Why Delta and Skyteam need the Virgin Atlantic partnership and Heathrow slots

Skift Take

Delta Air Lines and its Skyteam partners are slot paupers at London Heathrow, and that's an overriding reason why Delta is thought to be in the advanced stages of talks to buy Singapore Airlines' 49% stake in Virgin Atlantic Airways.

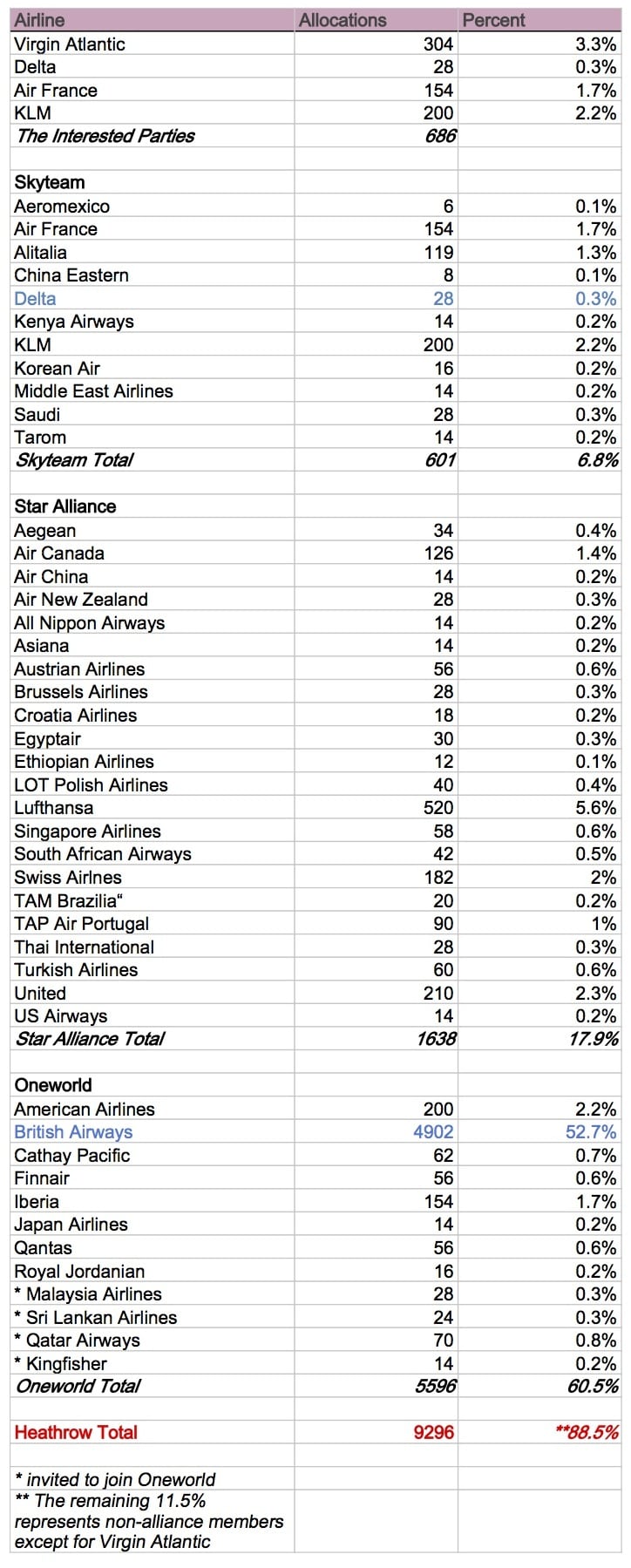

Skift analyzed the 2012-2013 winter allocations at Heathrow by airline alliance using data from Airport Coordination Ltd., a UK-based, airline-owned company responsible for coordinating slots at Heathrow and 29 other airports in Europe, North America, and the Middle East.

The allocations in the charts below are the weekly slot designations for airlines and alliances at Heathrow for winter 2012-2013, and the numbers show that Delta, the largest U.S.-based carrier, has a measly 28 slots at the airport, a vital gateway to the rest of Europe, Asia and the Middle East.

Those 28 slots for Delta amount to a minuscule .30% (i.e. less than 1%) of the 9,296 slots at the airport, while British Airways, which rules the roost at Heathrow, commands 4,902 (52.7%).

Alliances don't share and share alike

British Airways' dominance of Heathrow is great news for Oneworld partner and Delta competitor American Airlines, which has 200 (2.2%) Heathrow slots for the upcoming winter.

With 210 slots at Heathrow, United Airlines has a few more slots than American, but United doesn't have a Star Alliance partner that can rival British Airways' hold at Heathrow -- actually, no one does.

However, United's Star Alliance partner Lufthansa has 520 allocations (5.6%) at Heathrow, and that's the second-highest slot number of any airline at the airport.

Delta has Virgin slot lust

Virgin Atlantic doesn't belong to any of the big three airline alliances, and the airline commands a coveted 304 slots (3.3%) at Heathrow, and Delta lusts for access to them.

There is speculation that Delta's Skyteam partner, Air France-KLM, would jump into any Virgin ownership restructuring because Delta, as a U.S. carrier, is barred from taking a majority equity position in Virgin. Delta and and Air France-KLM already conduct some joint operations at Heathrow.

However, Air France-KLM indicates it is not currently involved in the discussions with Virgin, and Virgin boss Richard Branson says he has no intention of giving up control of his baby.

And, for now, at least, reports indicated that Delta and Virgin are discussing a transatlantic joint venture, which would have a combined 332 slots at Heathrow.

If Air France-KLM eventually joins in with Virgin and Delta, then together they would command 686 slots at Heathrow, which is a greater presence than Skyteam's entire current allotment of 601 slots at the airport.

Even if you add Virgin's 304 allocations to Skyteam, for argument's sake, bringing the total to 905 slots, the alliance would still be a distant third to Star Alliance's 1,638 slots, let alone Oneworld's 5,596.

However, with Delta's paltry 28 slots at Heathrow, or 446 per week if you count joint operations with Air France and KLM, it's clear that the Atlanta-based carrier has to do something dramatic to improve its access to more lucrative long-haul routes from Heathrow.

The slot numbers show it.

Allotted slots for Winter 2012-2013

Source: Airport Coordination Limited, September 6, 2012