Skift Take

Chase is doubling down on travel as an aspirational commerce category for its customers, with giant numbers to back up its ambitions. Expect some more travel M&A by these banks.

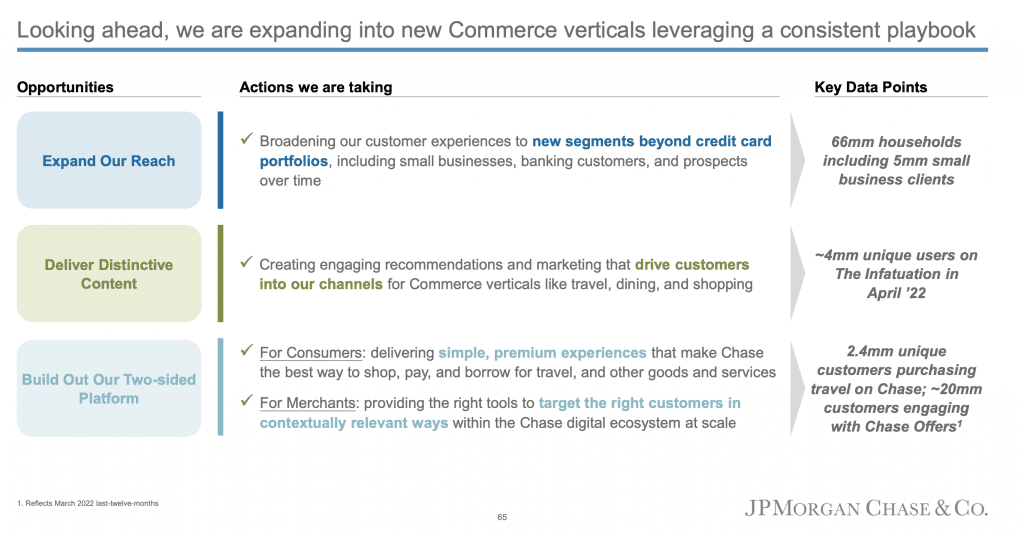

Chase is planning to launch ChaseTravel.com later this year as a consumer portal for its cardholders and its bank customers, a total of 66 million U.S. households, in a big upgrade on its ambitions in the travel sector.

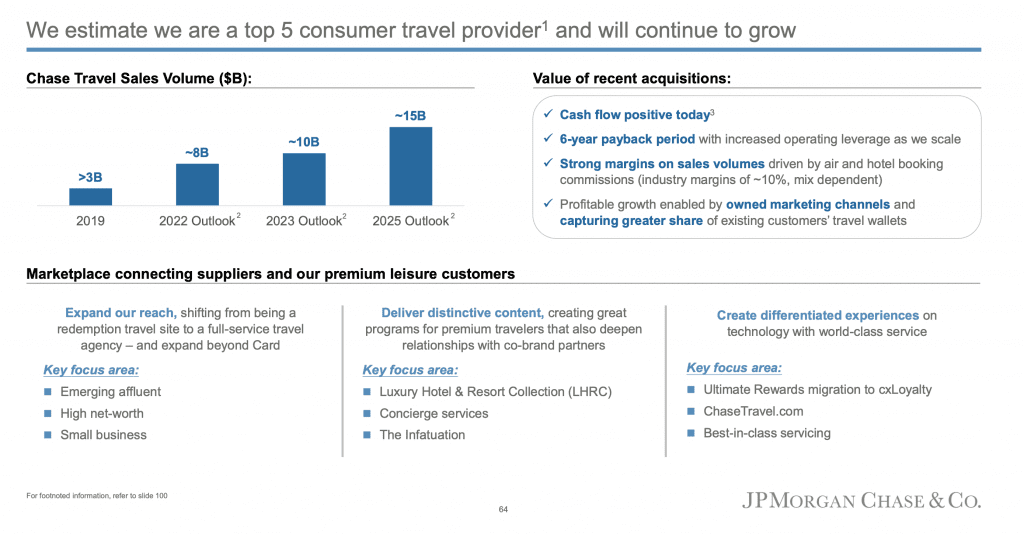

It is also disclosing details on the size of its travel business for the first time: it expects to reach about $8 billion in sales volume this year and aiming for $15 billion by 2025. It also said that in terms of U.S> leisure travel, $1 in every $4 spent is on a Chase Card, and $1 in every $3 spent is by a Chase customer. It also disclosed that it has now identified and plans to launch eight airport Chase Sapphire Lounges, up from its previously disclosed four.

All of these details were disclosed at parent company JPMorgan Chase’s annual 2022 investor day earlier in May, buried inside hundreds of slide presentations and presented by Marianne Lake, co-CEO of consumer and community banking at JPMC on the investor day.

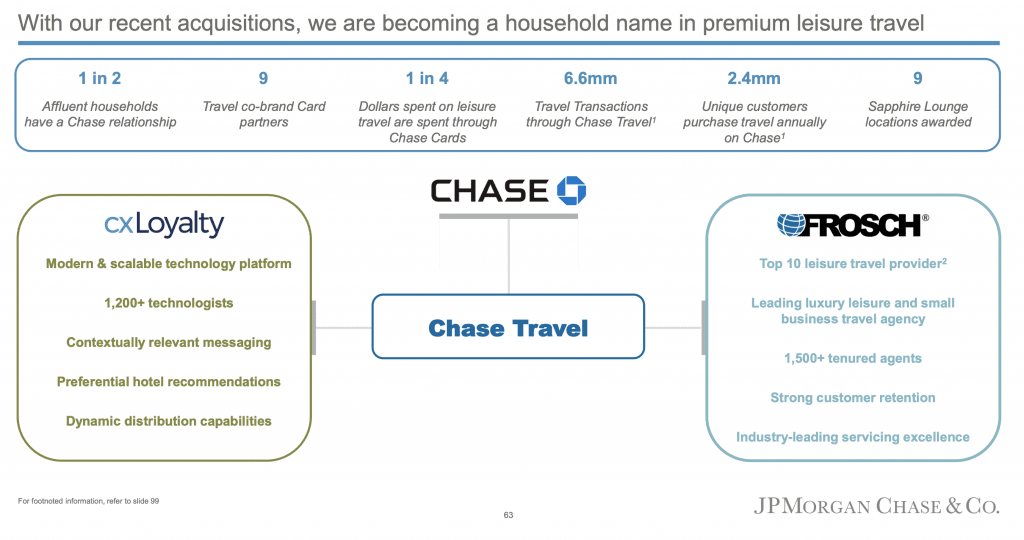

According to Lake: “We saw an opportunity during the pandemic to own our own destiny in travel, and we acquired cxLoyalty, a proprietary, two-sided travel platform, and Frosch, itself a top ten leisure travel agency, providing us now with the booking engine, the content, the servicing excellence and the concierge capabilities that our customers should expect. And today, we estimate we are a top five U.S. consumer travel provider. “

This move to supersize its ambitions in travel and control its own destiny — vs. banks and credit card companies that typically work with third party travel agencies — comes on the backs of its acquisitions over the pandemic of travel loyalty and rewards services provider cxLoyalty and corporate and luxury travel agency Frosch. Chase has already migrated over its cardholders who use its rewards platform Ultimate Rewards to the cxLoyalty platform and as a result ditched Expedia as its sole travel provider.

It also comes as its financial competitor Capital One also leaned heavily into travel during the pandemic with its acquisition of companies such as Freebird, Lola and invested in Hopper, and recently relaunched its travel site powered by Hopper. Another competitor U.S. Bancorp bought Will Smith-backed travel platform TravelBank for $200 million in November last year.

From the JPMC investor day presentation, these three slides below map out the state of its current business in travel, along with its expansion plans.

From the presentation transcript, the description as presented on the investor day, worth extracting in full:

“Travel has been the center of gravity for our Ultimate Rewards program for a decade, and remains the most aspirational lifestyle category for many of our customers. And we partner with some of the most admired brands in the travel industry. Travel is at the center of our card business.

“In terms of U.S. leisure travel, $1 in every $4 spent is on a Chase Card, and $1 in every $3 spent is by a Chase customer. And the stats for dining are quite similar. But only a small percentage of this spend went through our platform because our assets were not differentiated. But despite that, in 2019, we were already a top 15 travel provider.

“We saw an opportunity during the pandemic to own our own destiny in travel, and we acquired cxLoyalty, a proprietary, two-sided travel platform, and Frosch, itself a top ten leisure travel agency, providing us now with the booking engine, the content, the servicing excellence and the concierge capabilities that our customers should expect. And today, we estimate we are a top five US consumer travel provider.

“So, a moment on the business case. Along with controlling the customer experience, which is everything, we now have full ownership economics. We have all of the travel commissions. We will be at scale and cross $10 billion of travel volume on the platform next year, with strong underlying growth. And a point of reference, the pre-pandemic Ultimate Rewards growth rate was a 26% two-year CAGR. And obviously assuming a continued benign environment, we would expect to reach $15 billion of volume by 2025 if not before.

“Our travel business is cash flow positive today. The acquisitions pay back within six years on strong revenue margins. And for context here, industry commissions mix dependent are about 10%. And now we’re getting all of that, whereas previously we were not. The business will require little marketing expense as we leverage our existing customers and channels reinforced by our loyalty program Ultimate Rewards. And so, the net of all of that, we expect a net margin of about 5% plus or minus.

And the strategy, we will launch ChaseTravel.com with Card customers later this year and then we’re going to open it up to all of our Chase customers. We will deliver distinctive content and experiences and become a full-service travel agency to our small business and premium leisure travelers. And we will introduce those important customers to our strategic partners, and so the flywheel begins. So, let me bring this to life through our evolving super app and ChaseTravel.com.

“So, looking forward here we have 66 million US households, including 5 million small business customers. And now we have 4 million Infatuation dining enthusiasts. We’ve got industry-leading products, unmatched first party data and a two-sided commerce platform. And our strategy is to expose distinctive content to our broad customer base, making Chase the best way to shop, pay and borrow. Starting, as I said, with travel and introducing our customers to key merchants within our platform at scale.”

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: chase, credit cards, jp morgan chase