Skift Take

In some ways, Expedia Group's potential narrowing of the take rate gap with Booking Holdings has a lot to do with Booking's strategic decisions — pushing more into the U.S. and expanding its lower-margin flights business.

The traditional knock on Expedia Group in its matchup against rival Booking Holdings is that Booking has been way more profitable. And Booking can take those profits, plow them back into marketing, and win more market share.

In a research report last week entitled, “EXPE 101: A Deep Dive on the Business, Industry & Model,” Jake Fuller and Kevin Dolan of BTIG argued that Expedia is on the cusp of narrowing that profit gap.

The report looks at the profit question in terms of EBITDA (earnings before interest, taxes, depreciation and amortization) margin. In 2022, Expedia’s EBITDA margin was 11.9% versus 31.3% at Booking Holdings. BTIG said Expedia is on track to boost its margin to more than 23% in the 2024 to 2025 timeframe.

The Commission, Geography and Product Factors

The primary factor in the gap between the two companies’ EBITDA margins, BTIG said, is their respective take rates, or commissions and fees per booking.

Looking at their respective take rates in pre-pandemic 2019, BTIG notes that Expedia’s was much lower than Booking’s (11% versus 16%), and BTIG attributed that to Expedia’s heavier U.S. focus, where hotel chain commissions are lower than in a more independent hotel-minded Europe, which is Booking.com’s core market. Booking.com is Booking Holdings’ largest business and its flagship brand. Other brands include Priceline.com, Kayak, Agoda and OpenTable.

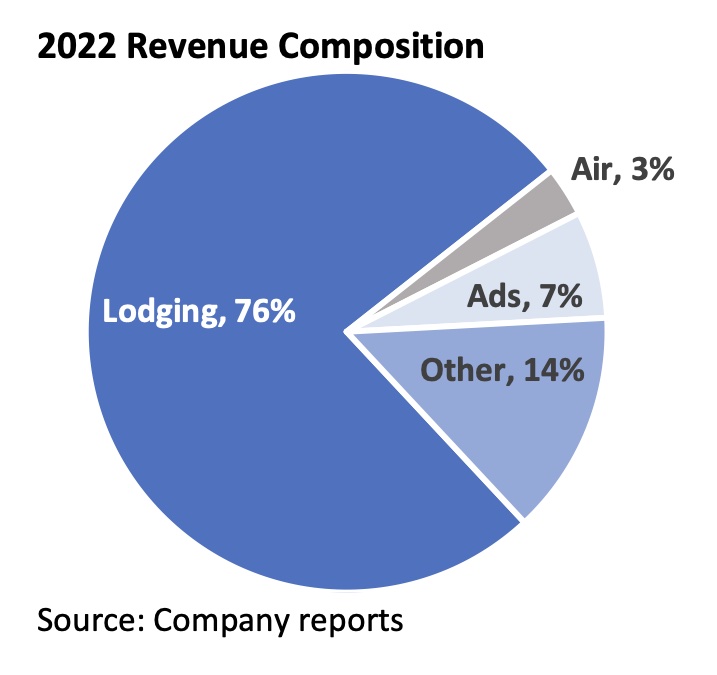

Expedia’s revenue in 2022 was heavily weighted toward lodging, as shown in this graphic from BTIG.

There is a historical irony to Booking having higher take rates than Expedia today. In the years after the Priceline Group, the former name of Booking Holdings, acquired Booking.com in 2005 and through around 2012, Booking.com took a ton of market share precisely because it was charging hotel commissions in the 10% neighborhood versus perhaps 20-30% for Expedia. That’s because Expedia was focused on the higher commission prepay hotel model while Booking.com solely did the lower-commission pay at the hotel model.

Today, both companies offer both models.

Since the pandemic, Expedia “reduced fixed costs while Booking is pushing into the U.S. and air, all of which should lead to a narrowing of the margin delta over time,” BTIG said.

Booking.com, traditionally focused in Europe, has been making market share gains in the U.S., and has been focused on expanding its flights business — where commissions for large online travel agencies may be in the 2-3% range — after years of offering accommodations only, with their higher commissions.

So these are among the reasons the margin gap between the two companies is tightening, according to BTIG.

A Bullish Assessment But Heavy Things on To-Do List

Expedia Group’s share price closed at $110.48, on Friday. BTIG has a “buy” rating on the stock, and a price target of $150. That’s based on “high single-digit revenue growth,” Expedia’s EBITDA margin expanding to more than 23%, and potentially $2 billion in stock buybacks.

There are a couple of related things that could sidetrack Expedia Group in the short-term, however. After transitioning its Hotels.com brand to the Expedia.com tech platform in 2022 and seeing ample gross booking benefits, Expedia Group is in the midst of migrating vacation rental brand Vrbo to that same tech stack to gain efficiencies. That is a precursor to imminently launching a new loyalty program that unifies the previously separate Expedia and Hotels.com loyalty programs, and extends it to Vrbo for the first time.

Tech and product integrations can be tough and if any of these moves have glitches or become problematic, they might interfere with BTIG’s upbeat forecast for Expedia Group.

The Daily Newsletter

Our daily coverage of the global travel industry. Written by editors and analysts from across Skift’s brands.

Have a confidential tip for Skift? Get in touch

Tags: booking holdings, booking.com, expedia, expedia group, hotels.com, loyalty, online travel newsletter, research, the future of lodging, travel tech, vrbo

Photo credit: A research report contends Expedia will narrow the profit gap with Booking Holdings. Source: Alejandro Escamilla/Wikimedia Commons https://commons.wikimedia.org/wiki/File:Man_with_smartphone_and_laptop_(Unsplash).jpg Alejandro Escamilla / Wikimedia Commons