Skift Take

Being a leading online travel company these days means adding expensive pieces to the portfolio, and both the Priceline Group and Expedia Inc. are signaling that their acquisition sprees are far from being finished.

Although valuations are soaring in the travel industry and beyond, have no fear that the Priceline Group and Expedia Inc. wouldn’t be able to keep up with the market: Both are well-positioned to keep on acquiring companies as they offer senior notes to boost their bankrolls.

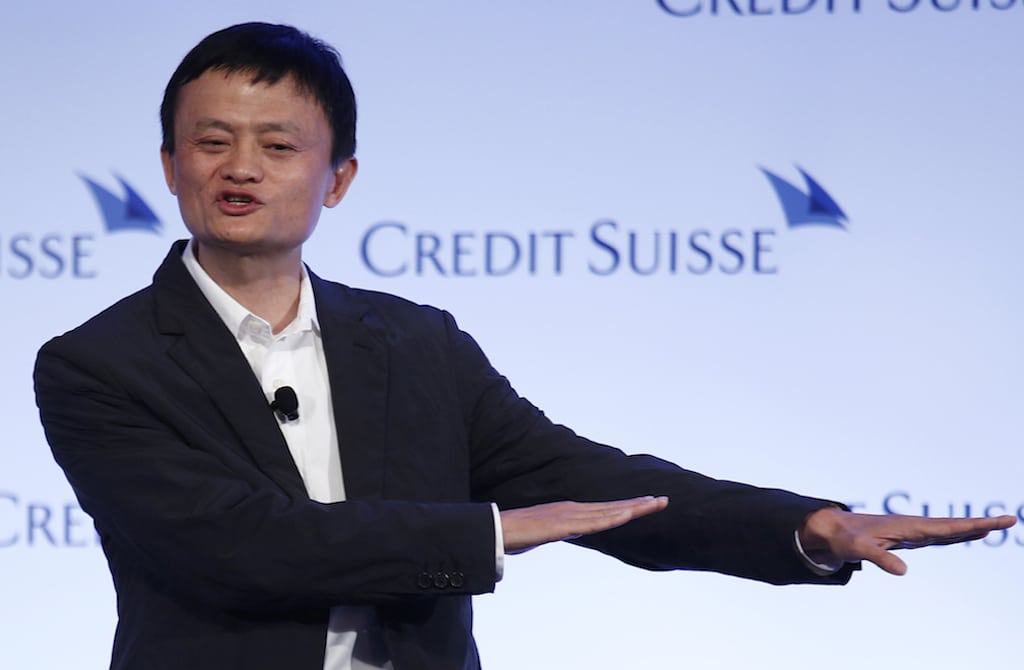

And then there’s Alibaba, which has a travel business and just raised $25 billion in the world’s largest IPO. At the end of the second quarter, Alibaba had about $8.5 billion in cash and equivalents at its disposal for acquisitions and other corporate purposes.

The Priceline Group, which acquired OpenTable for $2.6 billion this summer and is investing $500 million in China’s Ctrip, is readying an underwritten public offering of senior notes to be used for general corporate purpose, including share repurchases and acquisitions.

The pricing and amount of the Priceline Group offering have not been determined, but however much the online travel company raises, rest assured that it would certainly replenish and/or bolster its war chest.

Through the end of the second quarter of 2014, the Priceline Group already had $7.16 billion in cash and short-term investments.

There is no guarantee that the money raised in the new offering would be used for acquisitions, but they certainly are an option. The Priceline Group also acquired Buuteeq and Hotel Ninjas earlier this year, although the price tag was even lower than TripAdvisor’s Viator acquisition at $200 million.

Meanwhile, in August Expedia Inc. sold $500 million in senior notes to be used for general corporate purposes, including acquisitions.

Expedia, which is in the process of acquiring the Wotif Group in Australia for $658 million, subject to regulatory approval, and the Auto Escape Group in Europe for an undisclosed sum, had nearly $2.4 billion in cash and short-term investments at the end of June 2014.

Rounding out a list of the most active acquirers in travel, HomeAway could boast of nearly $800 million in cash and equivalents on hand through the end of the second quarter, and TripAdvisor was not far behind with $638 million.

HomeAway CEO Brian Sharples tells Skift that the company’s mergers and acquisitions department is very active, but valuations have been so high that they’ve limited the ability to make financially prudent acquisitions. HomeAway has only made one acquisition so far in 2014, namely the Glad to Have You property management app for a mere $16.8 million.

Sharples notes that the major players in travel — witness what the Priceline Group, Expedia Inc. and Alibaba are doing — are raising money.

The buying binge in travel is certainly not over.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: expedia, opentable, priceline, wotif

Photo credit: In this March 20, 2012 file photo, Jack Ma, chairman of China's largest e-commerce firm Alibaba Group, gestures during a conference in Hong Kong. Associated Press