Business Travel Recovering in Some Markets Faster Than Others

Skift Take

The latest signals suggest that business travelers are getting back on the road in significant numbers, although a full recovery keeps getting postponed.

“We are now experiencing a major uplift since February 2023,” said Tass Messinis, a strategic advisor at Australia-based travel platform Locomote.

Messinis said that as economies recover, businesses will feel more confident investing in travel spending for meetings, conferences, and events.

“As companies reassess their business travel requirements post-pandemic, we are seeing a resurgence in 'DIY' corporate travel departments in the U.S. and Australia,” Messinis said. “Driven by new emerging technology players, corporations [can now] negotiate better rates directly with airlines, hotels, and other travel providers, resulting in greater cost savings, increased efficiency, compliance, and traveler safety.”

While travel spending globally is gradually returning to pre-pandemic levels, markets such as India are already experiencing a significant restoration.

Gaurav Sundaram, president of India-based ProKonsul Consulting, said that the overall flight data for India reported in terms of passenger numbers in 2023 has already exceeded 2019 numbers.

“There is a very strong resurgence of travel due to a high degree of economic activity throughout the country,” Sundaram said. “[There is a] desire to meet with customers.”

He added that while much of the travel in India may be domestic, international travel is certainly on an upswing long-term — even despite obstacles posed by visa regulations.

“The government is actively supporting commercial activity,” Sundaram said. “India is now slated to be the third largest economy in the world within the next five or six years.”

In the UK, many companies increased their business travel over the past year, though the recovery still has room to run, said Scott Davies, CEO of Institute of Travel Management (ITM).

Citing a recent ITM survey of 100 corporate travel buyers, managers and heads of travel, with a mix of global, EMEA, UK and Ireland responsibilities, Davies said nearly 60 percent of corporate travel buyers described the current economic environment and cost of travel as being the largest deterrents for travel volumes in 2023. Supply chain disruption and service levels (17 percent of respondents) and sustainability or net zero targets (11 percent of buyers) were additional mitigating factors.

“Business travel is an essential enabler of commerce, and that is ultimately going to be a driving factor,” Davies said. “Volumes have gradually increased over the last year, but only 28 percent of respondents in a recent ITM survey said they are expecting travel to return to pre-pandemic levels.”

Mixed Projections

A January 2023 poll from The Global Business Travel Association found allocations for travel spending among businesses broke down as 28 percent for meetings with current or prospective customers, 20 percent for internal company meetings, 14 percent for service trips, and 18 percent for conferences or industry events.

Nikki Stimson, a spokesperson for the association, note regional differences in rates of post-pandemic business trips because of varied economic, political, and geographical reasons. Yet overall the major obstacles to a more accelerated recovery include “persistent inflation, high energy prices, severe supply chain challenges, and labor shortages, a significant economic slowdown and lockdowns in China, and major regional impacts due to the war in Ukraine as well as emerging sustainability considerations.”

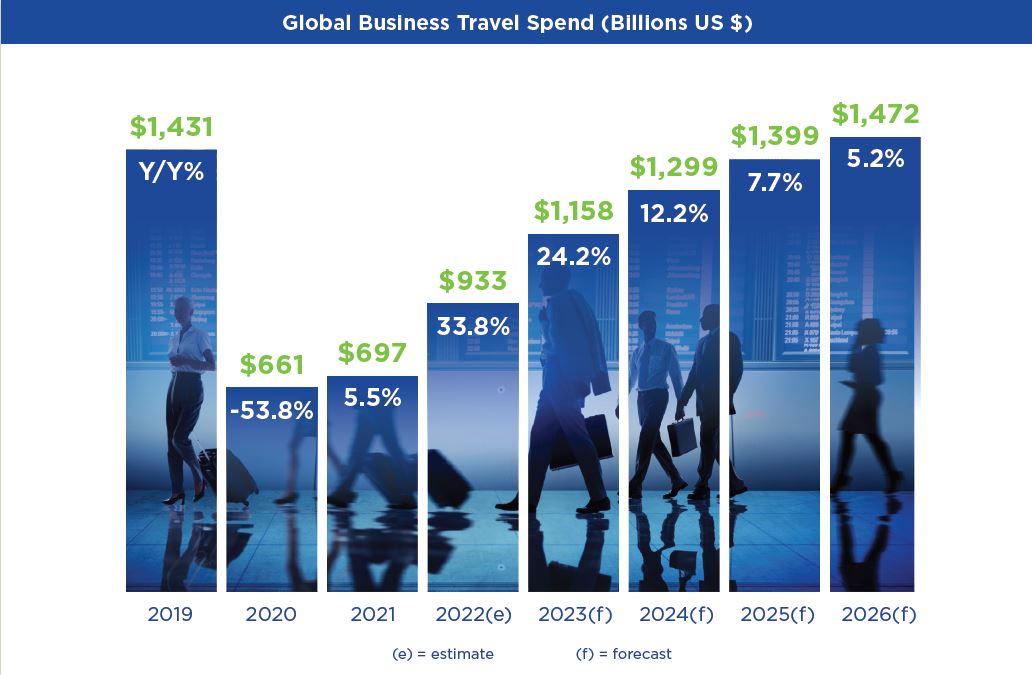

According to the association, global spending is not projected to make a full recovery to the $1.4 trillion range until about halfway through 2026 — at which point it's expected to hit the $1.47 trillion mark.

Global business travel spending in the U.S. since 2019. Source: Global Business Travel Association

These projections would estimate an additional 18 months for the travel industry's global recovery than was initially predicted in The Global Business Travel Association Business Travel Index back in November of 2021.

A Phased Recovery of Business Travel

Driven primarily by rates of domestic travel, North America led the recovery of travel spending throughout much of 2021, according to the Global Business Travel Association. Both North America and Western Europe are expected to experience drastic recoveries of compound annual growth increases of 23.4 percent (to $363.7 billion) and 16.9 percent (to $323.9 billion) by 2026.

Meanwhile, the Asia Pacific region — and more specifically, China — helped bolster recovery spending within the travel industry in 2021. The following year saw a reversal take place, due in large part to China’s Zero-Covid policy and lockdowns. However, the region collectively recovered up to 66 percent of pre-Covid levels by the end of the year.

Latin America, in turn, experienced only slight increases in travel spending during 2021 due to more gradual vaccination rates. This coming year projects 55 percent of growth in travel spending for Latin America as business travel is estimated to return to 83 percent of pre-covid levels.

During the pandemic, many businesses made adjustments to their travel policies — changes which are now continuing to evolve with a central focus on cost savings, sustainability, and safety for employees.

For example, trends such as sustainable and responsible business travel, the use of alternative lodging options, and the incorporation of leisure activities into business trips have developed as key aspects of post-pandemic travel initiatives.

“While virtual meetings have been effective during the pandemic, there is still a need for face-to-face interactions, especially for building relationships and closing deals,” Messinis said. “As businesses seek to expand their markets, they need to travel to explore new opportunities, meet with potential clients or partners and establish a physical presence in new locations.”