There Were Fears of an Airbnb Slowdown But Then Summer Travel Demand Kicked In

Skift Take

The summer of travel is here — despite the murmur of “booking slowdown.”

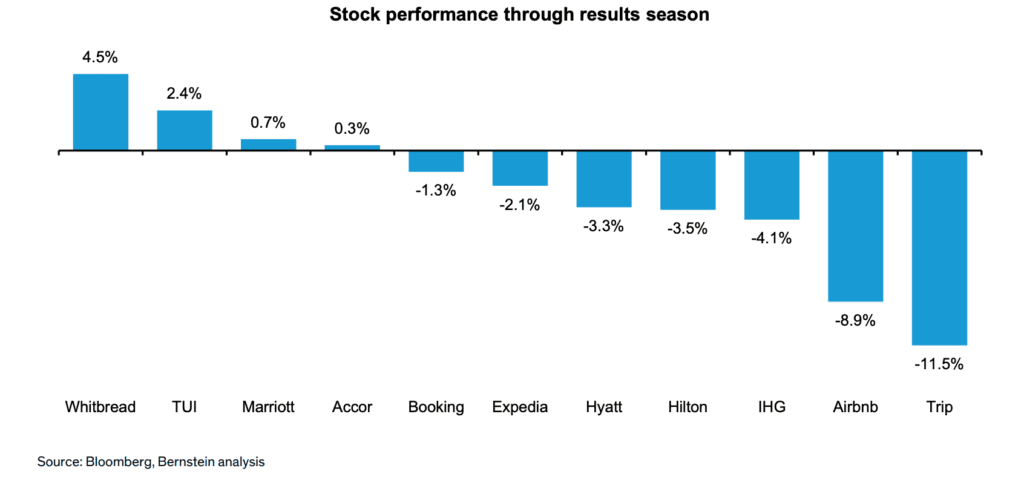

Shortly after its first quarter earnings a couple of weeks ago, Airbnb shares slid by 12 percent, hovering at $111 after Airbnb executives warned of a likely slowdown in bookings compared to 2022, when it benefited from pent-up post-COVID demand. Airbnb's shares closed at around $109 Monday.

Analysis from short-term rental data provider Key Data dispels some of that fear, finding that the number of nights booked in the second quarter globally is up 16 percent year-over-year. That’s 22.6 million more nights sold compared to the same period last year.

What the industry lost in average daily rates — which rose by a modest 1.4 percent annually — it made up for in occupancy, which grew by 15.7 percent globally, resulting in a 17.4 percent increase in revenue per available room.

In Europe and the UK, these numbers look different.

In Europe, nights booked for the second quarter are up 15.4 percent and average daily rates increased by 13.2 percent annually, while occupancy is up 10.2 percent. And in the UK, hosts are seeing a 15.2 percent increase in average daily rates, and a 14.4 percent increase in nights booked compared to last year.

Airbnb’s stock performance has left much to be desired through the first quarter earnings season. But according to analysis by the AB Bernstein, there are many variables influencing growth rates, and the firm maintains that Airbnb continues to be a long-term winner.

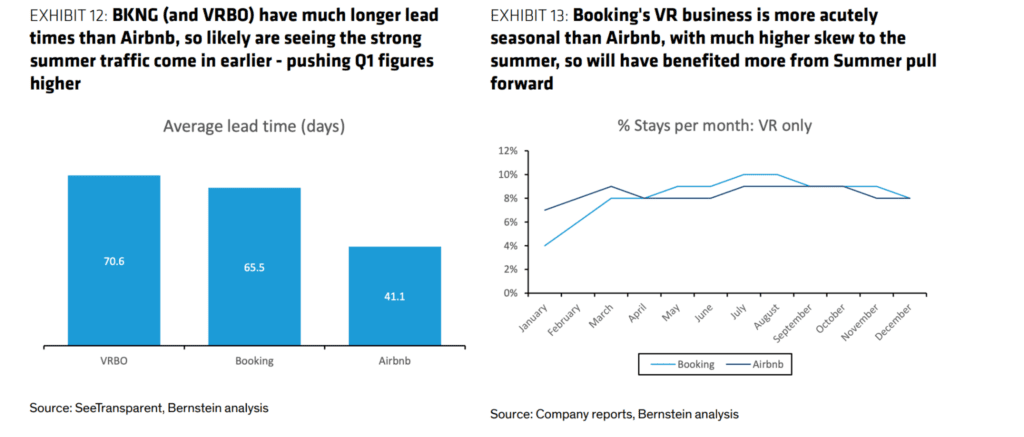

For instance, the AB Bernstein report explains that the discrepancy in growth rates can be attributed to different factors. Rival Booking Holdings benefited from an easier year-over-year comparison and geographic tailwinds, particularly in Europe. Booking's vacation rental supply is heavily skewed towards Europe.

Notably, another factor to consider is that room night trends and market share are not the sole drivers of increased profitability. Airbnb has increased its take rate and earnings before taxes, interest, depreciation and amortization (EBITDA) margin year-over-year, outperforming other lodging companies. The report says the opportunities for Airbnb to further expand its take rate from new revenue streams and sponsored placements could contribute to increased profitability and margin expansion as marketing spend decreases and scale continues to grow.

Similarly, bookings made on Booking and Vrbo have much longer lead times compared to Airbnb, allowing the companies to count for seasonal summer traffic earlier in the year.