Skift Take

Given Booking.com's digital prowess, its new service for hotels is likely to be an attractive one for a segment of the hotel market. But isn't it ironic that Booking.com is poised to get more involved in hotels' digital operations just when European regulators are trying to limit its influence?

If hotels and European regulators are already concerned about Booking.com’s clout with hotels, they’ll now have to consider that Booking.com is likely to gain even more leverage with hotels because the company has launched a new hotel-website creation and booking-engine service.

Booking.com, which recently reached agreements with several European regulators that would enable hoteliers to offer lower rates to Booking.com’s competitors for the first time in years, has unveiled a new division, BookingSuite, that creates websites for hotels and collects commissions from them when hotels sell rooms on their own websites when they use the BookingSuite Web Engine.

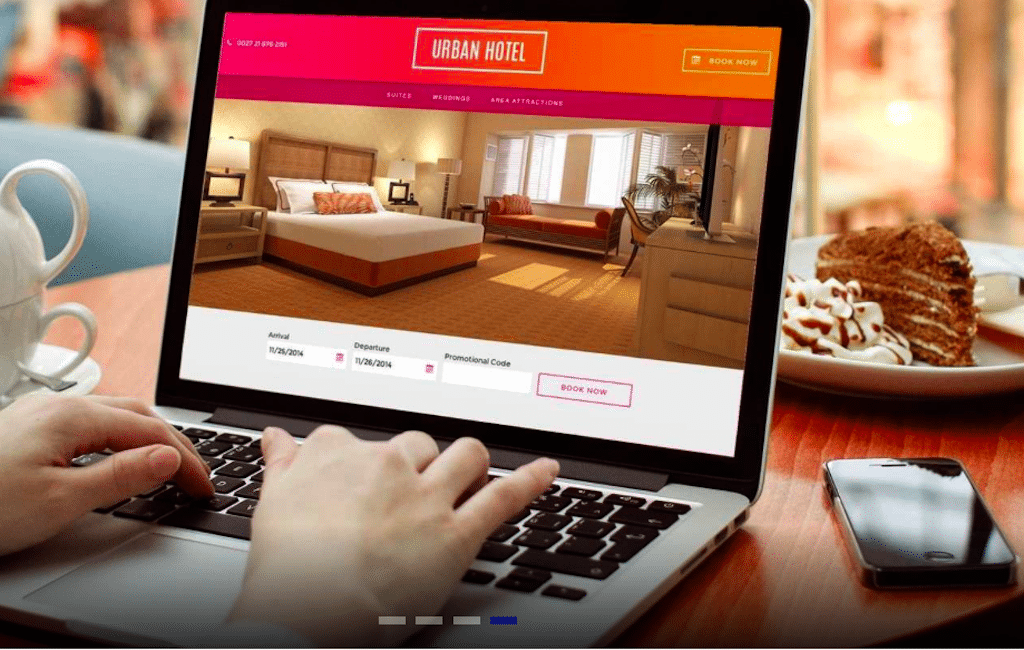

Booking.com states “WebDirect is for Booking.com partners who want a sophisticated Web presence” and they “only pay when a reservation is made through their booking engine and results in a stay by guests.”

The creation of the BookingSuite division is no surprise: The Priceline Group acquired Buuteeq and Hotel Ninjas last year and has openly discussed using them as a foundation for launching a B2B business for hotels. Skift reported last November how Booking.com’s work for Marriott in powering all of Marriott’s websites in the Italian, Russian, Arabic and Brazilian Portuguese languages was a harbinger of things to come.

BookingSuite’s newest and most important product is called WebDirect, which offers a full suite of services, including a cloud-hosted website (Amazon Web Services); analytics; SEO and customer support, and integration with property management systems, central reservations systems and booking engines, including to third-party booking engines or optionally BookingSuite’s own booking engine.

Booking.com’s WebDirect service also enables small, independent hotels that are customers of TripAdvisor Business Listings to market their websites through TripAdvisor’s metasearch product, Hotel Shopper.

For hoteliers that are looking for a more basic website service than WebDirect, Booking.com also offers a product to create mobile-optimized websites.

Getting Even Tighter With Hotels

Booking.com, like players around the industry from Alibaba to TripAdvisor, is looking to become more of an all-around service provider to hotels, but the ironies are many.

European regulators, in particular, are trying to rein in Booking.com’s power to entice greater competition in terms of giving hoteliers more freedom to offer diverse room rates to online travel agencies and other players.

Booking.com, the largest online hotel provider in the world, currently has the power to greatly influence hotels’ performance, and now through the launch of BookingSuite there is the prospect that some hoteliers could become even more dependent on Booking.com.

There is the perennial battle for market share in online travel between third-party online travel players such as Expedia and Booking.com and the hotel-direct channel i.e. hotels’ own brand.com websites.

With Booking.com’s BookingSuite hotel business, the boundaries become more blurred because Booking.com goes beyond its distribution services and gets its hand in the hotel-direct channel, collecting commissions from hotels when they use the Booking.com booking engine on hotels’ own websites.

It’s also ironic that BookingSuite gives hotel customers the option to connect their Booking.com-powered website to TripAdvisor metasearch when that service competes with Booking.com sister company Kayak.

One reason for BookingSuite’s integration of TripConnect, which targets small, independent hotels and B&Bs, is that Kayak doesn’t have a comparable connection service for this segment of the hotel market. Kayak is also more flight-oriented than TripAdvisor.

Depending on the quality of the BookingSuite service offerings, and the financials, which haven’t been disclosed, this Booking.com initiative could be very attractive to some hotels, giving them a one-stop shop for their distribution, marketing and hotel website operations.

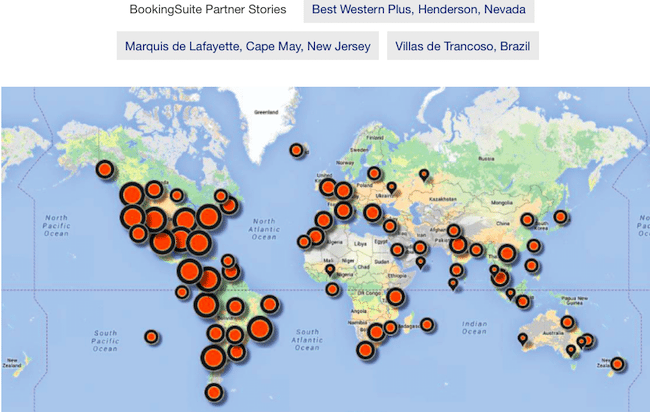

Booking.com says more than 20,000 properties, including the Best Western Plus Henderson Hotel, Henderson, Nevada; Marquis de Lafayette in Cape May, New Jersey, and Villas de Trancoso, Brazil, are already using some of its services.

For Booking.com, it all likely means that it will become an even more formidable player in the hotel industry.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: booking.com, marketing, mobile, tripadvisor

Photo credit: Booking.com is now creating websites for hotels and offering its own booking engine for use on hotels' brand.com websites. Booking.com