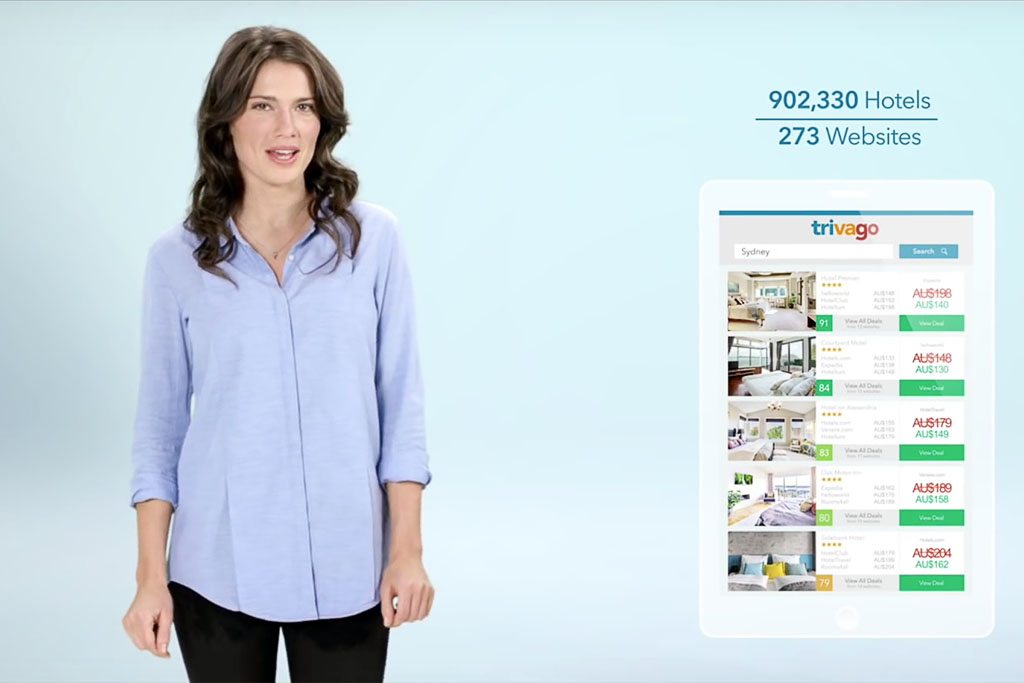

Trivago Concedes It Overspent on Advertising and Lowers Forecasts

Skift Take

A revenue shortfall tied to the way Trivago works with advertisers kicked in faster than expected, and the hotel-search site, known for its omnipresent TV advertising, didn’t tamp down its commercials fast enough.

That led Trivago Wednesday to revise downward its forecast for revenue and profit for the second half of the year.

At the end of July, the Düsseldorf-based hotel search giant had been confident its 2017 revenue growth would be 50 percent higher than its 2016 revenue. Today, it lowered that expectation to be only 40 percent higher than anticipated.

Investors responded by swiping a fourth off the value of the company — erasing nearly all of the gains of this year — in early morning trading. [UPDATE: By New York’s market close, it had regained some ground and lost only 16 percent from the day before.]

While the new forecast of a 40 percent year-over-year revenue growth would still be impressive for most companies, investors were disappointed that the forecasted earnings before income, taxes, depreciation, and amortization in 2017 would be lower than in 2016.

In other words, Trivago’s paltry 2016 profits — as it emphasizes growth over profits — would be higher than in 2017.

The public company, controlled by Expedia, issued a statement that it was revising its guidance for investors based on several factors.

In short, it appears that the German hotel search company revised its earnings guidance in the tail end of the third quarter for reasons that are specific to how it sources traffic — and not because of a falloff in travel demand more generically.

That suggests that the impact to Expedia, which has a controlling stake in Germany-based Trivago, should be minimal. Analysts at investment bank Raymond James say the impact to Expedia’s Expedia’s 2017 revenue will likely be small — around 1 percent. (Expedia purchased a 61.6 percent share of Trivago for $632 million in 2012, before Trivago went public in late 2016.)

A Priceline Sucker Punch?

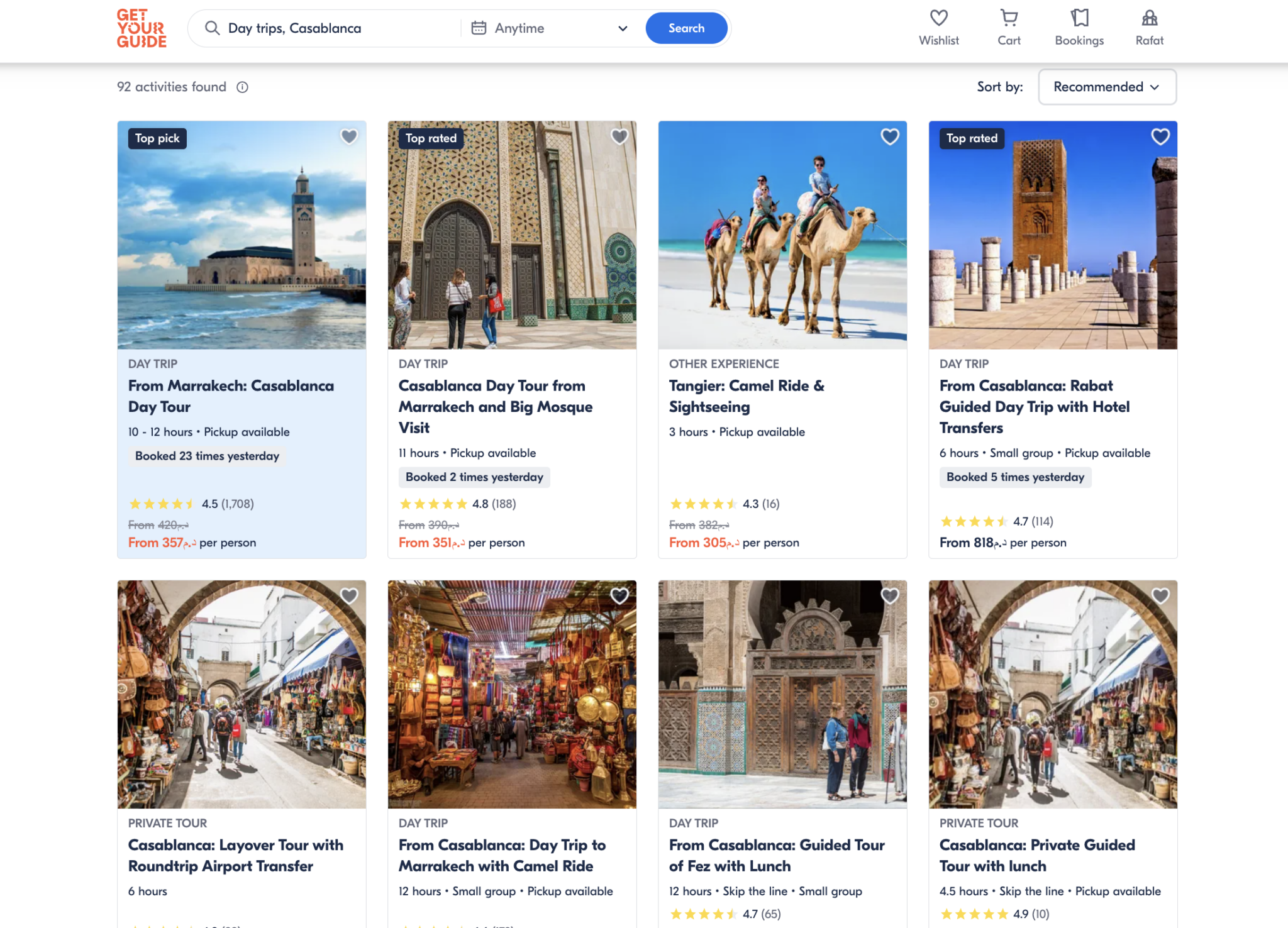

Here’s a quick look at the company’s business model: Trivago offers consumers rates from various hotels and online travel agencies and then charges advertisers for each click as a referral fee. The company tracks a key metric of revenue per qualified referral, which it hopes will rise over time.

In July, CFO Axel Hefer said Trivago had changed the way it acquires customers online to favor a method that brings in people who are more likely to book a trip. Hefer had warned on an earnings call then that the change would slow its growth in referrals at first. But he said that, over time, the change would boost the revenue earned for each so-called qualified referral.

Today, the company said that the short-term drop in revenue has been more significant than the company expected.

It took awhile for Trivago to pull back on its TV brand advertising in a near proportional way to keep its costs in line. So the company said it overspent for late summer. But the company does expect that the return it gets on advertising spending would revert to its previous levels “over time.”

To get into the details, in late 2016 Trivago rolled out so-called relevance assessments, or surveys that ask users if they’re happy with the site they click off to after leaving the search engine. Trivago required some advertisers that received poor ratings from users to place higher cost-per-click bids in the marketplace. This spring, many companies were spending more for the same number of leads as they had before.

By this summer, Trivago said the vast majority of the company’s largest advertisers improved their user experience. That resulted in a decline in the bidding that had inflated growth in the first half of the year.

Axel Hefer explained to Skift: “By improving the user experience on their websites, advertisers could improve their relevance assessment score. As a result, they were able to improve their position in the marketplace and as a consequence reduce their bids to attract the same traffic as before. This has led to a reduction of the revenue per qualified referral”.

The degree of that decline caught Trivago’s executives by surprise. Without the additional fees, Trivago has had less cash to use for bidding on keywords in Google search, which, in turn, reduces the traffic it gets from Google — compounding an overall revenue decline.

Why did the executives get surprised by the magnitude of the decline? As a logic puzzle, here’s one theory. Last year, 79 percent of Trivago’s revenue came through only two conglomerates, Expedia Inc., and Priceline Group. Hefer said on Wednesday that one of the two largest advertisers was affected by the policy change.

Let’s say it’s unlikely that Trivago would force its parent owner Expedia to have to pay higher-than-expected bids or to say the company’s user experience is poor. Priceline — which accounted for 43 percent of Trivago’s total revenue in 2016 — may have gotten hit in the first half of the year by Trivago’s policy change.

Fast forward to this summer: Maybe Priceline found a way to retaliate.

Priceline had no comment by publication time. In any event, it is odd that Trivago executives were surprised and also odd that they’re still not fully sure what happened.

Speaking to investment bank analysts in New York Wednesday morning at Citi’s 2017 Global Technology Conference, Hefer said: “The impact of the adjustment was greater than we anticipated. For us, it is not that easy for us to see whether that’s because we underestimated the impact. It’s a marketplace. We’re seeing billions of individual auctions. Has there been, on top of that, an adjustment in profitability? We don’t have full visibility on that.”

Trivago’s downward revision in revenue is mostly related to how it sources traffic. But its downward revision in its profit forecast is related to summer 2017 demand not being as high as summer 2016 — something executives hadn’t anticipated.

Related to that, travel industry executives and investors in the U.S. and Europe are cautious about the choppy American and European travel environment.

For the UK market, Trivago said today that it no longer thinks the British pound’s weakness relative to the euro is temporary. For forecasts, it will factor in the pound as being in a “permanently” weakened state — at least as far as currency projections go during the next year or so of Brexit negotiations.