Skift Take

Baseball's N.Y. Yankees had its "core four" of Derek Jeter, Andy Pettitte, Jorge Posada, and Mariano Rivera. And Expedia has its own core four, namely Expedia.com, Hotels.com, Trivago, and Egencia as the foundation for global growth and the plan is to add regional acquisitions around the edges.

In detailing the secrets of global expansion in travel, Expedia Inc. CEO Dara Khosrowshahi is starting to sound a little bit like newsman Dan Rather.

On cost-cutting we learned from Khosrowshahi: “Fat pigs get slaughtered,”

He also outlined a formula (see more below) on growing hotel room nights sold. Once you work it all out, Khosrowshahi advised, “then rinse and repeat.”

These homey admonitions for operating a global business with a $12 billion market cap were part of Khosrowshahi’s explanation of how Expedia Inc.’s recent acquisitions of Travelocity, Wotif, and (it hopes) Orbitz Worldwide fit into its overall growth strategy.

Flush after notching a whopping 32 percent growth in hotel room nights, predominantly of the organic variety, and raising its property count to 510,000 hotels in the first quarter, Khosrowshahi laid out his formula for future acquisitions and growth.

Khosrowshahi said the company doesn’t “need” acquisitions.

“There is no quote unquote need” for acquisitions, he said, but Expedia plans to grow through its four core brands, Expedia, Hotels.com, Trivago and Egencia, all of which are global in nature, and to be opportunistic about acquiring regional brands.

In that regard, Khosrowshahi characterized Travelocity as a primarily U.S. brand and Wotif as mostly an Australia one. Orbitz Worldwide, should the U.S. Justice Department give the green light for the merger after its review, is strongest in the U.S., as well.

“[CFO] Mark [Okerstrom] and his corporate development team will continue to sniff out opportunities” and Expedia will acquire companies when appropriate, Khosrowshahi said.

Look for a Business Travel Transaction

Expedia indeed wants to get more aggressive in corporate travel and could bolster its Egencia brand, Khosrowshahi said, adding that corporate travel is “a great segment.”

Expedia’s strategy is to growing globally through the four core brands, be opportunistic about acquiring regional companies such as Travelocity, Wotif, Orbitz and eLong, and get aggressive in corporate travel.

His remark about the attractiveness of corporate travel comes a day after a Skift story on rival Booking.com entering corporate travel for unmanaged business travelers with Booking.com For Business, although Egencia is light years ahead of Booking.com’s modest entry.

Speaking during Expedia Inc.’s first quarter earnings call April 30, Okerstrom chimed in that while the spate of headlines recently have centered around Expedia’s acquisition spree, the growth in the first quarter and likely through the latter part of the second quarter will be almost entirely revolving around organic growth.

In fact, Okerstrom said, when you add in $8 million in deal costs in the first quarter, the impact of acquisitions “is “solidly in the negative.”

However, it should be noted that Expedia Inc. grew its gross bookings 19 percent in the first quarter, and three percentage points of that growth came from newly acquired companies.

Trivago

It’s hard to tell which growth category — organic or inorganic — Expedia attributes to Trivago, one of the core global brands, these days, but it is on a growth tear. Expedia took a majority stake in Trivago in 2013.

In the first quarter, for the first time, the U.S. became Germany-headquartered Trivago’s largest market, Okerstrom said.

As Expedia Inc. brands such as Expedia.com, Hotels.com and the still-struggling Hotwire market themselves heavily through Trivago, that means Trivago’s growth in the U.S. “plays into our strengths” because of Expedia’s “great brands” and ample supply, Okerstrom said.

Trivago, which heavily advertised on U.S. television, turned a profit in the first quarter, taking in $119 million in revenue in the seasonally slow period.

Expedia’s advertising and media businesses, including Trivago and Exoedia Media Solutions, generated more than $500 million in revenue in the first quarter, a 35 percent jump year over year.

Slaughterhouse Lessons

Part of Expedia Inc.’s growth strategy is to scale the business and drive down costs, and to trim margins to attract new hotels in emerging markets. Reducing margins also convinces existing hotel customers to provide Expedia with better inventory.

“Fat pigs get slaughtered,” Khosrowshahi said.

Trimming margins, Khosrowshahi siad, also makes it more difficult for third parties to enter the space to compete. (Amazon Destinations anyone?)

Turning to a formula for room night growth, Khosrowshahi said there is “no magic bullet.”

The way to accelerate room night growth, he said, is to increase traffic, boost conversion, accelerate bookings from repeat visitors, and “then rinse and repeat.”

It’s as easy as that — folksy cliches and all.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: earnings, egencia, expedia, hotels.com, mergers, trivago

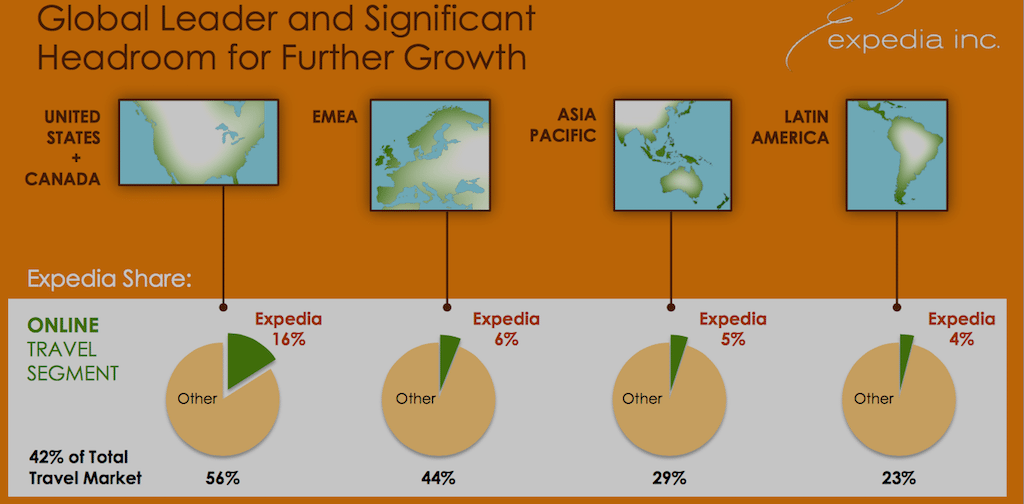

Photo credit: Expedia intends to make the blue triangles in the chart above through a combination of organic growth and acquisitions. Exoedia Inc.