Skift Take

A startup is only as good as the real-world use case it's trying to address, and sometime it takes the support of an accelerator to discover how to do this.

Editor’s Note: In our Skift Startup Stories series, we document travel startup issues, solutions, and lessons from a variety of angles, hoping to shed light on what separates the winners from the losers. You can read all the stories here.

Y Combinator released its latest tally about the fate of the 940 companies that the Mountain View, California-based startup accelerator has funded over the last decade: Eight are worth more than $1 billion, 400 carry $100 million-plus valuations, and 177, or 12.5 percent, have failed.

The failure rate is similar at another leading startup accelerator, Techstars, with offices in Boulder, New York City, Boston, Seattle, San Antonio, Austin, Chicago, and London. Techstars has funded 556 companies since its founding in 2006, and states that 75, or 13.5 percent, have been acquired and 62, or 11.1 percent, have failed.

Both of these accelerators include, but aren’t limited to, travel startups. Among travel startups, Airbnb, Hipmunk, Vayable, and Flightcaster trace their roots to Y Combinator while Techstars has nurtured Sidetour, Verbalizeit, Wander, and Hot Hotels, for example.

It’s the nature of the proposition that startups, in general, tend to have a relatively high failure rate as founders and co-founders sometimes tragically devote their life savings and years of effort to — let’s face it — ideas that may have been tried dozens of times already.

The Y Combinator and Techstars track records, while likely a lot better than those of travel startups generally, underestimate the numbers of their startups that fail. They only include companies that cease operations, and exclude all of those soft landings, asset sales and acquihires.

Still, getting accepted to participate in Y Combinator or Techstars is often a very good thing, according to Using Miles founder and former CEO Krista Paul, Rocketrip founder and CEO Dan Ruch, and Smart Host co-founder and vice president of sales Nick Persico, all of whom went through one of these accelerators. Skift also interviewed Techstars founder and co-managing partner David Cohen (see Q&A below) on accelerator trends.

But travel startups should be aware of the tradeoffs, including the equity the accelerators take, the distractions that come with a heavy schedule of meetings, and at-times a bevy of contradictory advice from assigned mentors. Y Combinator and Techstars generally invest around $120,000 in startups accepted into their programs in exchange for 7-10 percent equity.

Using Miles Founder and Former CEO Krista Paul

Loyalty program management site Using Miles went through Techstars in 2008, eventually raised some $3.3 million in funding, and Source Inc. and Help Worldwide acquired the startup in December 2013 for an undisclosed amount.

Paul, who currently works as vice president of global marketing for Ominto and mentors startups in The Founders Institute, says startup accelerators have proliferated in recent years and participating today in Techstars “is a no-brainer.”

The top startup accelerators usually have great mentor networks and can help launch a company or help with a pivot, Paul says. They give startups the credibility they would be slower to earn on their own and increase the likelihood of raising funds, she adds.

But meetings schedules and other obligations can often be a distraction and startups need to develop a strategy for coping with it, Paul says.

“It is a bizarre thing that happens,” Paul says. “You enter an accelerator to work on your business and suddenly you are not working on your business anymore.”

On the other hand, Using Miles managed to get meetings with investors and partners that they couldn’t get before their entrance into Techstars, Paul says.

“If things weren’t going well we could always pull out the Techstars card to open doors,” Paul says.

A good accelerator, with great networks, will pay for itself, Paul says.

Although the startup is apt to get “wicked good advice” in an accelerator, Paul says, one thorny issue is that advice may be contradictory when bouncing from mentor to mentor. “I don’t think I was prepared for all this,” Paul says.

You can’t let the widely divergent advice “derail you,” Paul says. “If we had followed some of them we would have never brought anything to market.”

Paul has another tip for startups looking to apply for accelerators: Don’t let one rejection discourage you. In fact, she says, sometimes a startup can apply for a Techstars slot and get turned down in one city but get accepted in another, she says.

Such perseverance is a necessity for any travel startup.

Rocketrip Founder and CEO Dan Ruch

Rocketrip, a business travel platform that incentivizes road warriors to find savings in their corporate travel, went through Y Combinator in 2014.

Dan Ruch of Rocketrip likens the question of whether a startup should enter an accelerator with the issue of whether someone should attend business school: each has an associated cost-benefit equation.

The costs associated with entering an accelerator include the equity that the startup has to give up and the time sacrifice it will require, including meetings and dinners, Ruch says.

Participating in a “top-tier” accelerator almost always makes sense, Ruch says, because the company’s valuation will increase. He places Y Combinator and Techstars in that upper echelon.

What Ruch calls “mid-tier” programs might not always make sense.

“There is Harvard and Stanford and Wharton and then there is everyone else,” Ruch says.

Smart Host Co-Founder and Vice President of Sales Nick Persico

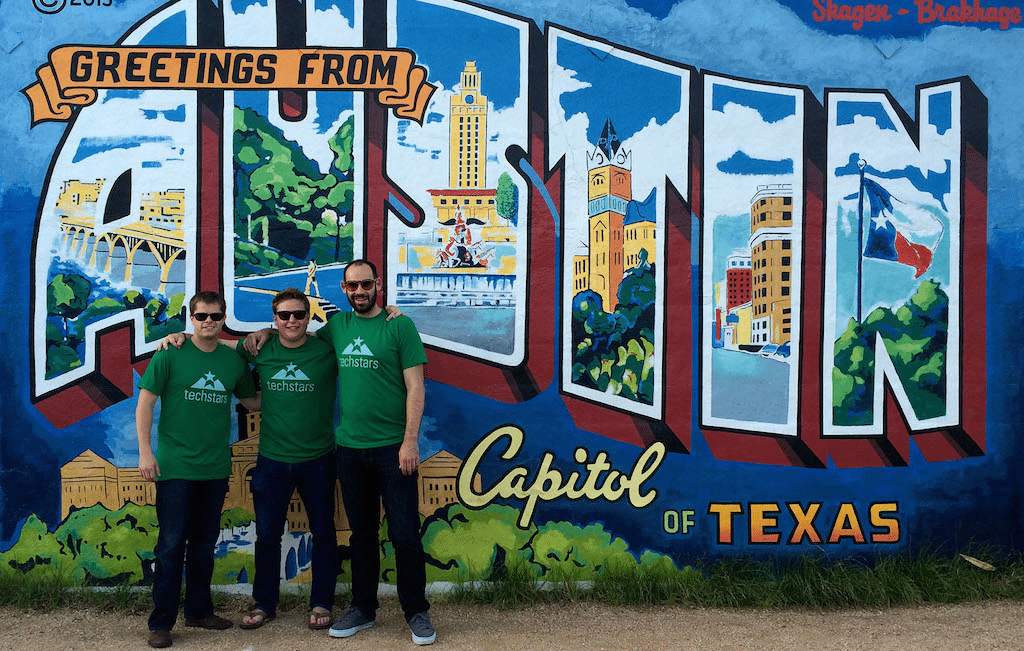

Smart Host, which helps vacation rental managers optimize revenue through variable pricing, went through Techstars in Austin, Texas in the summer of 2014.

The location was a big selling factor, says Smart Host co-founder Persico, because leading vacation rental site HomeAway is headquartered in Austin and several of the program mentors have HomeAway ties.

Simply increasing a startup’s valuation shouldn’t be the main reason for entering an accelerator, Persico says, adding that joining an accelerator can save a company months or years of trying an idea or product that might be doomed to fail.

The co-founders of Smart Host managed to quit their other jobs and devote themselves full-time to the startup once they joined Techstars, Persico says.

Smart Host’s initial idea was to bring hotel-like revenue-management techniques to individual hosts renting out their apartments or rooms.

“Our focus was totally on the consumer side but we learned through our mentors that this direction would be really difficult,” Persico says. “Within three weeks at Techstars we switched toward property managers.”

Startups need to devise a strategy for handling the accelerator work load, says Persico, adding “it comes in waves.”

Other Considerations

Startups need to speak with the alumni of various accelerators to figure out which ones, if any, may be best for them.

For example, Y Combinator may take 100 startups at a time, making it difficult for a startup to stand out and perhaps drawing a little less attention than at Techstars, where groups of startup entrants may number about a dozen or so.

Another consideration is that Techstars requires the dozen or so startups in a given city to work out of a common office while Y Combinator has companies working out of their own individual spaces. It comes down to the question of isolation — or perhaps the ability to focus — versus the comradery and skills-sharing of working alongside other entrepreneurs.

Techstars Founder and Co-Managing Partner David Cohen

Skift interviewed Cohen about trends in the startup accelerator arena.

Skift: Under the most notable Techstars companies in your FAQ I don’t see any recognizable travel startups. Is there more tech startup innovation outside of travel? Why?

David Cohen: Well, there are many Techstars companies and none of the “most notable” so far seem to be travel companies. FlexTrip was acquired by Nor1 and Using Miles did well and was acquired [by Source Inc. and Help Worldwide] too. Hot Hotels is in the current Boston class. Smart Host is early but doing well. Invited Home is doing super well. Sidetour was one of ours, and was acquired [by Groupon] when it was small.

Some of the ones still running could, of course, become breakouts. i think we haven’t invested in a ton of travel startups (out of 600-plus we’ve invested in) so it’s a numbers’ game on some level.

Skift: In the last year or so, have you come across travel startups inside or outside of Techstars that truly appear to be doing something different and noteworthy? An example or two and why?

Cohen: I think SideTour [a tours and activities platform] was a truly interesting idea. I think someone will get that right as a standalone company. I really like Invited Home [vacation home rentals] too.

Skift: What is it in particular that you found appealing about Sidetour. Was it the peer to peer tours? And what do you like about Invited Home?

Cohen: SideTour was its sharing-economy approach to travel: tours and activities designed by locals who know the area well, and can give a localized experience. Buyers bypassing “middlemen” who take a percentage just for advertising the opportunity and booking it. More money going directly to those who provide the service. Similar to Uber or Airbnb in that regard.

On Invited Home, I like the high end of markets: fewer customers, more dollars.

Skift: What are some dos and don’ts for travel startups in participating in accelerators and once they graduate? Can you provide an anecdote about a “do” and one about a “don’t?”

Cohen: Do build your network and continue to leverage it after the accelerator. Don’t do the opposite. Network isn’t everything in business but it’s almost everything.

Skift: What are some of the hottest trends for both accelerators and (travel) startups that you come into contact with? How are things changing?

Cohen: Accelerators are going vertical, focusing on specific mentors and spaces, such as the Disney Accelerator (entertainment) or Barclays Accelerator (financial tech), which Techstars powers. I think travel startups are starting to tap into the sharing economy. As an investor in Uber, I’ve witnessed the impact on the industry in a few short years by leveraging the power of the network and the sharing economy.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: rocketrip, sss, startups, techstars, y combinator

Photo credit: Smart Host co-founders (from left to right) Dave Redding, Nick Persico and Evan Hammer were set to present their solutions at Techstars in Austin September 3, 2014. Smart Host