Skift Take

With so many digital marketing players in the travel space, and so much growth in digital ad spend, hotels and DMOs are challenged with deciding how to best align their online campaigns with mountains of big data.

With the exponential rise in mobile bookings, hotel and travel suppliers are investing more heavily in digital advertising campaigns year over year.

However, there is some confusion in the industry about best practices, reputable partners, measuring ROI, and combing through all that big data.

“Advertising is seeing the strongest sustained period of growth in 10 years,” states marketing analytics firm ZenithOptimedia. “Despite its sizable growth, mobile advertising still only accounted for 2.7% of global ad spend in 2013. By 2016, however, it is expected to account for 7.7% of ad spend, surpassing radio, magazines and outdoor.”

In dollars, eMarketer predicts total online ad spend will reach $134 billion in 2014 and $149 billion in 2015, after topping $100 billion for the first time in 2012.

We spoke with Ryan Fitzgerald and Frank Vertolli, co-founders of Orlando-based digital marketing firm Net Conversion, about the state of online marketing in the hospitality and tourism industry in 2014. Last month, Net Conversion won two silver HSMAI Adrian Awards for Integrated Marketing and Mobile Marketing.

“There is an ever-increasing amount of guest intelligence available to hotels and DMOs (destination marketing organizations), and it can be overwhelming,” says Fitzgerald. “Big data is a hot topic across business sectors, but in many ways the travel industry has been a data-rich channel for years. We make it more manageable and effective, by getting back to the basics and evaluating current data as it relates to our clients’ goals.”

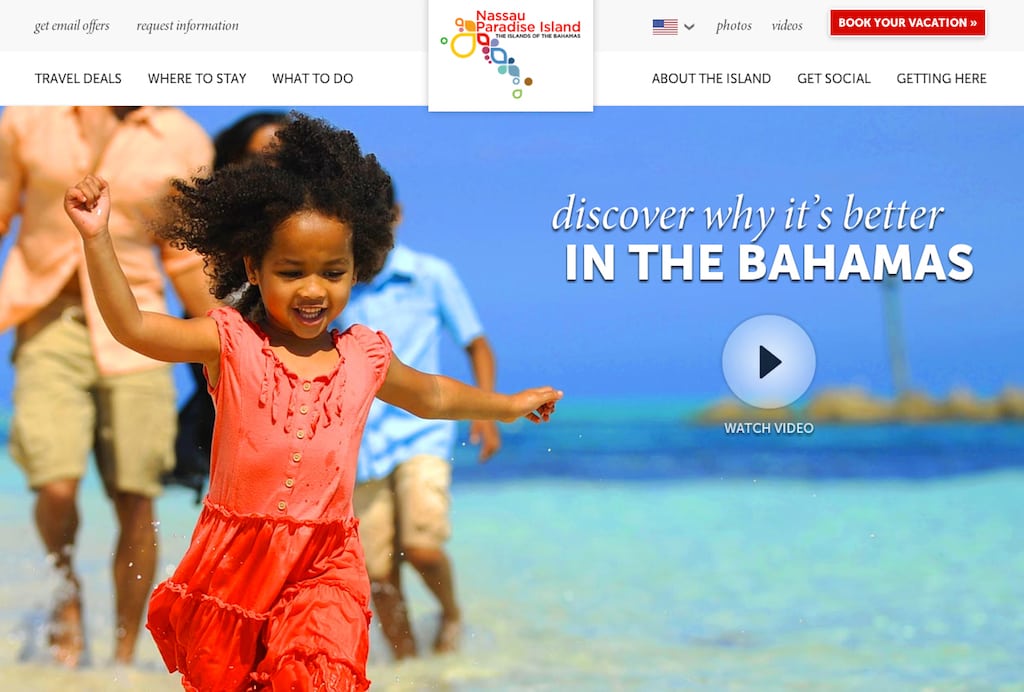

Two recent examples of digital marketing programs created by Net Conversion drove increased bookings for the Nassau Paradise Island Promotion Board (NPI) and Pebble Beach Resorts in California. In February, Google’s Think Insights presented a case study of Net Conversion’s work with the Bahamian DMO.

The Google overview focused on two key themes. The first is the market penetration and ad spend ROI of its YouTube TrueView video ad platform, where advertisers only pay for video impressions when consumers watch short videos in their entirety or at least 30 seconds of longer videos. The second is the overall value of video to effectively market travel. TrueView launched on desktop in 2011 and mobile in late 2012.

“Our destination is stunningly beautiful, and there is no way words or even photos can tell the story the way video can,” states Kim Andersen, VP of marketing for the NPI Promotion Board, in the Google report.

The goal of the Nassau Paradise Island campaign was to reinforce its message in key markets east of the Mississippi and expand market share in specific regions out West. However, the cost of ramping up advertising nationally through traditional methods was prohibitive, so NPI turned to Google’s TrueView video platform.

Google reports: “Of the five campaigns that ran over the course of the following year, each delivered an average lift of 33-56% in website visitations while TrueView ads were active. At the same time, cost-per-view decreased from 15 cents to 11 cents due to bid optimizations. Although NPI was concerned about the ROI of expanding nationally, conversion rates (clicks to partner properties) actually held steady.”

Following is our conversation with Fitzgerald and Vertolli about their recent campaigns, and how and why hotel/DMO marketing professionals are engaging with digital advertising in 2014.

Skift: Frank, in human-speak, what does Net Conversion do?

Frank Vertolli: Digital marketing enables great targeting, and the key differentiator is measurability. It’s unlike what we call traditional advertising where you put a stimulus in the market—TV, billboards, print, radio—and then you wait for something to happen. With online you can measure from that ad impression all the way through to someone taking a desired action. In an ideal state, it’s actually a hotel booking where I’ve got a revenue and room night number to associate with that marketing.

Other times, it’s just a lead or three minutes of engagement on a website. But ultimately we’re trying to achieve the same thing that marketer is trying to. I want to spend my advertising dollars efficiently and effectively. I want to measure consumer response. And I want to drive the bottom line, and we can do that better than ever before.

Skift: Is there an issue where sometimes there’s almost too much data for hotels and DMOs to cull through?

Ryan Fitzgerald: Right now the beauty of the internet is you can track everything. The worse thing about the internet is you can track everything. It creates these reams of data that’s very hard to understand because you can get lost in the numbers. And I think a lot of hotels and DMOs especially struggle with that, and wonder what are the right things to focus on.

What we tend to do is try to pivot off of data points that are most relevant for them. What types of consumers are interested in your product? What’s driving them to your website? And then once they get to your website, what are they doing on your website? Are they booking the hotel rooms? In the DMO space, are they becoming leads for your member properties, right?

So trying to understand the interactivity of the consumer segments that you’re going after, and their response to those conversion metrics, that’s how we break down the data and really kind of simplify it, so they know that, hey, is the consumer doing what I really want them to do?

We give them a vision of the shopper’s framework during the online experience. And that helps them kind of sell what they’re doing to either their CEO, or with the DMOs, their member hotels to make sure they’re making effective use of their tax dollars.

Skift: Can you provide a concrete example? Does that apply to the work you did with the Bahamas?

Vertolli: A great example of that is Nassau Paradise Island, a DMO that we’ve done a lot of work for over the years. Their typical bread-and-butter market historically is east of the Mississippi, typically in the Northeast or the South. So that was the bulk of their market forever. Through looking at some of the analytics data on who was coming to the website and what they were doing once they got there, we saw that there was this whole untapped, or never marketed to directly, group of people beyond that. Namely there were some pockets of interest in Texas and areas in California.

We were able to create marketing programs that cost effectively reached those people that were already somewhat identified to be interested in beaches and that product category. But not people we were directly talking to.

So we were able to expand overall website visitation and conversions for the destination by going after this new geographic consumer segment. And when we did this marketing stimulus with them, it grew at four to five times that rate at what we saw in our traditional northeast DMAs (designated market areas). So it added considerably to their key markets, and it’s becoming a bigger piece of their marketing efforts.

Skift: How about from the hotel side?

Vertolli: From the hotel side, there’s a couple things going on with Pebble Beach. One is they are one of those clients where you still have to pick up the phone, because tee times are one of the most scarce commodities. So combining that with a room booking is quite a technological challenge for them. A call center is still the way they transact, so even though we get them on the website, getting them on the phone is kind of the key conversion metric.

We saw this early on during the shift to mobile with more people using smart phones growing at double digits several years ago, so we were able to go after a strategy for a mobile-dedicated website, a mobile dedicated campaign. Now, a normal call metric might be, say, 5% of paid traffic to the website winds up calling. Through these dedicated mobile efforts, we were able to drive about a 25% click-to-call. So about one out of every four people we drove to the website, they were calling and ended up making a lot of bookings.

Skift: How is video marketing online evolving in 2014?

Vertolli: There’s more and more video, you see it every day, but this year potentially might be the tipping point. What’s happened is, the pricing model is changing.

This is where we come to TrueView, the pre-roll advertising unit of Google’s YouTube. With TrueView, you can show an ad and what happens is, if a viewer skips the ad anytime before 30 seconds, you don’t even have a view. And as a marketer, you’re only paying per completed view.

So you can get all of the targeting that you want on there, basically geography, consumer segmentation, keyword, those kind of things, and have the ability only to pay when someone watches the entire spot. So that’s like a self-selected kind of advertising. Very effective, it’s very efficient. The fact that you can cost per completed views at 10 to 20 cents for someone to watch a 30-second ad is pretty incredible, and I think it is changing a lot of people’s views.

The other thing is that people before would buy TV because it was kind of the mass market thing to do, and you had to do that to drive your marketing activities. But when you go to the digital side, measurement is always at the forefront. So that’s helping digital marketers explain and measure the true impact of digital video on a website all the way down to the booking.

Fitzgerald: Another thing to consider is not only the scale where everyone is consuming this video online, it’s becoming more and more blurred with TV. Like the Netflix of the world and HBO’s GO. Things we used to watch on TV we’re now watching on devices. So with digital, you’re not just targeting people who watch that certain show, like in the old demographic days. You’re targeting the robust set you get online, while learning what they’re watching and also where they live and what other interests they may have outside of this video they’re watching right now.

When you think about that, and the number of people online, the targeting of online with the customization that you get in that targeting set, you’re getting scale. You’re getting a big number of people, and the pricing model is only paying when someone watches the whole video. So that’s fundamentally shifting the way we think of video advertising.

Especially important for hotels or destinations, now you can get the reach that TV used to give you, where most of it was wasted because even though you’re showing to millions of people, only a small set of those were shopping for a vacation in a certain market.

We’ve gone the opposite of that, where you can refine who you’re showing the ad to, get it in front of a very targeted audience, and still only pay when they take some measurable or completed action. So that’s what’s really exciting about it for us, is being able to drive such relevance. And we know it’s relevant because such a high percentage of people choose to actively let that video complete. So we know we’re putting the right video message in front of the right consumer at the right time.

Greg Oates covers hotel/tourism development and travel brand media. He has toured over 1,000 hotels in 50+ countries. email / twitter

Have a confidential tip for Skift? Get in touch

Tags: Digital Marketing

Photo credit: Video marketing at Nassau Paradise Island Promotion Board NPI Promotion Board