Skift Take

Sometimes charts and even a TikTok capture 1,000 words. A handful relay some of the opportunities facing the hotel industry today.

Taking advantage of long-term trends that may boost hotel pricing power, driving more earnings per square meter at a hotel with concepts like “hybrid hospitality,” and exploring the potential of generative artificial intelligence are all potential areas of upheaval for hotel investors, owners, asset managers, and corporate brands.

These were some of the key takeaways from Skift’s Future of Lodging Forum in London on Wednesday, March 29, at The Londoner Hotel.

We’ve picked a handful of the visuals that captured the themes discussed by industry leaders, Skift’s editors, and research analysts. These visuals seemed to resonate especially with the audience of about 250 leaders, investors, and strategists. They’re an appetizer for the session videos we’ll share over the coming weeks.

Hybrid Hospitality’s Potential

The event opened with Varsha Arora, senior research analyst at Skift Research, sharing insights on “The Experience Economy 2.0.” She highlighted potential growth areas for hotel investors and operators, such as in hybrid hospitality, luxury travel, wellness, sustainability, hyper-personalization, and the impact of generative artificial intelligence.

One opportunity cited by Arora was the “hybrid hospitality model,” which she said “offers the flexibility to switch inventory around and reuse the units of space at different times of the day to boost profitability.

One example is hotels offering coworking spaces via a more profitable proposition.

“Looking at traditional coworking spaces, they have an approximately 50-hour per week revenue potential if we assume they are open 5 days a week from 8 to 6 o’clock,” Arora said.

A traditional hotel, on the other hand, is mostly occupied between 4 pm to 10 am and is open 7 days a week, culminating in 126 hours per week of revenue potential.

“Now let us talk about a hotel that is open 24 hours all 7 days of the week,” Arora said. “By stacking the coworking model, the hotel’s real estate and hospitality offerings, you can create 168 hours per week of revenue. That’s more than three times the revenue potential of a traditional coworking space.”

“A Hotel Supply/Demand Dreamland”

Throughout the day, “cautious optimism” was the catchphrase from industry leaders. Top commercial executives at Hilton, Accor, Highgate, and Starwood said hotel demand was staying resilient despite uncertain economic conditions.

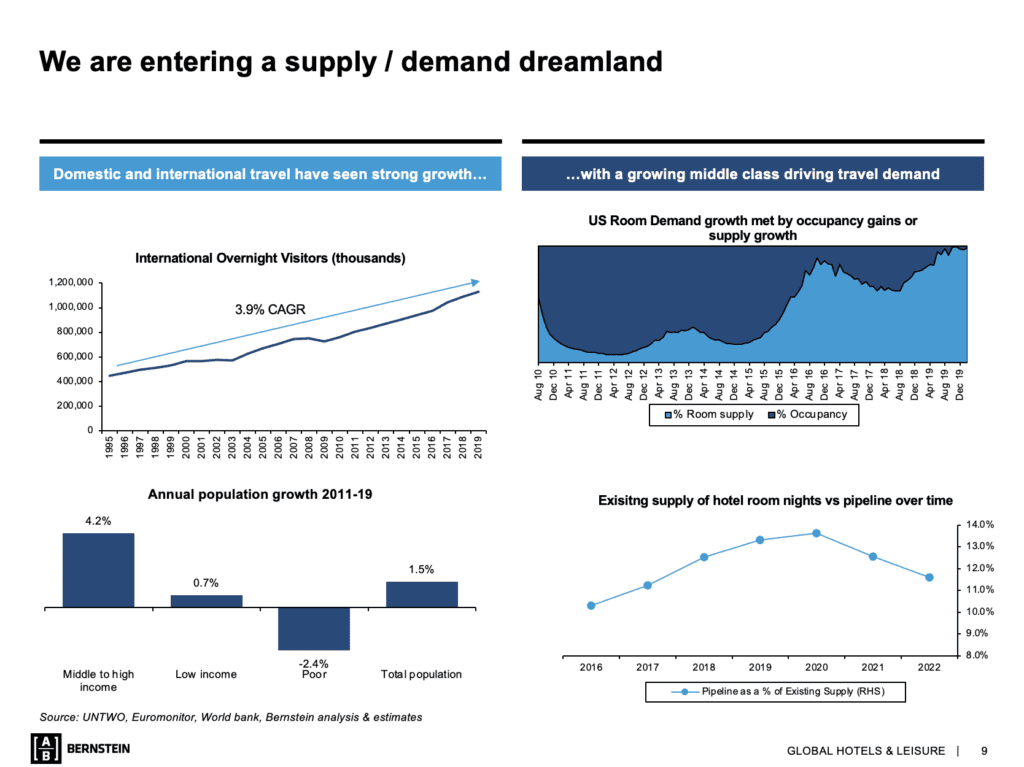

A longer-term perspective was taken by Richard Clarke, managing director at AB Bernstein. Clarke predicted a multi-year positive tailwind for hotel performance because demand will likely exceed supply in many key markets.

On the demand side, Clarke cited trends since 1996 that have seen a multi-year average growth in the middle class worldwide, which, when combined with an average annual increase in flight capacity, has helped drive gains in hotel demand of roughly 4 percent a year. Clarke suggested it was likely these demand-supporting factors ought to stay in place, on average, over the near term.

On the supply side, Clarke noted a different story.

“The [hotel development] pipeline is still down [from historical trend averages],” Clarke said. “So you have less supply and not enough to match demand.”

Generative AI and Sustainability

A couple of industry experts found a provocative intersection between two buzzy topics: generative artificial intelligence (or AI) and sustainability. The effort to measure a hotel company’s carbon emissions has been n intensely complicated, involving debates in methodology and massive, often manual, calculations and estimates about operations.

The potential of generative artificial intelligence is to ingest and analyze data and help overcome many of the current obstacles to comparing hotel performance. Data will become more real-time and consistent — potentially boosting its relevance to consumers and corporate travel managers at a time when net zero targets and weather-related crises will likely ramp up attention to the issue year after year.

During the event, Skift Research presented a rare comparison of hotel group performance based on hotel group reporting.

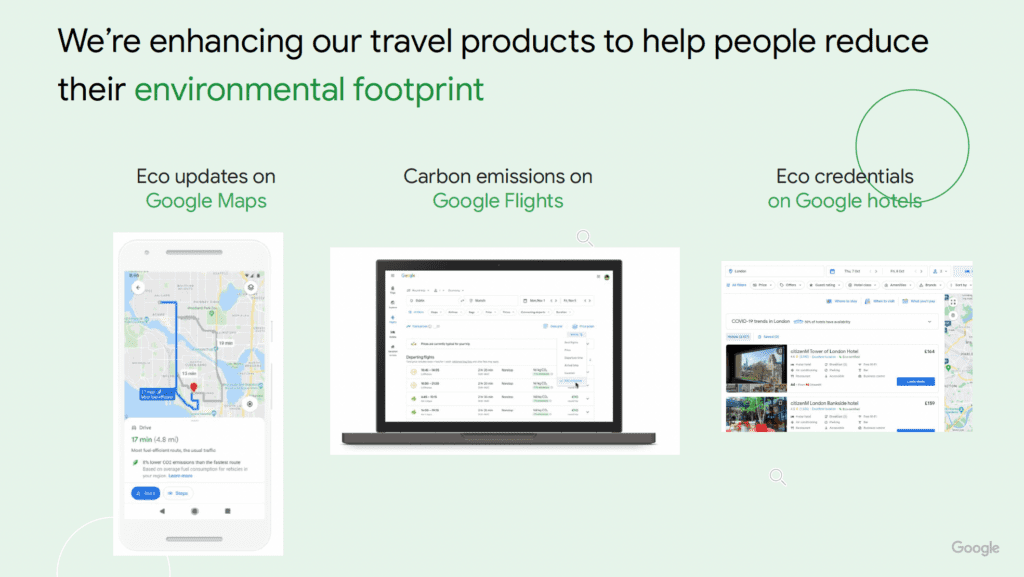

Today only investors and a handful of activists eye such data. But sustainability data will increasingly become a part of decision-making in trips, said Finnbar Cornwall, said industry sector leader for travel, Google UK.

“Google Flights counts carbon emissions down to the seat level on a flight,” Cornwall said. “We’ve built that in coalition with the industry…. We’ve published this algorithm to start to calculate the emissions on flights to help people understand the impact of their flights and to encourage them to make more sustainable options.”

Google is taking steps to offer similar information for hotels. As analysts tap the latest deep learning tools to model emissions at hotels, Google and others will be able to share that widely.

Travel’s TikTok Moment

Making brands relatable to a new generation of travelers and reaching those travelers in the channels they favor was another event theme.

Chris Silcock, chief commercial officer at Hilton, highlighted a 10-minute TikTok produced by Paris Hilton.

“It’s an experiment and a bit fun,” Silcock said. “We’re trying to be more culturally relevant and in the stream. We’re approaching 40 million views of the video and it’s doing well.”

Have a confidential tip for Skift? Get in touch

Tags: future of lodging, skift future of lodging forum, skift live

Photo credit: A presentation by Varsha Arora, an analyst at Skift Research, at Skift's Future of Lodging Forum 2023 in London. Photo by Russell Harper. Source: Skift.