Skift Take

Airbnb may be raising the visibility of traditional serviced apartments in the business travel space. It remains to be seen whether homesharing represents an existential threat to established corporate housing providers.

Serviced apartment rentals are an often overlooked sector that has deep penetration among business travelers.

The Global Serviced Apartments Industry Report 2016/17 from The Apartment Service Worldwide shows that hotel companies dominate the space in terms of pure capacity, and adoption seems to be slipping compared to previous years.

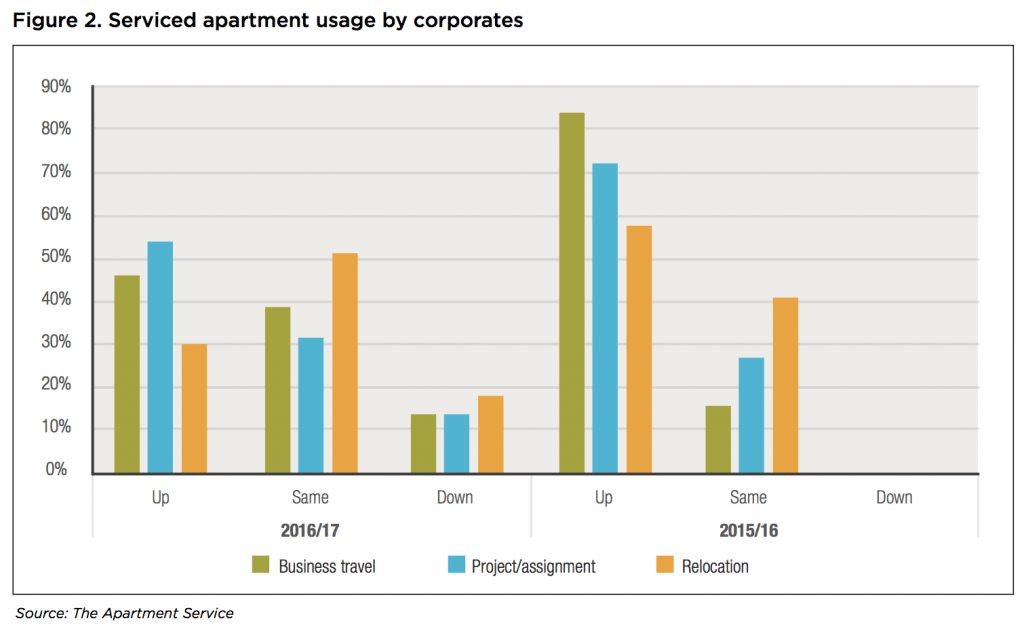

“Overall, 88 percent of companies now use serviced apartments for one business reason or another,” reads the report. “However in 2016, just 47.37 percent now report that their usage for business travel is increasing, compared to 54.9 percent for assignments and 30.43 percent for relocation. This does not suggest that interest is waning, but that mature corporate accommodation programmes now routinely include serviced apartments and that the sector is now more secure in its niche.”

More than 70 percent of global serviced apartment inventory is now bookable online, compared to around 60 percent last year. This is important, since many business travelers remain unfamiliar with dedicated corporate housing brands.

“As awareness of the serviced apartment product has grown amongst corporates, travellers and TMCs, so too has the level of expectation,” states the report. “At 83.08 percent free high-speed WiFi ranks highest on corporates’ priority lists, followed by (perhaps paradoxically) single occupancy (75.38 percent) and the scope to accommodate an entire family (49.23 percent). In-house services are not regarded as essential and is only a priority for 35.38 percent of corporates, whilst amenities are important to 32.31 percent.”

Here are four takeaways from the report.

OTA use is growing

| % of Bookings | 0 – 30% | 31 – 50% | 51 – 70% | 70 – 100% | ||||

|---|---|---|---|---|---|---|---|---|

| YEAR | 2015/16 | 2016/17 | 2015/16 | 2016/17 | 2015/16 | 2016/17 | 2015/16 | 2016/17 |

| Direct website | 62.12% | 56.59% | 14.56% | 24.80% | 10.61% | 10.85% | 12.33% | 4.65% |

| Online booking sites (OTAs) | 60.04% | 66.03% | 22.60% | 12.26% | 13.21% | 15.09% | 3.77% | 4.72% |

| TMCs/RMCs | 70.83% | 64.83% | 12.50% | 17.58% | 10.42% | 10.99% | 6.30% | 6.59% |

| Via GDS | 94.44% | 93.65% | 5.55% | 3.17% | 0% | 1.58% | 0% | 1.58% |

While confusing, GSAIR’s data on how business travelers are booking their serviced apartment stays is illuminating. Stays are booked through a diverse variety of channels, and direct bookings, along with online booking sites, are gaining traction.

“Overall, 88 percent of companies now use serviced apartments for one business reason or another,” states the report. “And yet only a half have a formal procurement process in place, suggesting that serviced apartments are either too difficult to source or book, or that they do not represent a high enough proportion of overall accommodation spend to be incorporates into annual RFPs.”

Marriott leads in global apartment units

| Company | 2016/2017 Locations | 2016/2017 Units |

|---|---|---|

| Marriott (Worldwide) | 1001 | 116,672 |

| Extended Stay Hotels USA | 629 | 69,400 |

| IHG (Worldwide) | 561 | 56,292 |

| Homewood Suites & Home2Suites | 479 | 53,040 |

| The Ascott | 250 | 37,712 |

| Oakwood Worldwide | 1895 | 25,350 |

Overall, Marriott owns the most serviced apartment units worldwide, while Oakwood has the most locations. Hotel companies dominate the space in terms of sheer units.

Serviced apartment usage is dropping… slightly

In the last year, more workers are using serviced apartments for projects and assignments than normal business travel or due to relocation. One has to wonder if homesharing services have contributed to the lack of growth among traditional business travelers.

“Companies like Airbnb are leading the expansion of the short term rental market, estimated to be turning over $100 billion annually and predicted to rise to $169.7 billion by 2019 (source: Research & Markets),” states the report. “Short-term rental platforms are bringing serviced apartments to a wider audience whilst bringing yet another alternative to traditional hotel stays. The vacation rental market is also competing directly with the serviced apartment sector by offering check-in/check-out, keyless entry, slicker booking processes and other services. Today’s competitor could be tomorrow’s colleague.”

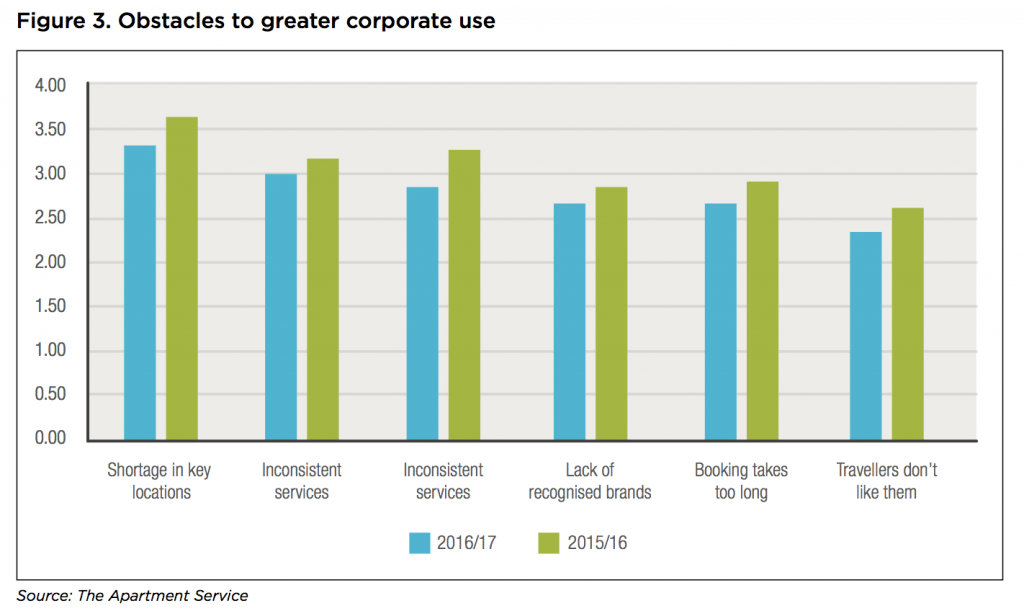

There aren’t not enough apartments in popular destinations

Despite the proliferation of corporate housing around the world, the report indicates that there is still a shortfall in key business travel destinations. Inconsistent services and the lack of recognized brands are other impediments to the lack of adoption by business travelers.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, business travel

Photo credit: Serviced apartments continue to be a top choice for business travelers. Bangkok, pictured here in 2012, has become one of the top global business travel destinations. Evo Flash / Flickr