Skift Take

Things haven't looked great on paper for travel startup funding this year. Many investors have told us they feel there's a lack of originality in travel and that, combined with the global economy, likely explains what's going on.

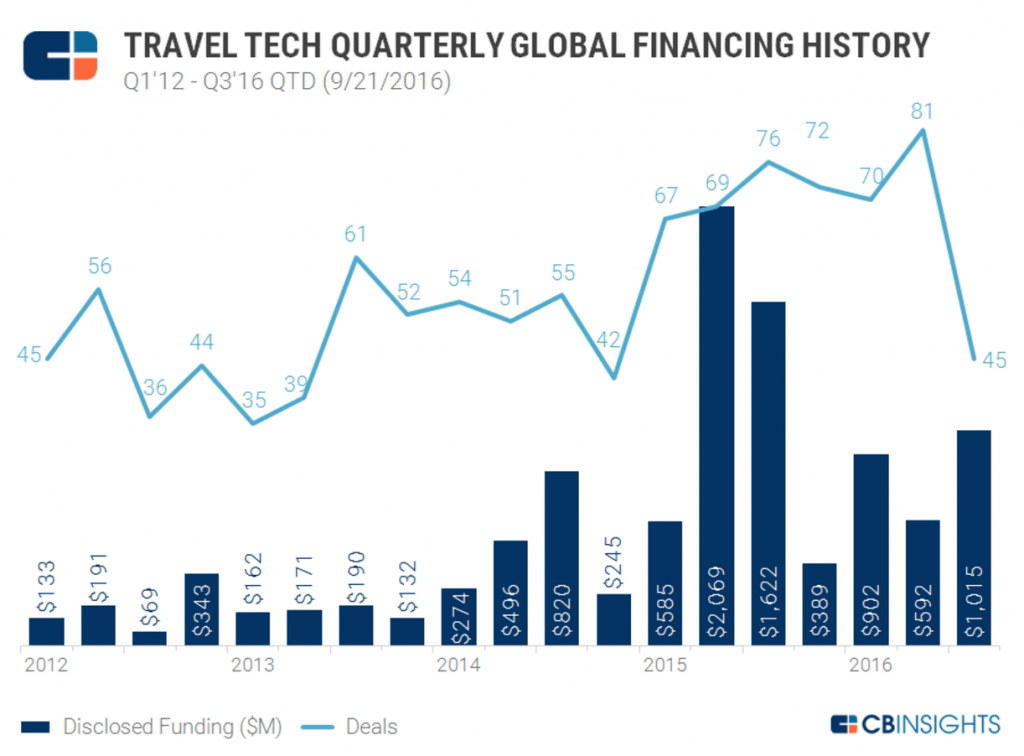

It’s been a rocky year for travel startups looking to raise funds with funding down 44 percent during the first half of 2016 and hospitality tech taking a hit. Although travel startups have raised $2.5 billion so far this year — with $1 billon coming from the third quarter alone — Airbnb’s $850 million Series F round in August is to thank for the uptick.

With Airbnb’s latest round included in the mix, 40 percent of travel startup funding for 2016 occurred during the third quarter representing a 72 percent increase in funding over the second quarter, according to data from CB Insights, a New York City-based venture capital and investment data firm.

But if Airbnb’s funding isn’t considered 2016 is basically an upside down hockey stick — non-Airbnb funding totals $150 million for the third quarter and that’s a plunge from $587 million in the second quarter and $867 million in the first (the latter two amounts don’t include any Airbnb rounds).

CB Insights’ analysis includes travel tech-enabled companies offering products and services focused on tourism, booking services, search and trip-planning platforms, on-demand travel and recommendation sites. Ride-sharing services such as Uber and Singapore-based Grab (formerly GrabTaxi, which raised a $750 million Series F round this month) are excluded from this analysis.

Some 45 of the 196 deals for travel startups this year closed during the third quarter. CB Insights notes that while the third quarter hasn’t closed yet the quarterly deal count is down 45 percent compared to the second quarter.

Note: This chart doesn’t include rounds from Airbnb

Source: CB Insights

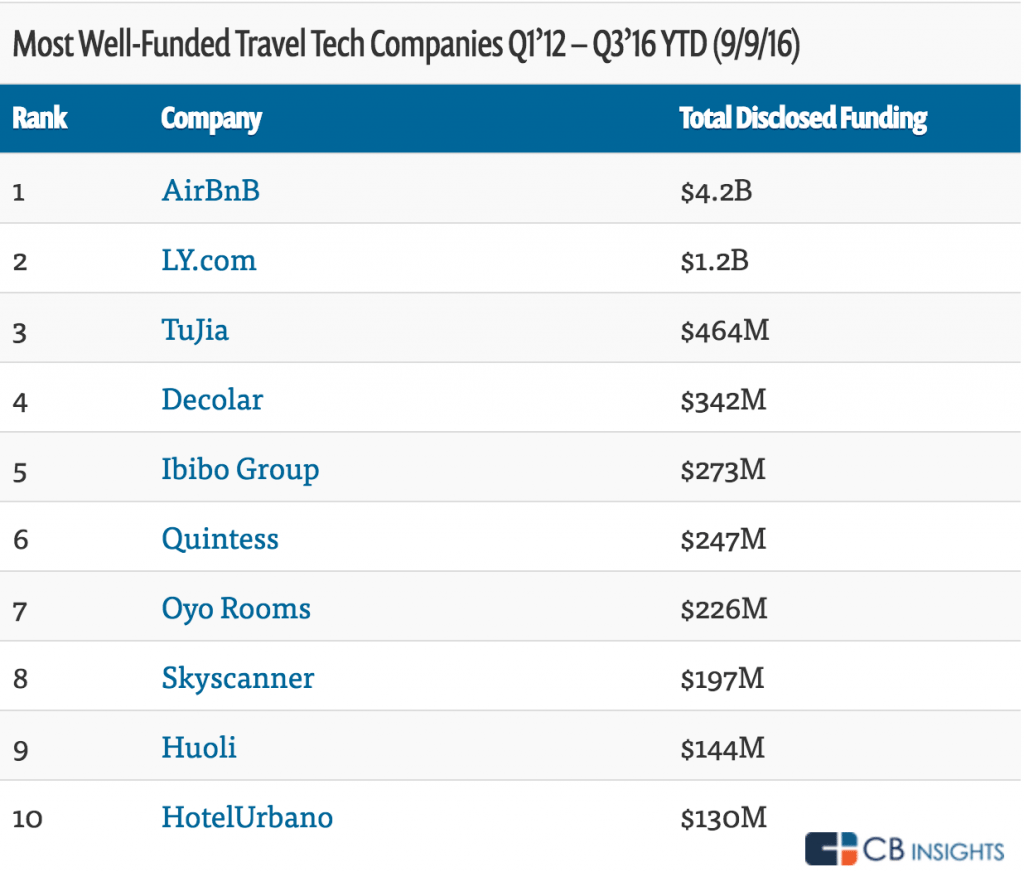

Airbnb also raised $1 billion of debt financing in June and, besides ride-sharing startups Uber and Didi Chuxing, it remains the most well-funded travel startup to date.

Source: CB Insights

Notable rounds for the third quarter include Oyo Rooms‘ $62M Series E round, Treebo Hotels‘ $17M Series B and cruise booking site Dreamlines‘ $16M Series D.

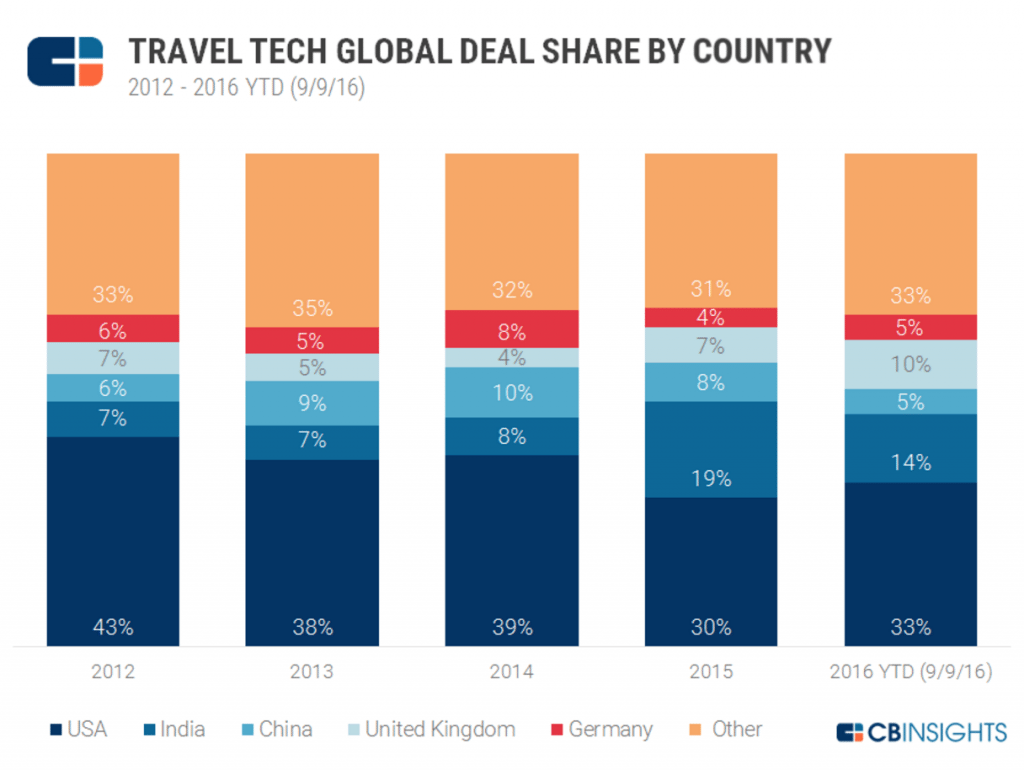

The U.S.’s percentage of travel startup deals has been declining since 2012 with more than 67 percent of deals going to non-U.S. companies this year. Though that doesn’t mean U.S. travel startups have received less funding than overseas companies. Vacation rental startups, for example, raised $100 million during the first quarter of 2016 across 11 deals. Eight of the deals were for non-U.S. companies but more than half of total vacation rental funding for the first quarter (62 percent) went to three U.S. companies, Vacasa, LeisureLink, and TurnKey.

Source: CB Insights

This Week’s Activity

Each week Skift creates a roundup of travel startups that have received or announced funding that week. The total amount raised this week among companies we tracked was $11 million.

Below are two companies that announced they raised funding this week. You can see previous roundups here.

>>Sonder raised a $10 million Series A round from four new investors including Spark Capital, BDC Capital, Real Ventures and Thayer Ventures. Sonder, previously known as Flatbook, recently rebranded and pivoted. The company closed this round in February but announced it this week to coincide with the launch of SonderCollection.com. The San Francisco-based company’s total funding is $15 million after raising $5 million in multiple seed rounds.

Originally founded in 2012 as a platform for subleasing apartments, Sonder has rebranded to move away from subleasing and focus on the short-term rental market for travelers. The company has two models with its new iteration: the leased model, where Sonder leases properties, furnishes them if needed and rents to travelers and the partnership model where it manages properties on behalf of a third-party owner.

SonderCollection.com officially launched this week and had been in stealth for the past two years while distributing short-term rentals through third-party channels such as Booking.com, Homeaway, VRBO and Airbnb. The company provides hosts with professional cleanings services, toiletries, kitchen basics, towels and linens and Wi-Fi.

Sonder said customers can engage with its concierge service by email, phone and Facebook Messenger. Bookings are instantly confirmed and available rentals include houses, condos, apartments and boats. Sonder currently has 500 rentals and is live in six U.S. cities including Boston, Chicago and Los Angeles and is also in Montreal and Vancouver.

Sonder also said it’s doubling down on safety with its rebrand by providing hosts with keypads and lock boxes that are changed after each stay. Travelers use a three-point verification process to verify their identities when checking-in.

>>Hostmaker raised a $1 million bridge round from new investor Initial Capital and existing investors DN Capital and DSG Consumer Partners. This brings the London-based startup’s total funding to $3 million after it raised a $2 million seed round in November 2015.

Launched in July 2014, Hostmaker is a full-service hospitality management company giving Airbnb and other alternative accommodations hosts access to a team of housekeepers and concierges to help guests enjoy their stays. It’s currently operational in London, Paris, Barcelona and Rome and claims to serve about 5,000 guests every month.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: airbnb, funding, vcroundup

Photo credit: Sonder, formerly Flatbook, has rebranded to move away from subleasing and focus on the short-term rental market for travelers. Sonder