Skift Take

Advertising in travel metasearch used to be near the top of the list for online travel agencies and hotels. But then along came Google Hotels, YouTube, and TikTok, as well as hotel and online travel agency loyalty programs to deflate the value proposition.

Travel metasearch companies used to be among the hottest things in travel. They enabled consumers to compare hotel or flight prices from multiple vendors at a glance, and many online travel agencies saw the need to acquire one.

In 2012, Booking Holdings (then called the Priceline Group) announced a deal to acquire Kayak and Expedia took a majority stake in Trivago.

In 2016, China’s Ctrip (now called Trip.com Group) agreed to acquire Scotland’s Skyscanner. “We could see their [Skyscanner’s] tremendous growth” in selling airline tickets in Asia, Trip.com Group CEO Jane Jie Sun told Skift at the time. “When the opportunity comes, we move very fast.”

As a rule, metasearch sites don’t sell the majority of the airline tickets or hotel stays on their sites – travelers click over to online travel agencies, hotels or airlines to book them.

A Struggling Metasearch Category?

But in recent years, the travel metasearch category, or at least some of its leading players, have struggled financially.

In a recent research note, Wells Fargo Securities wrote that it “remains cautious” about two public companies, Tripadvisor and Trivago. It “continues to see travel metasearch challenged as a category, while third party data indicate post-pandemic demand is normalizing.”

Let’s take Tripadvisor as an example. All would acknowledge that Google has eaten into Tripadvisor metasearch’s market share.

In 2023, Tripadvisor hotel metasearch, as captured in its Brand Tripadvisor segment, was still the largest part of Tripadvisor’s business. But its revenue grew just 7% in 2023, compared with 49% growth at Tripadvisor’s Viator tours and activities segment. Brand Tripadvisor, of which hotel metasearch is the largest portion, saw its EBITDA inch up just 1% to $348 million in 2023.

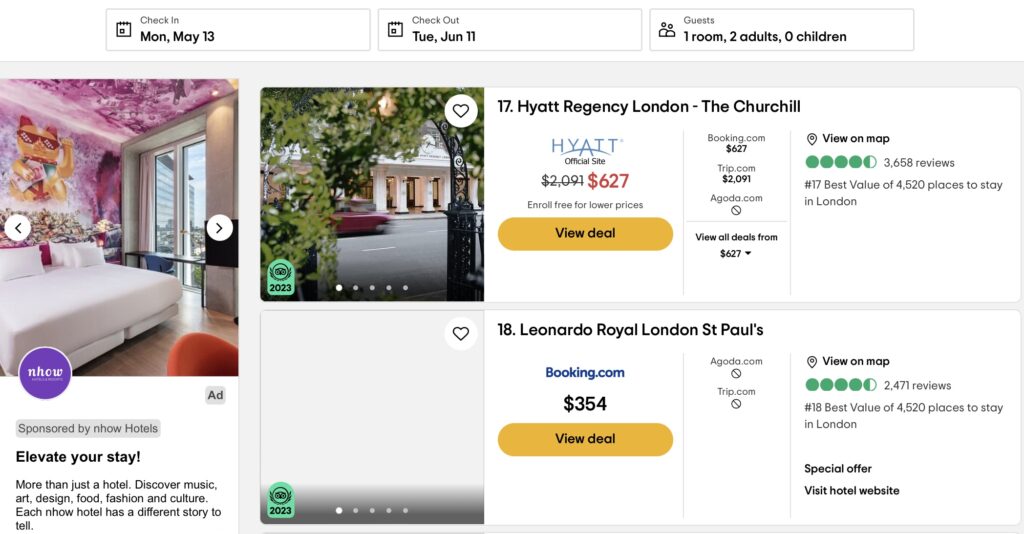

A screenshot of Tripadvisor hotel metasearch comparing rates from Hyatt, for example, with those on Booking.com, Trip.com, and Agoda. Source: Tripadvisor

For its part, Trivago notched a net loss of 164.5 million euros (about $176 million in the red) in 2023. On Monday, its shares were trading at less than $3.

The Google Factors and Other Reasons for Metasearch Struggles

In an email exchange, Wells Fargo Managing Director Brian Fitzgerald told Skift that heightened competition from Google Hotels and Flights, which attract users at the beginning of their travel searches, is a major factor weighing on Tripadvisor and Trivago.

Fitzgerald sees other issues, too.

Hotels have been able to attract more direct traffic through their loyalty programs: Many offer lower rates on their websites to loyalty program members than on metasearch sites such as Google, Tripadvisor, Kayak and Trivago.

Online travel agencies such as Booking.com and Expedia have their own loyalty programs, and have at times begun offering stiff discounts to attract their own direct traffic. This hurt metasearch platforms even if online travel agencies owned them.

“Almost everyone in the travel ecosystem came up with a loyalty program in one form or another and began pouring money into brand advertising to drive more direct traffic,” Fitzgerald said. “It was a gradual process. We can’t pinpoint a specific quarter when it all turned loose, but as a result, the life of the traditional travel metasearch platform became harder.”

In the early days of user reviews, Tripadvisor had a competitive advantage because it had so many and the online travel agencies had few, but they caught up, Fitzgerald said.

“The value prop of TRIP and travel meta was somewhat eroded,” he added.

Another factor is that online travel agencies have leaned into brand marketing campaigns, and there are so many other marketing platforms these days to choose from, ranging from YouTube to streaming platforms and TikTok.

Kayak CEO Steve Hafner’s View

Kayak co-founder and CEO Steve Hafner believes travelers still love comparison shopping for hotels and flights.

“The category is healthy,” Hafner said. “One player is gobbling all the growth. Google.”

Reacting to Fitzgerald’s comments, Hafner said Kayak indeed offers some hotel chains’ loyalty rates — when the chain gives Kayak permission to do so.

Hafner, though, agreed with Fitzgerald that online travel agencies’ discounting practices have impacted metasearch.

“The OTAs do discounting very well,” Hafner said. “So even Booking.com’s Genius rates are not available on Kayak.” Booking Holdings owns both Booking.com and Kayak.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: booking holdings, booking.com, expedia, google, kayak, loyalty, metasearch, online travel newsletter, skyscanner, trip.com group, tripadvisor, trivago

Photo credit: Mr Trivago ad 2023 showing hotel prices from different vendors. Source: Trivago