Skift Take

North and South America have been standout performers in leading the industry's capacity recovery post pandemic. While this was anticipated, there are noteworthy shifts in interregional capacity from North America to the Middle East, Africa and Asia.

Skift Research Insights

Get deeper insights into weekly news from the analyst team at Skift Research.

The Americas became the first region to recover to pre-pandemic capacity in the first half of 2023. Airline capacity, measured in Available Seat Miles (ASMs), is the number of passenger seats available on any given route, and while it does not take load factors (occupied seats) into consideration, it’s a good indicator of expected demand by airlines. Owing to a substantial intra-regional rebound in capacity, both North and South America have recovered to pre-pandemic levels.

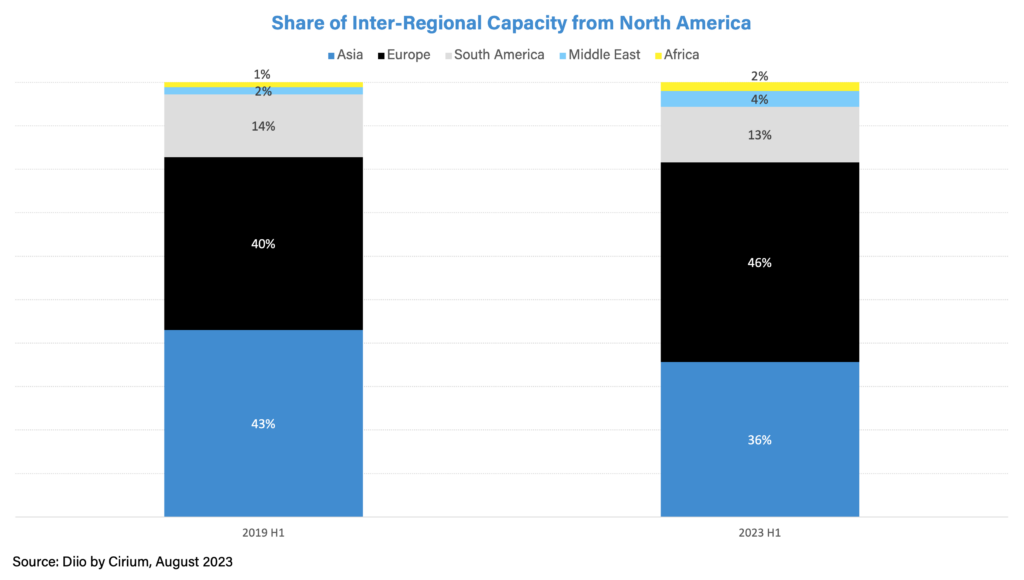

Beyond intra-regional travel, travel to other regions (interregional) from North America is yet to recover fully in the first half of 2023. The distribution, however, has shifted, with flights to and from the Middle East nearly doubling, routes to Africa increasing capacity by over 60%, and Europe seeing a nearly 5% increase from pre-covid levels. All of this comes at the expense of Asia, which has seen routes with North America recover the slowest.

Capacity Back to 2019 Levels

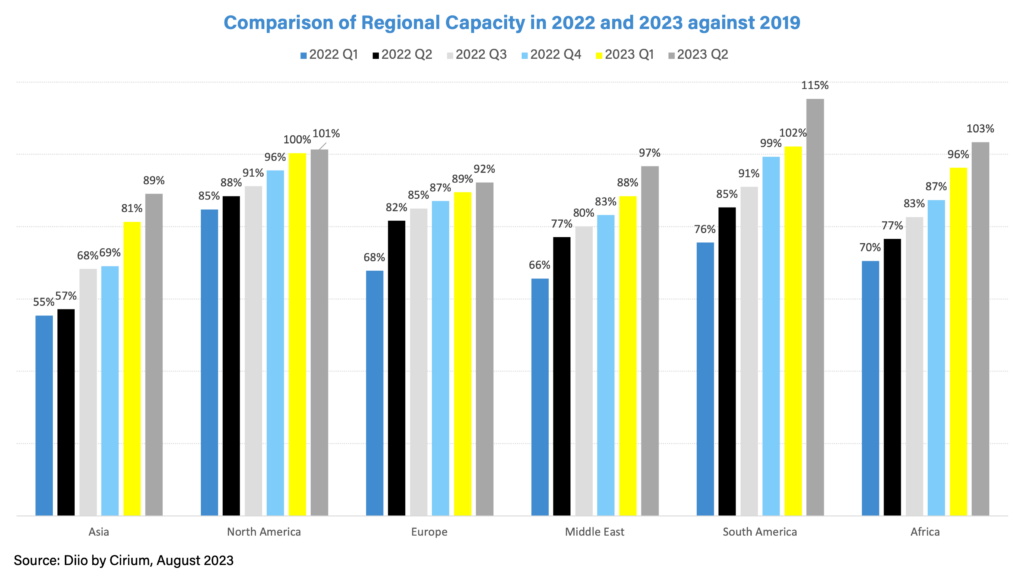

Quarterly capacity data from airline data provider Cirium, measured in Available Seat Miles (ASMs), shows that North and South America are leading the recovery. In the first half of 2023, North America reached 100% of its first-half 2019 capacity, and South America reached more than 108%. These are the only regions to have fully recovered, and even exceeded, capacity in the first half of 2023.

Africa, the Middle East, and Europe have all returned to more than 90% of their first half of 2019 capacity in 2023 so far, whereas Asia has only recovered to 85% of 2019 capacity.

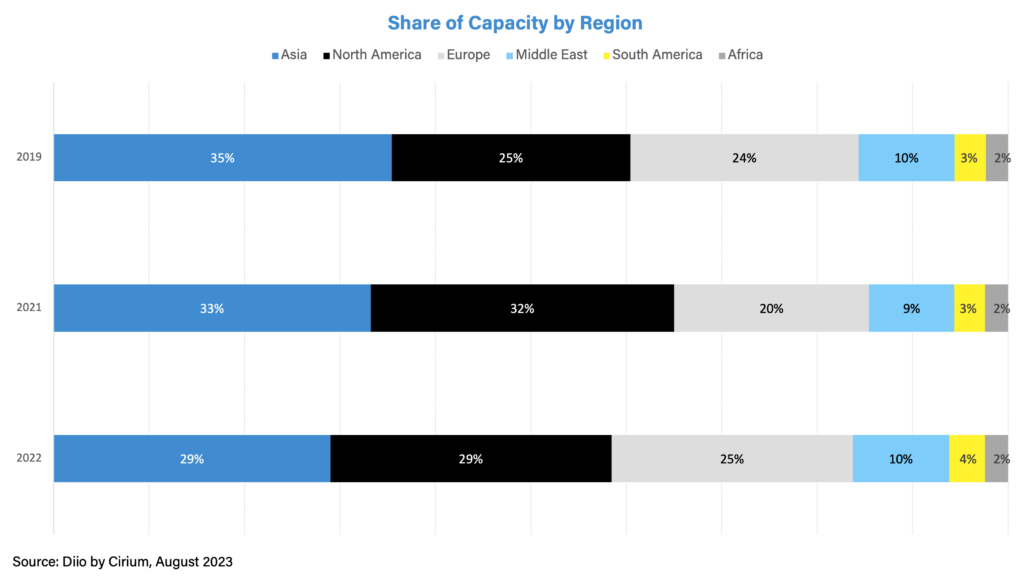

In terms of global capacity, Asia held close to 35% of the market in 2019, but a steady recovery in the Americas propelled it to become the largest aviation market in 2022, holding 29.4% of the market against Asia’s 29.0%

The Reshaping of Interregional Travel

North American airlines deploy nearly 84% of total capacity within the region, with the remainder deployed for interregional travel. And while the total intra-regional capacity has recovered, interregional capacity sits at 90% of pre-pandemic levels.

In 2023, interregional capacity from North America to Africa, Europe, and the Middle East surpassed pre-pandemic levels, but Asia and South America achieved less than 80%.

Prior to the pandemic, Europe contributed 40% of overall interregional capacity, but this has increased to 46% in 2023.

In the first half of 2023, the Middle East’s market share has nearly doubled from 2019. Africa, too, has increased significantly within the same time span, increasing its share to 2% from 1% prior to the pandemic.

South America, which accounted for 14% of total interregional capacity in 2019, has dropped to 13%, reaching nearly 80% of pre-pandemic capacity during the first half of 2023. North American carriers served just 37 South American cities in Q2 2023, a considerable decrease from the 81 cities served in Q2 2019.

Deeper Airline Insights From Skift Research

Updated Aug. 3, 2023

Asia, where North American carriers placed the most interregional capacity prior to the pandemic, has fallen behind Europe, dropping share from 43% to 36% with the overall capacity slightly under 72% in 2023 from 2019. The delayed recovery in Asia following the pandemic, particularly in Hong Kong and China, has had a significant impact on capacity. Japan, China, and Hong Kong, which together made up nearly 80% of Asia’s total capacity in 2019, had only recovered by 66% by June 2023, with China’s recovery barely at 10% and Hong Kong’s at under 30%.

That said, the reopening of China, the world’s second-largest air transport market, will improve global airline capacity considerably for the industry and, in particular, Asia. North American carriers have already increased the number of Asian destinations they serve in 2023 compared to 2019, and Asia is forecasted to grow capacity by nearly 50% year on year by the end of 2023.

All this sets the industry up for double-digit capacity growth in 2023 compared to 2022, with airlines predicted to steam past pre-pandemic capacity levels.

Ashab Rizvi is a research analyst at Skift Research. Subscribe to Skift Research to read more of his airline analysis.

Get Skift Research

Skift Research products provide deep analysis, data, and expert research on the companies and trends that are shaping the future of travel.

Have a confidential tip for Skift? Get in touch

Tags: coronavirus recovery, middle east, skift research, south america, usa

Photo credit: Aerial view of a plane at Newark International Airport in New Jersey. Chris Leipelt / Unsplash