Skift Take

Priceline's CEO says its "competitive moat is deep and wide." His counterpart at Expedia believes his company needs to get more international. And TripAdvisor's new CFO says it has ample resources for acquisitions. This all should make for an interesting 2016.

TripAdvisor sold its money-losing Chinese site, Kuxun, for $28 million in 2015 and likely used the money to acquire Ze Trip, a personal journal app, and two restaurant reservation platforms, BestTables in Portugal and Brazil, and Dimmi in Australia for a kindred $28 million.

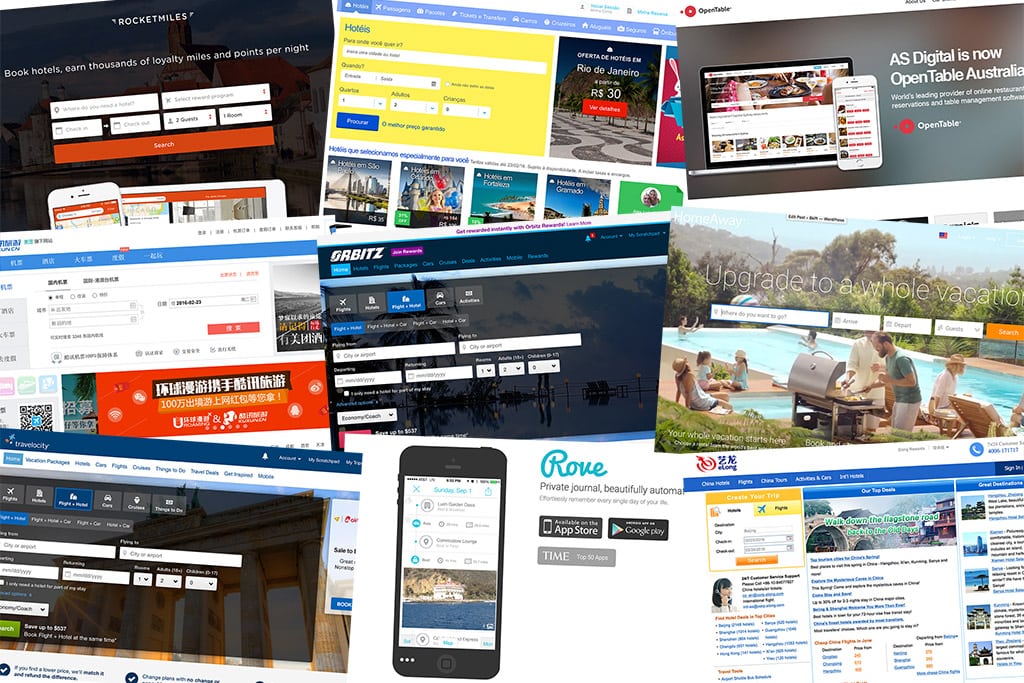

Meanwhile, the Priceline Group, which spent nearly $2.6 billion on acquisitions in 2014, spent just $75 million in 2015 on acquisitions for businesses, including hotel-booking site Rocketmiles, revenue management company PriceMatch, and Australia restaurant reservations platform AS Digital.

These were among the newly disclosed details that we gleaned from the recent TripAdvisor, Priceline, and Expedia annual 10-K report filings with the Securities and Exchange Commission. While TripAdvisor’s and Priceline’s 2015 merger and acquisition activities were modest compared with 2014, Expedia stole the show in 2015, spending $6.05 billion on outright acquisitions and an investment in Latin America site Decolar while selling its 64.2 percent stake in Chinese site eLong for $671 million.

Lets’s look at the three companies’ transactions a little closer.

TripAdvisor’s 2015 Acquisitions and A Sale

| BRAND | ACQUISITIONS | DISPOSITIONS |

|---|---|---|

| Kuxun | $28M | |

| Ze Trip* | $28M | |

| BestTables* | ||

| Dimmi* |

* Note: TripAdvisor disclosed that it spent $28 million for Ze Trip, BestTables and Dimmi but didn’t break down what it spent for each.

Priceline Group’s 2015 Acquisitions

| BRAND | ACQUISITIONS |

|---|---|

| Rocketmiles* | $75M |

| PriceMatch* | |

| AS Digital* |

* Note: Priceline disclosed it spent $75 million on acquisitions in 2015 but didn’t specify in its 10-K which companies it acquired or the breakdown.

Expedia’s 2015 Acquisitions Plus an Investment and Sale

| BRAND | ACQUISITIONS | DISPOSITIONS |

|---|---|---|

| Travelocity | $280M | |

| AAE Travel Pte.* | $94M | |

| Decolar** | $270M | |

| elong* | $671M | |

| Orbitz | $1.8B | |

| HomeAway | $3.6B | |

| Others*** | $9M |

Notes

* Expedia acquired the 25 percent of its joint venture with Air Asia that Expedia didn’t already own.

** Expedia’s investment in Decolar gave Expedia a 16.36 percent stake.

*** Expedia didn’t disclose which “other” companies it acquired in 2015 for a total of $9 million.

TripAdvisor Sold Kuxun

TripAdvisor states it realized a $20 million gain on its sale of Kuxun for $28 million to Alibaba-backed Meitun and hinted that the transaction funded three acquisitions in 2015.

In TripAdvisor’s 10-K filing, TripAdvisor states: “The cash consideration [for the acquisitions of Ze Trip, BestTables and Dimmi] was paid primarily from our international subsidiaries.”

TripAdvisor’s modest mergers and acquisition activity in 2015 stands in contrast to its $400 million in acquisitions in 2014, including $192 million for tours and activities site Viator and $208 million for six other acquisitions, including VacationHomeRentals, Tripbod, Lafourchette, MyTable, Restopolis and Iens ($11 million).

TripAdvisor had a lot on its plate in 2015, including integrating Viator and expanding TripAdvisor’s Instant Booking feature, which enables consumer to book hotels right on TripAdvisor, and these ventures undoubtedly limited TripAdvisor’s appetite for acquisitions.

Priceline Acquired Rocketmiles and Others

The Wall Street Journal reported in February 2015 that Priceline spent around $20 million to acquire Rocketmiles. If that report was accurate, then Priceline shelled out around another $55 million net of cash acquired for PriceMatch and AS Digital.

Like TripAdvisor, Priceline in 2015 likely was absorbed in integrating an acquisition, OpenTable, a task it admitted in its 10-K report is taking longer than initially expected. However, it is believed that Priceline took a hard look at acquiring HomeAway in 2014 or 2015 and Skyscanner after that, but walked away without making these transactions.

In contrast, Priceline executed nearly $2.6 billion in acquisitions in 2014, including $2.5 billion for OpenTable and $98 million net of cash acquired for hotel-marketing companies Buuteeq, Hotel Ninjas and Qlika.

Expedia Spent More Than $6 Billion

Expedia’s 2015 acquisitions of Travelocity North America ($280 million), the 25 percent stake it didn’t already own in AAE Travel Pte. i.e. Expedia’s joint venture with Air Asia ($94 million), Orbitz Worldwide ($1.8 billion) and HomeAway $3.6 billion) had been well-documented prior to Expedia’s 10-K filing. Likewise, we already knew that Expedia sold its 64.2 percent stake in eLong to Ctrip and others for $671 million.

What’s new in Expedia’s 10-K filing and an exhibit is that its $270 million investment in Decolar, which also operates Despegar sites, brought Expedia a 16.36 percent stake, and that Expedia made three additional and undisclosed acquisitions in 2015 for a total of $9 million.

Expedia’s more than $6 billion of mergers and acquisitions activity contrasted with a relatively subdued 2014 — about $743 million in acquisitions, including $658 million for Australi’s Wotif and $85 million for Europe’s Auto Escape Group.

2016 Has Been Quiet

What’s ahead in 2016?

Priceline’s CEO says his company’s “competitive moat is deep and wide,” meaning Priceline doesn’t necessarily have to make acquisitions to remain ahead of the pack.

Expedia’s CEO doesn’t commit to mergers and acquisition activity in 2016 but argues that his company is too U.S.-dependent and needs to get more international sooner rather than later.

TripAdvisor CFO Ernst Teunissen said during the company’s earnings call last week that TripAdvisor has plenty of bucks to make acquisitions.

“In addition, to organic investments, we continue to have significant financial capacity for inorganic growth,” Teunissen said. “We are very pleased with the acquisitions we’ve made over the last few years and remain open to similar opportunities to consolidate great businesses with innovative products and great management teams. Although, we look at many opportunities, we remain very selective and our focus on return on investment and long-term value creation.”

The three companies, Expedia, Priceline, and TripAdvisor, have been very quiet acquisition-wise so far in 2016 but the year is still very young.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: expedia, otas, priceline, tripadvisor