Skift Take

When you consider that Expedia and Booking each made at least $900 million in advertising-related revenue in 2022 (though likely much more) and Airbnb pocketed next to zilch, then you know that Airbnb can take advantage of a substantial opportunity.

Booking.com does it and so do Amazon, Etsy and Alibaba, so why not Airbnb?

Airbnb co-founder and CEO Brian Chesky mentioned all these companies earlier this week when he discussed potentially launching sponsored listings and an advertising platform for Airbnb. He could have also referenced Google, Expedia, Tripadvisor and many others.

“I think it’s a massive opportunity,” Chesky said. “I think you could imagine easily adding a few equivalent percentage rates [points] of take rate if you were to scale that over time. I think there’s a lot of comparables like Amazon, one of the largest advertising platforms now in the world, Etsy or Alibaba or even Booking.com. This is a big part of their take rate.”

Take rates are generally the commissions or fees that a company collects for each booking. Airbnb currently charges hosts a 3 percent fee, and guests in the 10 to 14 percent neighborhood on average, although it varies.

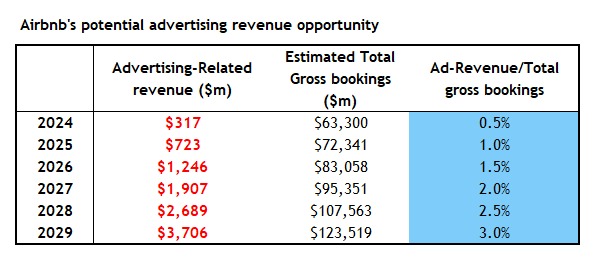

Skift Research estimated that if Airbnb debuted an ad platform in 2024 — Chesky told Morgan Stanley tech conference attendees “it’s absolutely on the horizon” — it could start slowly in its first year with around $317 million in revenue, or around 0.5 percent of gross bookings, and grow to a $1.25 billion business by 2026 at 1 percent of gross bookings. That business could soar to $3.7 billion by the end of the decade at 3 percent of gross bookings.

This would mean that Airbnb could boost its take rate 0.5 percent in 2024, 1.5 percent in 2026, and 3 percent in 2029, Skift Research estimated.

“And the bigger the platform gets, actually the more interesting monetization gets,” Chesky said. “Monetization is great at scale. So you want to get as much scale as possible. So we still feel like we’re still in land grab mode.”

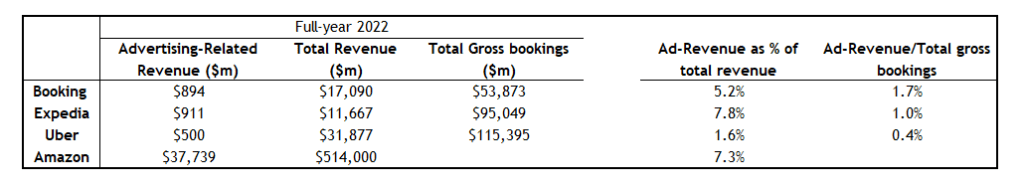

There is plenty of land to grab. Booking Holdings and Expedia Group has multiple sources of ad revenue ranging from sponsored listings to metasearch cost-per-click advertising at subsidiaries Kayak and Trivago. Though Booking and Expedia reported $894 million and $911 million in advertising-related revenue in 2022, respectively, the actual revenue they generate from sponsored listings is likely much larger than this. Uber reported a more modest $500 million in advertising, while Amazon generated nearly $38 billion, which was 7.3 percent of total revenue, according to Skift Research.

Asked to comment on Airbnb’s plans Thursday, a spokesperson said: “We are always exploring new business ideas and continue to evaluate this opportunity.”

Reported Advertising Revenue on Travel and Tech Platforms in 2022

Booking.com states its sponsored placements start at $0.50 per click.

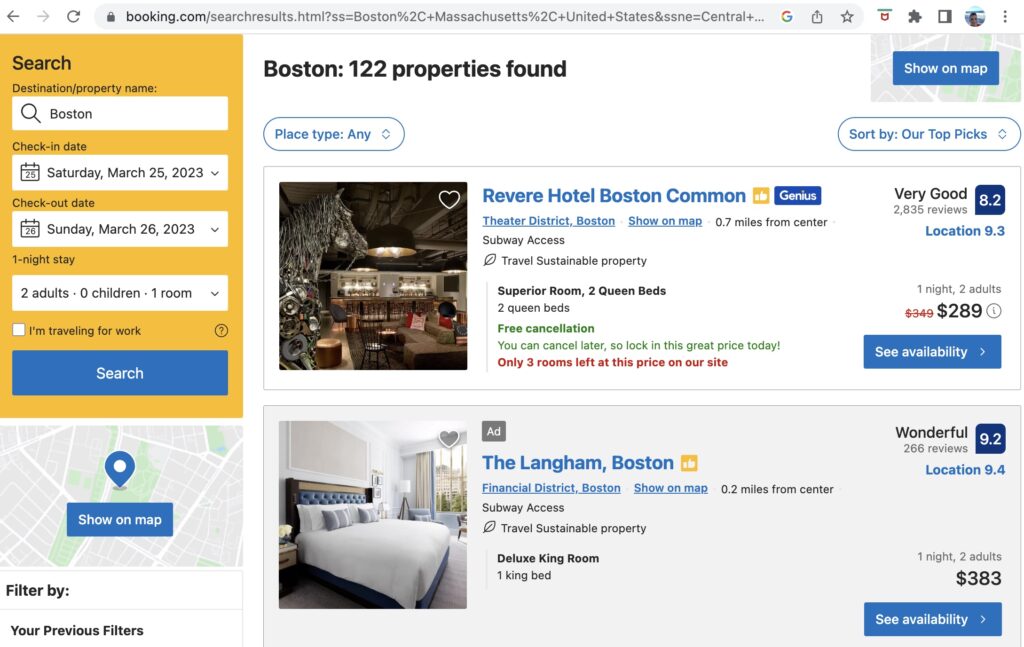

“Because most potential guests click on hotels from the first page of search results, we’ve reserved top placement on our website for Booking Network Sponsored Ads – for example, position two on Booking.com and positions one and five on Priceline and Agoda,” according to the Booking.com partner hub.

Booking.com said it gives ad positions “to the highest and most relevant bidders. Relevant criteria are based on factors such as the property’s location and classification.”

In the following screenshot, the listing for The Langham, Boston is an advertisement. If you click on the word Ad, Booking.com states: “This property spends a little extra to appear in this spot, and it matches your search criteria.”

Airbnb currently doesn’t have such advertisements.

As with many things, such as host-run and off-the beaten track tours and activities, Airbnb would most likely not want to clone the way another platform publishes sponsored listings and ads, but would do it with its own twist. About the only detail that Chesky provided was along those lines.

“And when we would do it, I would also want to do an ad platform different than anyone else,” he said. “I’d want it to be much more targeted and really abide by user experience principles and be very, very careful over turning that dial too quickly.”

That would be one of Airbnb’s challenges. It would likely not want to clutter things up with ads sandwiched between every two or three listings, like Instagram does with posts, at the risk of annoying potential bookers and driving them away.

Like Google, Booking.com and Tripadvisor, for example, many ad publishers have their own back-end platforms to enable advertisers to bid on placements, and to target specific demographics or geographies. Airbnb would likely have to build such a platform eventually, especially if Chesky wants to deliver a sophisticated, world-class product.

Asked about Airbnb potentially launching sponsored listings and an advertising platform, Kayak co-founder and CEO Steve Hafner said: “Every marketplace eventually pursues the highest monetization possible. OTAs (Online Travel Agencies) have been doing this for years. The only news here is what took them so long?”

Dwell Newsletter

Get breaking news, analysis and data from the week’s most important stories about short-term rentals, vacation rentals, housing, and real estate.

Have a confidential tip for Skift? Get in touch

Tags: advertising, airbnb, amazon, booking.com, expedia, future of lodging, google, hosts, kayak, online travel newsletter, platforms, sponsored listings, travel tech, tripadvisor, uber

Photo credit: An Airbnb host in Milan, Italy. The company is mulling launching an advertising platform. Airbnb