TripAdvisor’s New Program Launch Will Bring In Small Hotels Like Never Before

Skift Take

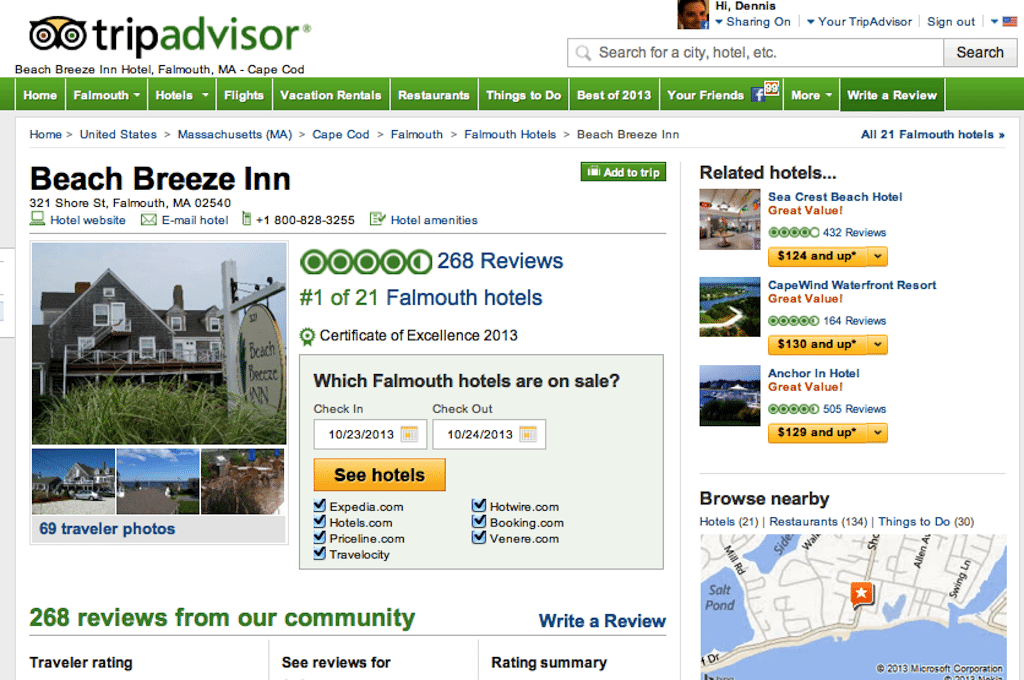

Booking.com, with its 354,000 hotels, has the largest collection of properties among booking sites, but TripAdvisor has launched a new program, TripConnect, that may enable it to attract a swath of small hotels, B&Bs and inns that even Booking.com hasn’t reached.

With TripConnect, independent hotels that are subscribers to TripAdvisor’s Business Listings and who work with one or several of 300-500 participating Internet booking engines, including Sabre Hospitality, Pegasus Solutions’ Open Hospitality, TravelClick’s iHotelier, will be able to enroll and use a self-service TripAdvisor auction platform modeled after Google AdWords, Facebook and LinkedIn to place their bids and participate in TripAdvisor’s hotel metasearch, with the ability to change their bids every 24 hours.

Independent hotels won’t have the money that large online travel agencies and hotel chains will bring to TripAdvisor’s hotel metasearch, but perhaps the smaller properties will get a little more flexibility than the larger players by using the auction platform.

The independent hotels can use the auction platform to set a daily cap or maximum budget, and they can view a forecast number of clicks and click-through rates based on their bids, which might range from $2.20 on a desktop to $0.70 on mobile, depending on the market, position or other circumstances, for example.

The rollout of TripConnect is a big deal for TripAdvisor, the independent hotels, and competitors because it has the potential to bring on board a huge number of independent and smaller properties that have been mostly shut out of hotel metasearch.

Kayak works with some of these Internet booking engines to woo the participation of some independent hotels, but TripAdvisor appears to be doing it on a much larger scale.

“We have never been able to adequately address the needs of the long-tail provider,” TripAdvisor CEO Stephen Kaufer tells Skift. “Can I participate in your Check Rates or your meta offering? The answer was no, you can’t.”

“In the matter of a few short months, we think that most properties will be able to connect and have their best pricing and availability appear next to all the big guys,” Kaufer says. “That opens the door to additional relationships, from TripAdvisor’s perspective, to additional relationships with hundreds of thousands of hoteliers and lodging providers.”

There are 50,000 hotels worldwide that currently subscribe to TripAdvisor’s Business Listings, and many more that work with Internet booking engines may sign on so they can participate in TripAdvisor metasearch.

Programs of this type are something that B&Bs, inns and independent hotels have sought for years to enable direct bookings.

Whether it is airlines, hotels, car rental companies, cruise lines, global distribution systems or online travel agencies, the travel industry grapples with the hangover of trying to make things work optimally when they have to drag legacy systems, in technology or otherwise, along for the ride.

People at HotelTonight, for example, will tell you how much easier it was to build a same-day hotel booking app from scratch a couple of years ago than it was for Priceline to construct a copycat app that is saddled with requiring users to go through dozens of more clicks than the HotelTonight app to book a room because Priceline needed to tie-in with existing, legacy systems.

Enter TripAdvisor, which today began rolling out the new global platform, TripConnect, that will enable independent hotels, B&Bs and inns to participate and compete in TripAdvisor’s new hotel metasearch, officially called Hotel Price Comparison, for the first time.

TripConnect will give these smaller, independent hotels something that Expedia, Booking.com, Travelocity, Marriott, Hilton, and InterContinental don’t have when participating in TripAdvisor hotel metasearch — a self-service cost-per-click advertising plaform.

It’s a dirty little secret in metasearch that most of the major players don’t offer their OTA and hotel customers auction platforms, such as Google AdWords, when they want to bid for positions.

For example, the OTAs and hotel chains using TripAdvisor for hotel metasearch can change their bids every 24 hours, but they must do so through their human account managers.

Jean-Charles Lacoste, TripAdvisor’s vice president of direct-connect solutions who heads up the rollout of TripConnect, points out that there are advantages of using account managers for hotel chains with hundreds or thousands of properties because of the complexities of the proposition.

Others would say, however, that the lack of a self-service auction platform for these big players is in part, at least, a legacy issue that brings some inefficiencies.

Will they be able to outbid the big chains? Perhaps tactically in some markets or at times for some properties where the competition isn’t that important to the larger hotels.

But, Lacoste points out that the independent hotels and B&Bs will have an advantage at some junctures when they show availability, and the larger hotels are “sold out.”

There is also demand in its own right for smaller hotels for travelers who want to avoid the big chains and that whole experience, Lacoste says.

“It’s a unique way we can use technology to level the travel accommodation landscape, placing small and independent properties on an equal footing with large hotels and online travel agencies,” Lacoste says.

That may be a bit of an overstatement. The playing field won’t be level, but at least TripAdvisor’s auction platform, a new product largely unencumbered by legacy issues, will give independent hotels and B&Bs an advantageous new weapon.

And, many of TripAdvisor’s account managers likely aren’t happy about the whole thing.