Mainstream Travel Apps Still Have Long Way To Go On User Engagement

Skift Take

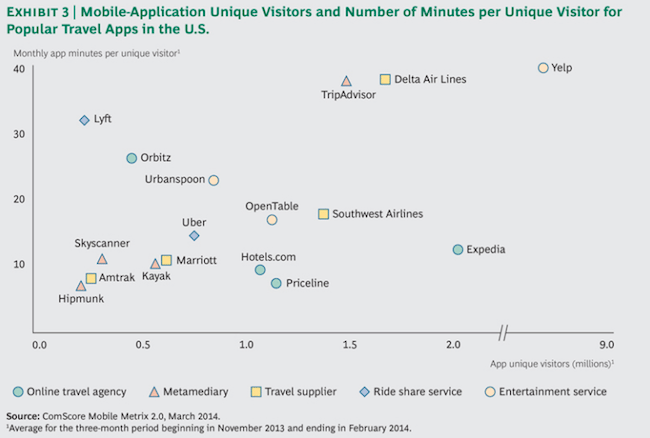

For U.S.-based travel-related companies seeking to engage customers with their mobile apps, as opposed to just hiking their app download numbers for appearances’ sake, Yelp, Delta Air Lines, TripAdvisor, Lyft and Orbitz are among the leaders, according to a new study from the Boston Consulting Group.

Using ComsScore Media Metrix figures for the three months ended February 2014, the study, which BCG released in partnership with Facebook, shows that among popular travel apps Yelp, Delta, TripAdvisor, Lyft and Orbitz led their peers in minutes per unique visitor in their respective mobile apps.

Hipmunk, Priceline, Amtrak, Kayak, and Hotels.com were at the bottom of the list among popular travel apps when considering minutes per unique visitor, according to the study.

The minutes per unique visitor numbers reflect to some degree the different functionalities of the various apps. For example, it is easy to see how users would spend more minutes reading restaurant and hotel reviews in the Yelp and TripAdvisor apps than they might booking an Amtrak ticket through the rail company’s app.

The Rankings Change

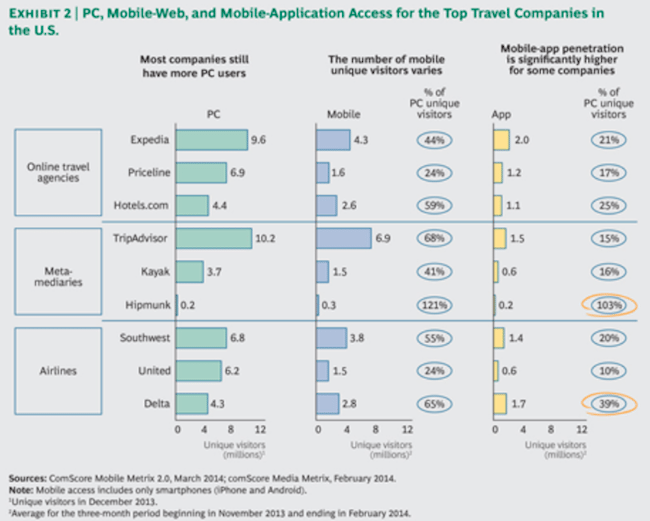

By another mobile measure, however, the study’s rankings change dramatically. [Tables below]

When considering mobile app penetration as a percentage of desktop unique visitor numbers, the leaders among travel metasearch companies become Hipmunk (103%), among airlines Delta Air Lines (39%), and among online travel agencies Hotels.com (25%).

If Comscore’s numbers are the be believed, then Hipmunk had greater mobile app penetration in February 2014 than it had desktop unique visitors in December 2013. Despite Hipmunk’s efforts in developing multi-device search, there is some deserved skepticism in Comscore’s tally.

Hipmunk CEO Adam Goldstein declined to comment on the BCG numbers, saying Hipmunk wouldn’t get into details on its cross-platform usage.

And, Lee McCabe, Facebook’s global head of travel strategy said Hipmunk’s 103% mobile penetration doesn’t surprise him. “Companies like Hipmunk are ahead of the game on mobile growth strategy,” McCabe says.

The numbers in most research studies can be open to question. The statistics in the BCG study are still worth considering if they reflect the basic trajectory of the various companies’ mobile efforts.

Although Hipmunk’s mobile penetration (103%) as a percentage of desktop users far exceeded that of Kayak (16%) and TripAdvisor (15%), according to the study, it should be pointed out that Hipmunk has only a fraction of the Web traffic of its two rivals.

Lose in One Channel, Win In Another

The BCG study shows how mobile can be a new battleground for travel companies, and although they may have lost the war to date on the Web, they can still be winners in mobile.

“For example, Delta Air Lines has fewer unique visitors on the Web than its major competitors, but almost 40 percent of them use its mobile app, which puts it in the lead in terms of mobile success — at least for the moment,” the study states, when compared with Southwest’s (20%) mobile penetration and United’s (10%).

BCG outlines mobile’s evolving role in the struggle for customer loyalty in travel.

“The biggest opportunity is to cement relationships with customers — especially a company’s best, high-value customers — by offering them truly personalized service and experiences” the study, “Travel Goes Mobile,” states. “The biggest threat is that one or more companies will cement their relationships with your best customers before you do.

“In this context, travel companies of all kinds need to recognize that the universe of potential competitors is broadening, a process that started on the PC. Suppliers are competing directly with OTAs, metamediaries, search engines, and social networks –and each of those players with all the others — to own customer relationships. New entrants that offer predominantly mobile-based functionality, meanwhile, are moving into the travel market more easily than ever.”

The Gatekeepers

Besides merely enhancing their mobile apps, how can travel companies improve their standing in mobile?

Advertising, of course.

It should come as no surprise in an exercise such as this, which saw Facebook partner in the BCG study, that the argument is made that ‘gatekeepers’ such as Facebook, Google, Apple, messaging-app operators and gaming companies could be key in driving mobile engagement for travel companies because these gatekeepers have the audience, and data to provide clarity as a supplement to travel companies’ own data about customer behavior.

Big brands such as Kayak, Expedia, TripAdvisor and Booking.com “will not be as dependent on mobile gatekeepers as smaller companies or start-ups,” the study states.

Companies such as the Priceline Group and TripAdvisor have been saying as much, arguing in recent months that they aren’t getting as much as they would have hoped out of Facebook advertising.

Booking.com, for one, states the holy grail in mobile is not chasing downloads or bookings, but using mobile as a means to forge ongoing relationships with customers.