Hotel Wellness Strategies With the Biggest Payoff

Skift Take

Early Check-In

Editor’s Note: Skift Senior Hospitality Editor Sean O’Neill brings readers exclusive reporting and insights into hotel deals and development, and how those trends are making an impact across the travel industry.I received a lot of reader response back in March when I wrote about hotel strategies in wellness. So I went back to the well on wellness and found fresh data from another authoritative source.

The Wellness Real Estate Report 2023, was recently released by RLA Global, a consultancy, with statistical help from HotStats, a hotel benchmarking service.

- The report is a rare effort to quantify trends in how hotels tap interest in "wellness," including gyms, spas, meditation, yoga classes, adventure activities, healthful food offerings, and cosmetic or medical care.

- The report analyzed data at 2,600 properties worldwide with some wellness.

- Hotels generating wellness and leisure revenue of more than $1 million and/or at least 10% of total hotel revenues in 2022 generated $273 a night in total revenue per available room — a figure down 29% from before the pandemic. Occupancy was 61%, just three percentage points off 2019 levels.

- The picture for hotels with major wellness investments, as defined above, improves when one looks at their profits. Gross operating profit per available room, or GOPPAR, measures the portion of incremental revenue that results in incremental profit. These hotels saw a $68 average GOPPAR last year.

The report comes as a handful of hotel players dabble or invest in wellness offerings.

- Hyatt bought Miraval, the owner of three U.S. wellness resorts and spas, for $215 million in 2017, and plans to expand the brand. In 2021, it acquired Zoëtry Wellness & Spa Resorts. Last year, Hyatt said it planned to launch a new brand, Atona, that will distill the elements of traditional Japanese ryokans — including healthful hot springs — while adding some modern comforts.

- Accor, seeing potential in what it calls “well-being culture,” will quadruple the number of Rixos Hotels to 100 by 2027. Rixos is an all-inclusive brand that includes wellness offerings.

- Hilton has since October installed Peloton Bikes in gyms at its hotels in the U.S. and Europe.

- Equinox, the high-end gym brand, has one branded hotel in New York City with plans to expand.

- IHG (InterContinental Hotels Group) has been refreshing its Even brand of “wellness lifestyle hotels.”

- In May, 1 Hotel Hanalei Bay debuted 1x Vitahealth Medi Spa, offering an integrated medicine program powered by a medical team on Kauai’s North Shore in Princeville, Hawaii.

The tricky challenge is how hotels that just want to add a minor wellness component can do so profitably long-term.

- The report's data broadly suggests across all measures that dabbling in wellness, as opposed to having major investments (where, say, 10% of your revenue comes from a spa) is harder to do properly.

- An extensive wellness offering typically translates into higher occupancy, higher average daily revenue gains, and higher profit (because of cost efficiencies in handling the labor component of delivery), according to the data.

- But minor investments that are well executed can thrive.

- For hotels with a minor wellness offering, gross operating profits as a percentage of total revenue averaged 30% last year versus 25% at hotels with major wellness offerings, even though both had comparable departmental expenses. A slight reduction in labor expenses at minor wellness properties helped.

- "On these ratios, minor wellness indicates potentially better cash returns," said Roger Allen, Group CEO of RLA Global.

- For midscale city properties, for example, it may be effective to pair up with providers of local community classes outside of the hotel, which you co-market to guests. That's an example of providing incremental income and satisfying a growing consumer demand without installing large infrastructure. Similarly, adding connected fitness equipment, such as Peloton bikes, to a gym might bring incremental gains.

- "Particularly at the development and planning stage, investors need to give serious consideration to the overall wellness proposition and be sure they're measuring the impacts on the profitability of different options correctly," Davis said. Profit measures can be tricky. If a large spa boosts occupancy in a hotel overall, how do you attribute that gain properly on profit and loss sheets?

The report is free to download, here. Its findings dovetail with other estimates of the sector.

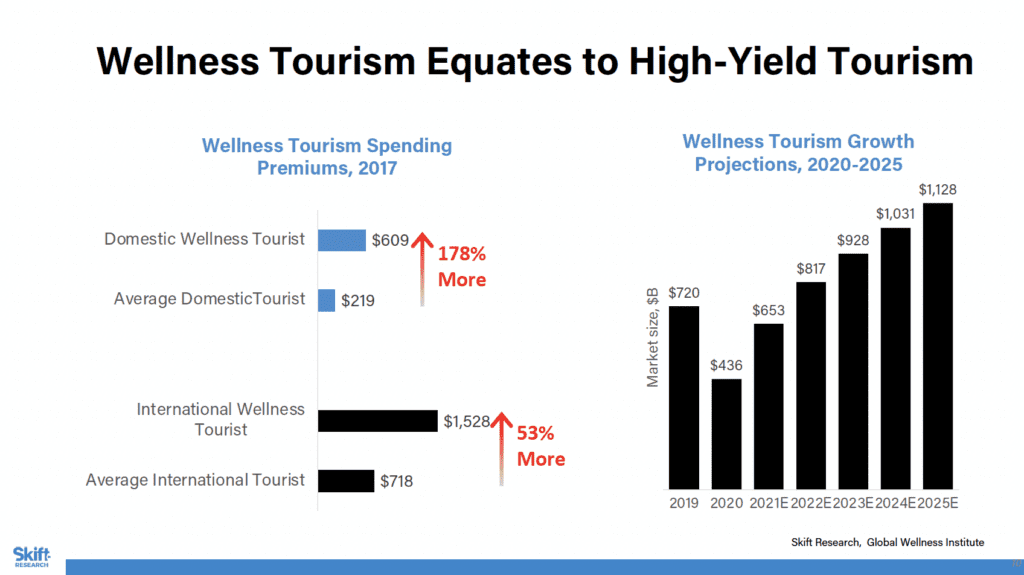

- As Skift Research highlighted in a presentation in January, data from the Global Wellness Institute suggests an upward trend in wellness tourism growth in the next couple of years.

I always read tips and feedback. Contact me at so@skift.com or through my LinkedIn profile.