U.S. Airline Revenue Growth Will Slow in 2019: New Skift Research Estimates

Skift Take

Executives, investors, and marketers alike seeking to understand the business of travel first need to establish a baseline of information to work from. How big is the market and is it growing? Who are the big players, what are their products, and what operational metrics are they benchmarked against?

To answer these questions with a single source of data, Skift Research is launching its own series of travel market estimates.

Our inaugural report, U.S. Airline Sector: Skift Research Estimates 2019, provides proprietary estimates for the U.S. passenger airline sector. It is based on our analysis of multiple sources, including the U.S. Department of Transportation, the Census Bureau, and individual company securities filings.

Preview and Buy the Full Report

Market Overview and Forecast

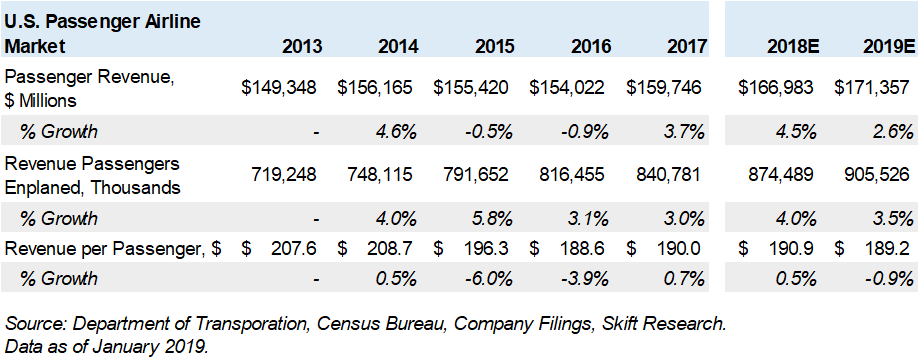

As we close the books on 2018, U.S. passenger airlines are set to report another year of robust revenue growth. We expect the U.S. industry generated just shy of $167 billion in revenues from transporting passengers in 2018, including ticket prices and ancillary sales, up 4.5% from 2017. This increase should come from both gains in air passenger volumes and in revenue per passenger.

Looking forward into 2019, we expect that revenue will continue to grow to $171.4 billion, though the pace will slow somewhat to a 2.6% growth rate. This third consecutive year of passenger revenue growth should be a relief to the industry after it saw sales decline in both 2015 and 2016, due to challenges at the big three carriers — American Airlines, Delta Air Lines, and United Airlines.

U.S. Passenger Airline Market Estimates, 2013-2019

Skift Research’s estimate and forecast for passenger revenue includes all sales collected from scheduled ticket sales, ancillary product sales, baggage fees, reservation change/cancellation fees, and private passenger charters. Our estimate is based on analysis of data from multiple sources, including the Department of Transportation, the Census Bureau, and individual company securities filings.

In developing our 2019 market forecast, we created independent estimates for passengers enplaned (volume) and for revenue per passenger (pricing), which were combined to derive our final market size figures.

Echoing what we expressed in our 2019 travel economic outlook for a “steady-as-she-goes” growth environment led by a healthy U.S. consumer market, we expect upbeat passenger demand in 2019. Skift Research models that more than 905 million passengers will fly on U.S. airlines in 2019, up 3.5% from last year.

In contrast, the revenue-per-passenger time series is more volatile. Revenue per passenger is a function of ticket prices and airlines’ ability to upsell ancillary items, offset by customers flying for free on loyalty redemptions. Factors driving prices include industry-wide seat capacity, competition along specific routes, and jet fuel prices.

Overall, when taking into account intense low-cost and ultra-low-cost competition, new routes/capacity, and cheaper jet fuel, our initial estimate is for an industry-wide decline in revenue per passenger of -0.9% in 2019. We expect that this decrease will be modest and more than offset by volume gains.

Combining our 3.5% passenger growth with our -0.9% revenue-per-passenger figures, yields our total market estimate for passenger revenue to grow 2.6% in 2019. In sum, we expect to see positive top-line growth for the U.S. passenger airline market in 2019.

Preview and Buy the Full Report

Subscribe now to Skift Research Reports

This is the latest in a series of research reports, analyst sessions, and data sheets aimed at analyzing the fault lines of disruption in travel. These reports are intended for the busy travel industry decision-maker. Tap into the opinions and insights of our seasoned network of staffers and contributors. Over 200 hours of desk research, data collection, and/or analysis goes into each report.

After you subscribe, you will gain access to our entire vault of reports, analyst sessions, and data sheets conducted on topics ranging from technology to marketing strategy to deep-dives on key travel brands. Reports are available online in a responsive design format, or you can also buy each report a la carte at a higher price.