Here's Why Royal Caribbean's Expansion in Singapore Matters

Skift Take

Asian cruising is booming and Singapore has quietly capitalized on it to become the most popular cruise port in Asia.

Royal Caribbean International (RCI) signed a deal this week with the Singapore Tourism Board (STB) and Changi Airport Group (CAG) to promote cruises from Singapore and launch more cruises than ever before from its port.

The agreement will run until 2018 and more than 170,000 foreign visitors from Asia, Europe and North America are expected to embark on Royal Caribbean cruises from Singapore. Royal Caribbean expects to attract 50 percent more cruisers to Singapore and begin offering longer cruises from the Marina Bay Cruise Centre Singapore.

"Having deployed ships here regularly for the last seven years, Royal Caribbean now looks forward to its next phase of significant growth in Singapore," said Sean Tracey, managing director of Royal Caribbean Cruises in Southeast Asia and Singapore. "Our three-year deployment plan is our strongest commitment ever to this market and we see great potential in Singapore as a source market and regional cruise hub."

The investment is likely a move by Royal Caribbean to counterbalance Genting Hong Kong's acquisition of Norwegian Cruise Line, Regent Seven Seas Cruises, and Oceania Cruises in 2014. Royal Caribbean is already the number three cruise player in Asia, trailing behind Star Cruises (owned by Genting Hong Kong) and Costa Cruises.

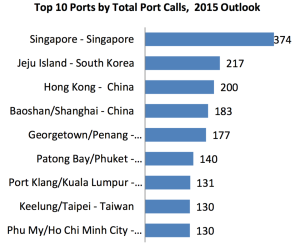

Why Singapore? Singapore is expected to host the most Asian port calls in 2015, according to Cruise Lines International Association's Asia Cruise Trends 2014 report, which was released in April 2015.

Total calls in China declined by 23 percent from 2014 to 2015, with Hong Kong and Shanghai acting as the country's most popular cruise ports. Singapore's port calls increased by 12 percent over the same period.

Turnaround calls dominate Singaporean cruising, with 82 percent of cruises originating and terminating in Singapore. Vacationers from other Asian countries, particularly China, Taiwan, and Japan, are flying to Singapore and departing on their cruises from there.

China is Asia's top source market, and the vast majority of Chinese cruisers want to cruise regionally; 94.7 percent of Chinese cruisers stay in Asia. Right now just 1.1 percent of Chinese cruisers fly to another country to begin their cruise, however.

Chinese cruisers increased by 79 percent annually from 2012 to 2014, and totaled 697,316 passengers in 2014. In 2014, Chinese cruisers represented half of all cruise passengers sourced in Asia.

This is where the partnership with Changi Airport makes sense; the airport's 6,700 weekly flights ensure that interested Asian cruisers have ample opportunity to fly into Singapore for cheap.

"This collaboration represents the synergistic efforts by CAG, Royal Caribbean and STB to effectively tap fly-cruise traffic from across the globe and serve as a cruise hub for Asia," said Lim Ching Kiat, Changi Airport's senior vice president of market development. "Changi Airport will continue to leverage on its network and work with airlines and travel agents to promote fly-cruise packages through Singapore."

Royal Caribbean Cruises' Treacy told Skift that the cruise line will continue to work with other Asian ports to diversify its range of port calls.

"Singapore is naturally our choice for this collaboration being our only homeport in Southeast Asia, hence Royal Caribbean has always been keen to work with the Singapore government to diversify and grow its source markets with more fly-cruise guests from Asia and beyond for its Singapore cruises," said Treacy. "In addition, we are very interested in working with various governments in the region on the development of port-of-calls to create more attractive cruise itineraries for our guests. This is exemplified by our agreement with KAJ Development to jointly develop the new cruise terminal in Malacca and, more recently, our investment in Chan May Port to upgrade its facilities in order to accommodate larger ships like the ones we operate in Asia."