Deutsche Bank Analyst Doesn’t Understand the Sharing Economy and Booking Sites

Skift Take

The sharing economy will put a bigger hurt on Booking.com than Expedia.

That’s the questionable view espoused by Deutsche Bank analyst Lloyd Walmsley, who several days ago downgraded Booking.com’s parent, the Priceline Group, to “hold” from “buy,” and upgraded Expedia Inc.’s stock to “buy” from “hold,” according to published reports.

There were numerous reasons for the disparate ratings, including the concern that the Priceline Group may have topped out on its upside and that Expedia Inc. would make strides in its hotel business because of better monetization and its acquisitions spree.

But the opinion that the Priceline Group and its Booking.com unit would feel the wrath of Airbnb and its peers to a greater extent than Expedia doesn’t make sense — especially over the long term.

“We believe investors are underappreciating the risk that Airbnb eventually adds more professional hotel supply to its product offering,” said Walmsley, according to Investors.com. “Could Airbnb disrupt (Priceline’s) Booking.com with lower take-rates on long-tail inventory in ways similar to how Booking.com disrupted Expedia?

“With this new risk in mind, we put the vacation rental space — which we have followed closely through coverage of HomeAway — back under the microscope with a broader perspective on how Airbnb, in particular, could disrupt online travel agencies.”

Yes, the sharing economy is starting to disrupt online travel agencies as currently constituted. In fact, in its March 2015 report, Sharing Economy: An In-Depth Look Its Evolution & Trajectory Across Industries, Piper Jaffray Investment Research estimates that vacation rentals and apartment shares accounted for some 14 percent of the global hotel market in 2014, and from 2014 to 2025 vacation rentals would grow 8 percent and peer-to-peer rentals would climb around 27 percent.

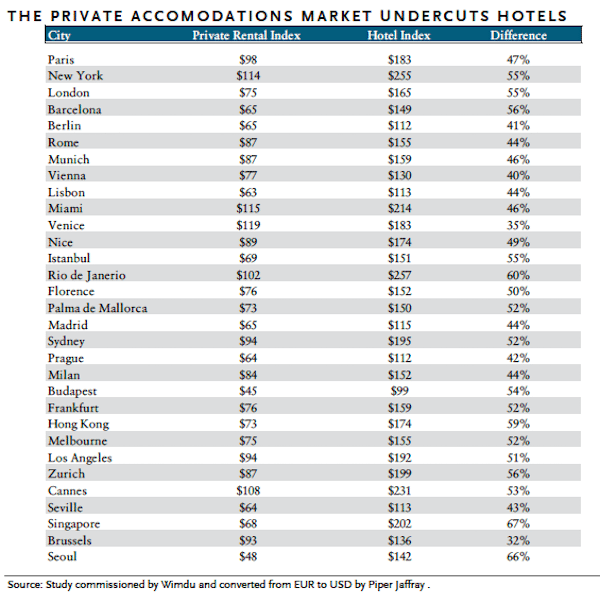

The hotel industry, particularly the limited-service to midscale sectors, is already losing business to the sharing economy, which is undercutting the traditional lodging industry on price as shown in the following Piper Jaffray chart:

The chart, which was commissioned by sharing company Wimdu, simply takes into account the average listing prices in these cities on websites of private rental companies, not what’s actually being booked. Airbnb’s site for New York City, for instance, has a high number of listings at low prices, yet they are largely of low quality and — if the number of user reviews are any indication — are not booked as often as more expensive, higher-quality listings.

“Primarily, we expect hotels to experience slowed growth as they lose share to Airbnb,” Piper Jaffray states. “According to a research report conducted by Boston University, in an observation of Texas hotels, for every 1% increase in Airbnb listings there was a corresponding 20bps decrease in annual hotel revenue; the hotels that were most affected were, unsurprisingly, hotels with low price points. We believe this confirms what many suspect, which is that Airbnb is already having a meaningful impact on hotels.”

But when it comes to the sharing economy’s negative impact on Booking.com versus Expedia, Walmsley of Deutsche Bank argues that Booking.com would take the harder hit because vacation rentals account for nearly one-third of its international bookings.

“Priceline has a strong lead in hotels, superior execution and an under-appreciated strategic play in BookingSuite. But our proprietary analysis of its vacation rental bookings shows this segment adding an estimated 9 percentage points of international bookings growth excluding foreign exchange rates, without which core bookings growth would have been an estimated 19% year-over year excluding foreign exchange rates in 4Q14 (vs headline +27% ex-FX),” the Deutsche Bank report noted, according to Benzinga.

In essence, Walmsley argues that Booking.com would face a bigger challenge than Expedia from the likes of Airbnb, HomeAway, Flipkey, Couchsurfing, 9flats, and others because Booking.com indeed has a sharing economy business in the form of the nearly 300,000 vacation rentals and apartment hotels it offers while Expedia Inc. currently is a no-show at scale. Expedia has a distribution partnership with HomeAway but hasn’t done much with it.

Over the long term it is doubtful that Expedia would be able to continue its growth pace without a viable toehold in the sharing economy.

What about all the revenue that Expedia is leaving on the table as potential customers increasingly look elsewhere because the online travel agency doesn’t have a wide array of vacation rental choices?

At least Booking.com is a player in vacation rentals and it is also trying to expand beyond its base of professionally managed properties and into vacation rental by owner. Expedia has been preoccupied with its acquisitions of Travelocity, Wotif, the AirAsia joint venture and Orbitz Worldwide (pending) and hasn’t yet made vacation rentals a priority.

Short-Sighted Gloom and Doom

All of the pangs about how the sharing economy will eat the online travel agencies’ lunch are short-sighted.

While Booking.com, Expedia and TripAdvisor, as public companies, have not dabbled in Airbnb-style peer-to-peer apartment rentals because of the inherent legal risks and, in some cases, fears about lower margins when compared with hotels, the big three booking sites aren’t static creatures.

They can mostly afford to sit back and see how the sharing economy shakes out before making acquisitions or otherwise building their own solutions. The Priceline Group, which received the downgrade from Deutsche Bank, ironically is the most advanced of the trio when it comes to the sharing economy.

If pundits are writing obituaries for the online travel agencies because of inroads from Airbnb and others just recall that the big metasearch companies years ago were viewed as an existential threat to the online travel agencies. The comparative shopping engines would provide a way for airlines to bypass the online travel agencies altogether, the doomsday arguments went.

Eventually the Priceline Group and Expedia Inc. just went out and acquired leading metasearch companies, including Kayak and Trivago, respectively. TripAdvisor built its own solution.

Airbnb, with its $24 billion valuation, is likely too big for the online travel agencies to acquire — even if they had the appetite for such a buy — but there will be other ways for the online travel agencies to maneuver into the sharing economy in a bigger way when the time comes.