New Kind of Hospitality

Skift: Right. That has us thinking specifically about this hotel [the Charlotte City Center Marriott], too. What are some of the major themes or trends in hospitality that you wanted to really bring to life here? What do people want from hospitality brands today?

Edmundson: Some of the learnings that we had were that guests want to spend more time in communal spaces. People generally — I'm making broad generalizations here — don't want to check into a hotel, go to their room, and then order room service and stay there and never come out.

People want to see other people and they want to be in a private, yet public, space. I may not want to go talk to those guys over there, but I may want to be in a space that feels alive and that I get energy from. Even if I'm traveling alone, I want to come down to this communal environment. Guests are telling us, "Hey, give me a space that will allow me to do that."

We also know that guests are increasingly more interested in what is happening in the locale. "Give me a feeling, when I wake up in the morning or when I'm at a hotel. I want to know that I'm in Charlotte. I want to know that I'm in Hong Kong. I want to know where I am. Don't give me this generic look." Bringing the locale in with architecture and with design has become really, really important.

Then travel, the Internet, all of these things have contributed to all the factors like, "Hey, I can do X, Y, Z, on my phone, therefore I should be able to do this during my hotel stay. If I can order an Uber on the phone, I should be able to order room service from my phone, too."

Skift: That seems to translate into the very on-demand nature of things.

Edmundson: Exactly. That has really forced us to focus on technology and really to start testing about what's the next thing, what's the next thing. Hence the mobile key and the guest services. You want a pillow, you can just order it on your phone, and being at the forefront of all of those things from an industry standpoint.

Then, not surprisingly, design has become democratic. Gone are the days that you could only go to luxury hotels or only go to some lifestyle hotels to have good design. Guests are demanding that every hotel that they go to has good design. We have to be really smart about those things.

Then this notion of they want to be able to share things and they want to be able to, on social media, brag, and so what are we doing from a badging perspective and how are we rewarding them for engaging with us in social media?

Skift: Another piece of technology that I’ve seen here at the M Beta Hotel is these "like" Beta buttons. But they just tell you that someone likes a particular feature of the hotel. How are you getting that really nitty-gritty nuanced feedback that you want from the guests?

Edmundson: We do it a bunch of different ways. One way that I like, really, is to do what we call guest intercepts. We'll have our consumer insights people intercept and offer you either points or say, "Hey, can I buy you breakfast and can you give me 10 minutes to talk to me about your experience? What did you like, what did you not like?"

When we did the [Marriott] guest room survey, actually, we set it up in Bethesda in a test environment, invited guests in, and actually had them spend time in the space. We had cameras and so they could just speak whatever and say, "Hey, I really don't like this open shelf or this corner of the bed is too sharp or whatever." We used really methodical ways to get feedback, and we do it multiple times. We don't do it just with guests. We do it certainly with guests. We do it with all ages of guests, because generations like different things at different times and so we want to make sure we capture that. Then, importantly, with our owners.

Skift: Is Marriott looking at the disruptors, especially those in the alternative accommodations space, like Airbnb, and asking yourself how you can translate what they are doing to what you do?

Edmundson: Absolutely.

Skift: Earlier, I spoke to Leeny Oberg [CFO], David Grissen [group president of Marriott International], and Anthony Capuano [Marriott’s EVP and global chief development officer] and I asked them whether there was a space Marriott could enter where it didn’t have a corresponding brand. They mentioned all-inclusives, which I thought was interesting. I wondered if Marriott might consider lifestyle-driven hostels, like Generator Hostels or what AccorHotels plans to do with Jo&Joe. What are your thoughts?

Edmundson: Not so much in the hostel space, because it's hard to make money. All-inclusive has been on the radar for many years. I don't know that we'll go running out tomorrow to pursue it, just because we just have 30 brands right now, but it's an interesting proposition that is extremely popular in the Caribbean and in Latin America. The guys that are in the space do really well. It's one of those.

Our focus, honestly, right now is, one, running our business and not taking our eye off the ball, because that's super important as we integrate. All the questions that you asked before: How do these brands play with each other and how do we actually move a guest through the different brands so they can have all of the different experiences, and they can do that through the loyalty program? I think that will be the next frontier.

Skift: If you could create the ultimate hotel brand, what elements would you put into it? What would be your dream hotel brand?

Edmundson: Well, we have 30 now. To me, just stepping back from it all, to me, at the end of the day, brands should help people make decisions. If you can have a brand positioning and an expression and articulation of the brand that is clear to customers, I think you win. I don't care what segment you're in. If you're in the budget segment and your proposition is really clear, I think that's ideal. As a brand purist, that's what you want at every level.

I think it gets harder the more brands you have, and then it gets harder in the middle. Take, for example, The Ritz-Carlton Reserve. It's an exotic experience, they're in exotic places, and they really provide this very enriching, beautiful experience. Moxy is about a very cozy room, i.e., small, a do-it-yourself sort of atmosphere, and a great bar. You can get that experience at a reasonable, affordable price, in an urban market. They're easier to define. When you get in the middle, it’s harder.

When you get to a full-service hotel, then you have to have strong positioning and strong brands like the Westin, that even in that space does this really nice job of saying, "Here's what you'll get when you stay at a Westin." Again, brands help people make decisions and so, as a brand person, our goal is to help you make a decision.

Skift: Whatever it may be?

Edmundson: Whatever it may be. Whatever your needs are from a trip purpose or type of persona, because when you travel with your family your needs are different versus when you travel alone. Or if you're going on a vacation, your needs are different from when you're traveling on business.