SeaWorld Has a New Ad Campaign to Make People Like It Again

Skift Take

For his company’s latest quarter, SeaWorld Entertainment CEO Joel Manby had some underwhelming words of reassurance: “Absent the significant weather impact from the hurricanes, company-wide our underlying results were largely what we expected them to be.”

The problem is that the company already reduced its full-year earnings expectations in the second quarter. And thanks to the impact from hurricanes Harvey and Irma — combined with existing public perception issues and competition from bigger rivals — SeaWorld couldn’t even meet that lower bar.

Attendance fell by 732,000 in the quarter that ended September 30, with the biggest drops coming at the SeaWorld parks in San Diego and Orlando. The company has 12 parks and its brands include SeaWorld, Busch Gardens, and Sesame Place. During the quarter, attendance from the UK was down 28 percent year-over-year and visitor numbers from Latin America fell 11 percent.

Revenue dropped 10 percent to nearly $438 million, while profits fell from more than $65 million in the third quarter of last year to $55 million this year.

Chief Financial Officer Mark Swanson said during a quarterly earnings call Tuesday that the combined impact of weather events in the third quarter resulted in 26 days of park closures. The financial hit was $7 million of adjusted earnings before interest, taxes, depreciation, and amortization.

But Manby said business has picked up since late September, with more crowds coming out to participate in Halloween events. And he said he was confident that a new public relations and marketing plan would be successful going into 2018; in August, he told analysts that the company realized it needed to spend more on advertising.

“We recognized that we must continue to maintain sufficient awareness and share of voice in the national marketplace to highlight our exciting new rides and attractions, as well as a positive inspirational message about the SeaWorld brand itself,” Manby told analysts during the call.

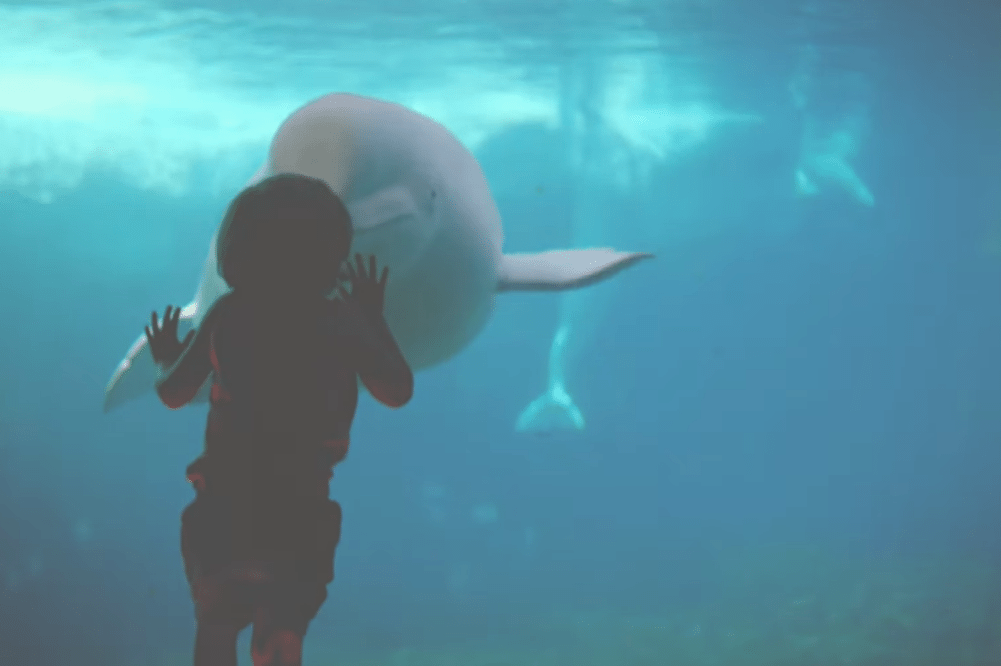

The result is a campaign called “From Park to Planet” that emphasizes the company’s animal rescue and conservation efforts. SeaWorld has long been criticized by animal rights groups for its treatment of captive orcas, and sentiment turned widely negative after the release of the documentary Blackfish in 2013. The company has since ended its orca breeding program and started to switch its killer whale shows to more natural exhibits.

A roughly 90-second commercial, embedded below, covers a lot of territory. It shows sea creatures in the wild being helped by park staff, people enjoying the ocean, roller coasters, and visitors looking at orcas in a parks.

The voiceover highlights the company’s love for the ocean and its big “but not impossible” mission. The ad ends: “From park to planet — see it here, save it there.”

Manby said the ad got a soft launch in San Diego in October and has led to good results. When people watch that ad following by one focusing just on attractions, the conversion rate to buy a ticket on the company’s website is six times higher than if they just watched an ad about attractions, he said.

“Based on this success, we will launch a nationwide fully integrated PR advertising and park activation plan in the first quarter of 2018, ahead of spring break and summer vacation planning,” Manby said.

He did not say how much SeaWorld would pay for the new campaign. But the company has a program in place to save $40 million by the end of next year, and found another potential $25 million to cut. That included the elimination of 350 positions last month.

“We expect to redeploy some of these cost savings into initiatives that drive revenue growth and to offset the cost of increased marketing activity in 2018 without increasing overall expenses,” Manby said.

SeaWorld is still spending on new attractions, but less than it did a couple years ago. Capital spending is expected to be about $165 million to $175 million a year instead of $190 to $200 million.

“Big picture, we have accelerated and pulled forward capital into the SeaWorld Parks,” Manby said. “So, you can anticipate consistent investments in those parks until we turn around, which we feel we are doing and will do in 2018.”

He highlighted Infinity Falls, a raft ride opening next year.

“It’s a huge water attraction, which the park doesn’t have,” Manby said. “It’s kind of a bread and butter need in that park, but it has incredible marketing hooks, tallest drop in the world of any family raft ride, level-four rapids.”

Manby said he was inspired by the buoyancy of the Texas market, where he said SeaWorld San Antonio attendance and earnings will be up this year.

“The good news is we’ve proven in 2017 we can turn a SeaWorld Park in a positive direction,” he said. “So, with a good product, well-marketed, we’ve proven we can do it in Texas. And we intend with all of our effort and all of our energy to turn the other two SeaWorld Parks [in Orlando and San Diego] around. And once we show growth in 2018, it’s really clear that the stock is undervalued in our mind, and we’re going to grow attendance, and we’re going to grow revenue.”

Executives were less chatty about rumors that surfaced last month suggesting UK-baesd Merlin Entertainments was interested in acquiring some of SeaWorld’s assets.

“I actually don’t think you’re going to answer this,” Stifel analyst Steven Wieczynski said. “But obviously, there’s been a lot of rumors out there about potential asset sales and things like that with your company. Is there any color you can kind of give us around that, or the way you view certain assets under your umbrella?

Manby said he wouldn’t “speculate on rumors or comment on speculations.” But he also didn’t rule out the possibility.

“All I can tell you is this board is very engaged and over time we have always looked at opportunities both on the buy side and the sell side, and we always do that as a matter of order,” he said. “And so you can be assured that this is a very strong board, very engaged board. We would handle anything like that in a way that maximizes shareholder value.”

[youtube https://www.youtube.com/watch?v=kupi0IfUbJI]