Skift Take

Hilton CEO Christopher Nassetta praised the Middle East for its commitment to boosting tourism, and he explained at the recent Skift Global Forum East why public-private partnerships are critical in improving tourism infrastructure.

Hilton CEO Christopher Nassetta considers himself amazed at level of growth he’s seen in the Middle East’s hotel industry during his roughly 40-year career. Nassetta described the commitment officials in the region have made to travel and tourism as extraordinary during his appearance at the recent Skift Global Forum East in Dubai, adding he views Saudi Arabia and the United Arab Emirates as markets for significant growth.

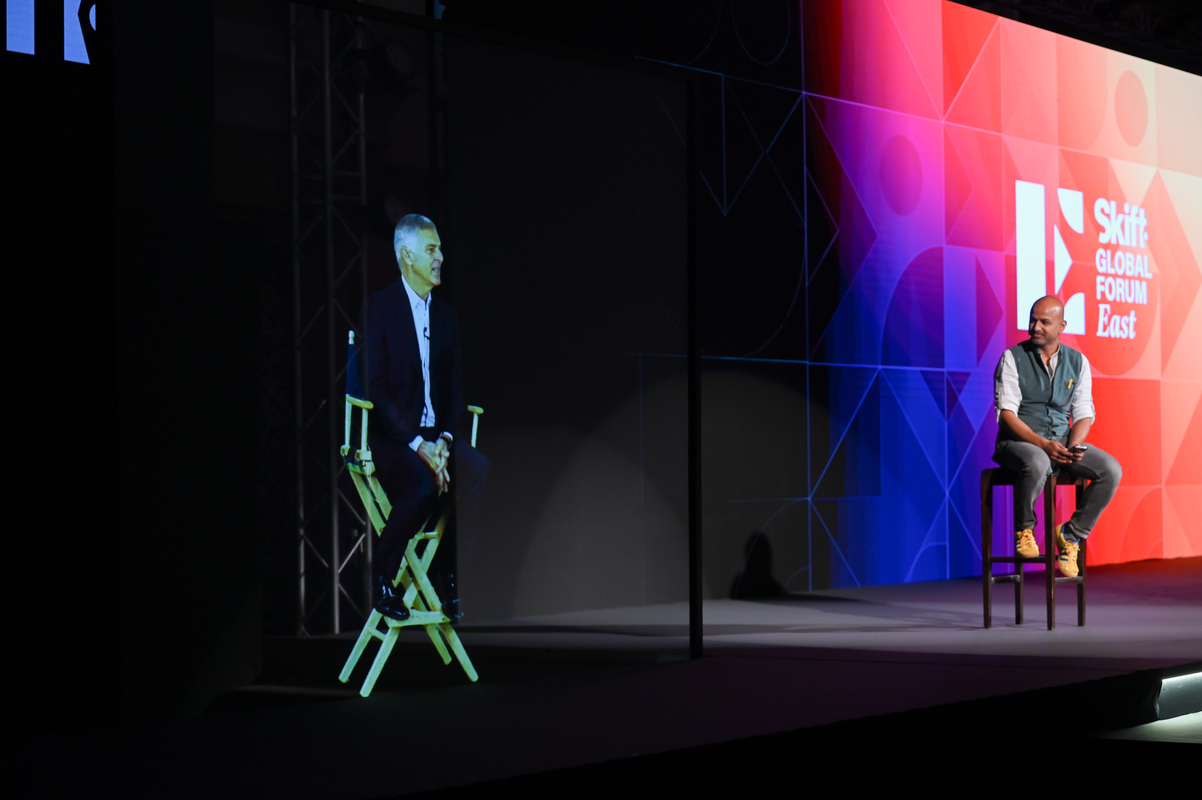

Nassetta, who spoke at the Forum via hologram, touched on his optimism about the travel industry’s recovery, Hilton’s focus on small and medium-sized businesses and why the company hasn’t made any mergers and acquisitions.

Watch the full video of Nassetta’s interview with Skift founder and CEO Rafat Ali as well as read the transcript below.

Interview Transcript

Rafat Ali: All right, folks. This is the session we’ve been waiting for. Thank you for staying. When we first started thinking about this, the screen is a very complex affair. This obviously looks very simple. I want to thank Art Media Inc, that’s the company behind this tech that you’re about to see and they’ve just done an incredible job. This is days and days and days and weeks of planning for this particular session to happen as well. So, let’s bring up Chris Nassetta. Let’s move in.

All right, Chris, thank you for being here. This is certainly a very novel experience for you. It’s also a very novel experience for us as well. This is our first ever conference that we’re bringing a speaker in as a hologram. Are you enjoying the experience so far, Chris?

Christopher Nassetta: I am. Thanks for having me. When you asked me to do this and do it by hologram, I couldn’t help but say yes because I’ve done lots of public speaking all over the world, obviously mostly live these days through Covid. Certainly some virtual, but I’ve never done a hologram, so I don’t know how it looks.

Ali: It looks great.

Nassetta: I’m really enjoying this first experience. And it was great to see you in the region. I’m sorry, I’m not there now. But as you know, I was there a couple of weeks ago and the region so was difficult to get back. So, everybody in the audience, I’m sorry. I’m not there live and we’re subjecting you to this technology. Hopefully, it’s working well over five. It’s great, great to see you and Riyadh for the World Travel and Tourism Global Summit, which was a spectacular success I think with 3,000 folks from travel and tourism all over the world, seeing what the Middle East has to offer. Great to be here. Thanks for having me.

Ali: Of course. Yeah, thank you. Thank you for doing this. When we thought of people who we wanted, your name, trust me, was the first name that came to mind that says we have to get Chris because he’s going to be totally game for this. So, let’s talk Middle East since we were both in Saudi [Arabia] just 10 days ago or so. From a Hilton perspective, why are you so interested in this region and what is your hopes from this region for Hilton?

Nassetta: I’ve been traveling to the Middle East for decades, probably 30 years or so, maybe even longer. I’m forgetting how many years I’ve been doing this, I’m going on 40 years in the industry. And to see what’s been happening in this region has been awe-inspiring. The commitment of the region to travel and tourism over these last couple of decades has been extraordinary. And the opportunity, I think, for all of us and for the region to continue to build out the infrastructure of travel and tourism and to continue to bring more people to the Middle East to see all that it has to offer, I find fascinating.

And from the standpoint of Hilton, we view it as one of the most important growth regions … In Africa, we have 100 hotels that are up and operating. We have 150 in the pipeline and growing. Gives you a sense of where we think it’s going. We talked when we were together a couple weeks ago about the opportunities in the Kingdom of Saudi Arabia, which are extraordinary, given the investment that’s going on there.

But in Dubai, I wish I was there, I feel like I’m there in Dubai. When I got to the company — I’ve been at Hilton 15 years now almost to the day — we had one hotel in Dubai. In the UAE, I think we had three hotels. If you fast forward in the UAE today we have 35 hotels open and another 15 that are going to open in the next couple of years. So, in that in the UAE, we think there’s extraordinary growth in Saudi Arabia, we think. But the region overall, I think, has extraordinary opportunities in front of it. And that’s because people want to be there, infrastructure is getting built out. There’s been a real commitment in terms of strategy in parts of the Middle East, but more importantly backed up by significant investment, significant infrastructure to make it a reality.

Ali: And one of the things that obviously is possible in this part of the world that maybe is not possible in part of the world that you and I live in is the public-private partnership, which is the biggest thing that obviously enables tourism? You are not just the CEO of Hilton, you were the chairman of the board of WTTC, you’re very involved with governments as well-

Nassetta: Many years.

Ali: And so the public-private partnership, talk about the importance of public-private partnership in building these tourism economies that we just wish is there in our part of the world.

Nassetta: Yeah, if you look at the maturation of travel and tourism in different parts of the world, obviously, many parts of the west including here in the U.S., but all in Europe are more mature travel in tourism markets. And so there’s sort of a in-place infrastructure if you will, in terms of transfer. Not that it can’t be improved for sure, but there’s an in-place infrastructure that you have built around travel and tourism.

And there’s financing availability. There are a lot of players in the industry both on the brand side, on the ownership side, on the operating side. There’s just a very big broad infrastructure, which means that it takes on a life of its own and it has a certain amount of momentum. Now that goes up and down as we know, and I’ve witnessed in this last few years relative to economic cycles and the like.

But by and large, with very few exceptions in most of the western world, you don’t need a tremendous amount of help from government. So, you don’t have as much public-private partnership. Now there are exceptions to that. You think about major convention hotels in major cities, and those are still, I think, for the most part, largely public-private partnership. But otherwise, the industry has enough substance that it has momentum in emerging parts of the world, meaning emerging economies or economies where travel and tourism is a meaningful component.

But where the aspirations are to have it be a much larger component of overall economic growth, which I think is very true in the Middle East as we were hearing it, WTTC or all of that infrastructure is not in place, meeting, airports, bridges, roads, the financing infrastructure, all of the various industry players may be there but they may be earlier in their maturation process.

It is really important in those circumstances that government work with the private sector to gain that momentum. I suspect certainly the hope would be in the Middle East and in other regions of the world where traveling tourism is, I would say, in its infancy. And when you wake up 10 or 20 years from now, that those markets too will have momentum that will require a lot less public-private partnership. And at the moment it’s needed.

And if you go back historically and you look at the origins of Hilton, we’re 103-year-old company and you look at some of the big projects that we did around the world and in the western world and Europe, in the United States. And I can think of, I won’t bore you with all the details, but I can think of a bunch of in my head, I wasn’t around but they’re part of the history of the company. They were public-private partnerships.

After World War II in many, many destinations in Europe as an example, the boss for Hilton and Istanbul was a joint venture between the Turkish government, the American government, and Hilton to get that done. And there are hundreds of examples of that around the world. So, when it’s needed, those public-private partnerships are critical. And I would say in the Middle East region at the moment, not every market is a little bit different, but I still think that in many of the markets, that partnership is critical. Dubai, where you’re sitting, to a degree, is probably a little bit less so, because that market is ahead from a travel and tourism point of view.

I don’t know whether it’s a decade but at least a decade ahead of other parts of the region. And as a result, it has built some of this momentum in some of this base infrastructure — not just transportation infrastructure but financing infrastructure, the various players in the various component parts that make up travel and tourism.

So, like Dubai certainly you could argue has built some of that momentum. But in other parts of the region that are really just getting going where we were in Riyadh and Saudi Arabia, obviously, huge investment going on with in Saudi Arabia in public-private partnership of which we’re fortunate to be part of to gain that, build that infrastructure and gain that momentum.

Ali: In terms of the portfolio that you have, one of the things that we’ve heard to this day, one of the things we heard in Saudi [Arabia] when we were there as well, is a focus on luxury. And Hilton is a brand that spans obviously across the board. It’s not just luxury, you span across the board. Do you think we’re going overboard with luxury in this part of the world?

Nassetta: No, I don’t in the sense that all of the segments are underbuilt at the moment. If you look at the demand equation, we go through cycles of ups and downs everywhere in the world. But if you look at it broadly over time, I think all segments of hospitality are underserved in the Middle East region broadly. Now, I’m not going to get into sub-market by sub-market because we don’t have the time for that, but broadly I’d say all the segments are underrepresented.

So, no, I don’t think broadly that we’re going overboard on the high-end. I do think, and this is something I say frequently and in fact, I said it, as you know, on stage at WTTC in Riyadh just a couple weeks ago. I do think that what is critical to build out this infrastructure that I’m talking about for travel and tourism is building a network effect.

So, that’s certainly what we at Hilton are focused on. We love luxury, we love doing Conrads, we love doing Waldorfs, we love doing LXRs, everywhere in the world and particularly in that region we open… I went and saw three brand new Waldorf Astorias in two days when I was in the Middle East last 10 days ago. And it brings joy to my heart and I love luxury and I’m, I’m a luxury customer. But also, I’m every other customer, have different type of trip occasions that require different products and different price points in different kinds of locations.

If you look at the most powerful travel and tourism markets, they have built a network effect that are able then to serve people for what their travel needs are as those adapt and change depending on the trip occasion. So, what that means to me is you have to cover different product types, different price points to build the network effect.

So, as an example, using Hilton, since you got me and I have to push my products, the mid-market, the thing that I don’t think gets enough attention anywhere in the world but certainly does from us, the bulk of the consumers in the world are in the middle class. The big trend everywhere in the world and happening in the Middle East as well is growing middle classes. That’s where you have the greatest growth in the numbers of people.

The middle class wants mid-price products. So, in the case of Hilton, that would be like Hilton Garden inn, Hampton by Hilton, Tru, extended stay might be Homewood, Home2, depending on again trip occasion for why people are traveling. Building a network effect for us certainly at Hilton so that we can serve any customer anywhere in the world, including the Middle East for any need they have requires that we have those mid-market destinations, those dots on the map.

And so as I was at WTTC, there was a point, on stage and I made in individual meetings, it’s like, “It’s great, we’re dying to do luxury. We love luxury and I love luxury. We’ve got incredible growth. Our luxury brands are some of the fastest growing on earth.” But if we really want to build out a network effect for travel and tourism and certainly as we think about it at Hilton, we need to make sure that we pay close attention to the mid-market to make sure that in secondary and tertiary markets, we’ve got dots on the map with good product that allow customers to travel to those destinations in addition to having the high-end cover.

Ali: Thank you. That was very detailed. Let’s talk a little about macro. Obviously, you sit on so much of data, and we talked about this two weeks ago, are you seeing any weakness anywhere in the world?

Nassetta: We’re not. We’re not. And I start every Monday with an executive committee meeting of the top people in the company that represent the entire world. And my first question is, “Any cracks? Any cracks in the armor in terms of what we’re seeing in recovery? Any cracks in any of the segments?” And the honest truth is we’re not seeing any. You can see it in the star data all around the world.

Obviously, China had been. Latin [America] is lagging in recovery. It’s a big world and every part of the world’s a little bit different story, but I would say is broadly the world is in strong recovery mode in our industry with the exception of China. And that is now morphing to what we think is going to be a strong recovery mode we will see over the next 60 or 90 days. But it certainly feels like it’s going that direction. We can already start to see it in the daily data.

But outside of that, in the rest of the world, things continue to be quite strong. Everybody asks me if the world is getting weaker, why do you think that is the case? And now I should be letting you ask me that, Rafat, but I’m now doing my own [questions and answers]. But it is the question everybody’s asking. It’s like, “All right, well, you know the macro, particularly in the west, macro conditions are slowing ’cause central banks are making sure of that.” But what’s underneath it all is some bigger tailwinds that are allowing us to remain strong in recovery across all segments.

And what are those? One is people are definitely shifting spending patterns, going from spending all their time buying things to wanting experiences. And that’s fabulous for our business. So, there’s a huge shift back that is still ongoing to people wanting to get out, experience things given what they they’ve dealt with the last couple years.

The other thing is the world’s opening up. Right now, the borders are not widely open everywhere, but most everywhere, hopefully soon China. And so reality is people have built up a lot of needs to go see parts of the world or desire and need, and so international travels coming back. And then there’s just a significant amount of pent-up demand. Let’s be honest, people have pent-up demand for leisure, they got locked up for two years, they want to live their life and they want to have more experiences.

All the business trips that people didn’t do, they’re doing. And look at what we’re doing here. Sadly I’m not there because I was there 10 days ago. But meetings and events, it’s off the charts. I’ve never been to more meetings in one year in my life than I’ve been in. I think objectively and statistically that’s true. Why? Because we stacked so many different things up across the industry, across our company that we’ve had to get out.

And if you look at it in the next year or two, the forward-looking bookings and meetings and events are off the charts. Partly pent-up demand, partly new demand. So, you have all of those tailwinds. And from a secular point of view, you also have a world that’s becoming, which I think is a longer term tailwind in addition to people wanting experiences more than things, which is what was happening pre-Covid and now happening. People are more remote. So think about it, during Covid, everybody figured out how to work remotely and office environments have changed. And they’re normalizing to a degree, you’re 100 percent remote at this point-

Ali: As a company, correct.

Nassetta: …I’m told.

Ali: Yes.

Nassetta: And so what does that mean? You’re a good example. Your people have to travel, they have to eventually go places. And what does that mean? They’re staying in our hotels, you’re probably hosting meetings I hope in Hiltons — not in the competition — because you don’t have office space. You may be the more extreme in the sense of being completely remote, but most businesses have become more remote, a significant percentage of their workforce is more mobile.

That’s a really good long-term secular tailwind for our business. So, listen, there are some headwinds. There’s no beating around the bush, the macro environment’s going to slow, but these tailwinds that I’m talking about feel quite powerful and I think will propel us for some period of time through these headwinds.

Ali: So, you talked about business travel and let me confess, you were right on business travel.

Nassetta: You told me I was going to be wrong.

Ali: I did. I did. You were right.

Nassetta: It was the day you gave me that really cool slot in New York, the last speaker of the day. I’ll never forgive the call.

Ali: Yes, yes. But we had a great interview.

Nassetta: We did. I enjoyed it. I’m teasing.

Ali: And so one of the things I was reading to your latest earnings calls and you said on this earnings call, “What held up business travel during the pandemic? What is still holding up business in business travel is the small and medium businesses.” And you have, I don’t know if I want to use the word pivoted, but you’ve certainly focused on small and medium businesses as your corporate travel side of your business. So, talk about that versus the large corporates.

Nassetta: Yeah, well we love all our customers. Let me be clear whether they’re small, medium or big, we love them all and we want to do a great job serving them pre-Covid. This is something I don’t think many people focused on. I did and our team did, but most people outside our direct ecosystem and that is 80 percent of business travel at Hilton was SME, small and medium-sized enterprises pre-Covid. So, the vast majority, super majority, of our business travel has always been that type of travel.

So that meant 20 percent were the large corporate. And we love great relationships with many, many of the large corporate entities that have traveled needs. During Covid, what happened is a lot of the large corporates basically slash all travel, both for financial reasons but also health and safety. Where [small and medium-sized enterprises] did not, they just didn’t have the luxury of doing it. First of all, it’s not as efficient a market in the sense that they’re small and medium players, they don’t necessarily have a travel department, a procurement department.

And their business is such that they don’t have the luxury of just saying, “I’m not going to travel because they got to keep the business going. And so what we found during Covid is they were much more resilient. Everybody stopped at the beginning of Covid, let’s be honest. There wasn’t anybody traveling, but very rapidly, the [small and medium-sized enterprises] business recovered because they needed to. And we found it to be much more resilient. And during Covid it was probably 95 percent of our business, and the large corporates had diminished greatly. And now, I wouldn’t say we pivoted because it was already 80 percent of our business, but we’ve probably leaned a little harder on that and I think we will longer term.

So, I don’t know exactly where we’ll end up, but if it ended up at 85, 15, it wouldn’t surprise me. And we like that, it’s more resilient, it’s lower beta, it’s higher paying business because the nature of the business. But again, we love all our customers. It’s not like we’re going to say we don’t want to serve the large corporate, of course, we’re one of the biggest players in the world. We need to and we’ll continue to serve them. So, I would say it’s leaning a little bit heavier that direction. We think longer term that is probably better for our ownership terms of pricing, distribution, cost, resiliency, just being a lower base.

Ali: Speaking of ownership, I would say have famously sat out-

Nassetta: I can’t hear you.

Ali: You can’t hear me? I guess-

Nassetta: Now I can hear you.

Ali: You can? Okay. So, you have famously sat out the big [mergers and acquisitions] Gold Rush, would it be fair to say? But you are a deal guy, your whole life, you’ve been a deal guy. And you and I talked about-

Nassetta: Can you imagine a guy that was born and raised on [mergers and acquisitions] has… I’ve been running Hilton 15 years and we’ve bought nothing. We’ve done zero [mergers and acquisitions]. Now, to be fair, we’ve done a lot of really interesting transactions. We went private, we went public, we broke the company into three pieces and made it three public companies instead of one. So, we’ve done a lot of fun financial engineering and transactional work, but we haven’t bought any. You’re right.

Ali: So, tell me what your philosophy is on that.

Nassetta: Philosophy’s really simple and that is we’re all about basically serving the customer as best we can. Giving customers, products, service, technology that is reliable in a friendly way, that is better than everybody else, and as a result, they’ll pay us a premium. And so as we look at, we have a huge base, obviously, we’re 1.1 plus, almost 1.2 million rooms, 7,000 plus hotels, 126 countries. We have a wonderful network.

So, we have scale, we don’t have to do things just scale. So, as we look at the segments that we have or those that we view might provide an opportunity, then we look at how do we deliver the best product for our customers and how do we do it in the way that is most advantageous for the shareholders that own the company. And so we look at everything. Ironically, I have an [merger and acquisition] team, as you point out, I have an [merger and acquisition] background. We love looking at things. It’s fun to analyze them and we learn things.

But the reality is when we put it through our filter of how do we deliver the best product for our customer and how do we do it in the way that is most advantageous for our shareholders. Every time so far, and I suspect, that pattern will continue. We determine that we’re better off if we see an opportunity developing our own brand. I would say when I got to the company, we had nine brands, we have 19 more than double the portfolio brands. They’re all successful. Some of them are a little bit early in gestation, many of them have matured quite rapidly. They’re very successful. Why? Because we have designed these in a modern context around exactly what customers want and we built it out of the dust.

We built it with our own blood, sweat and tears, rather than paying a big price. It’s been great for our shareholders infinite yields effectively by creating these and creating brands that really resonate with our customers. I would say that’s why when you look at our market share, you got all the Smith travel numbers, you would see on average our brands significantly outperform any other portfolio brands in the business.

So, when we look at things, it’s not that we don’t like things, it’s just every time we look at it we realize everything has… We don’t want to have to go fix other people’s problems when we already have scale and we become very good at organic brand development and we can deliver very precisely what we think best want.

Ali: You and I have talked about this many times before, but you are also a company that has famously set out anything in the alternative accommodation world. And you want to stick to hotels, you’ve told me many times we’re going to continue to stick to hotels. For the benefit of this audience, what’s your latest thinking on it?

Nassetta: Same. Let me be clear. Yes, you’ve accurately describing our conversation. We are in, to a degree, alternative accommodations. Think about it. We have residences for Waldorfs and Conrads. We have Hilton residences all over the world. So, basically Hilton apartments in various regions in the world. That’s not been a big thing in the U.S., but in other regions of the world… One of our spin companies was Hilton Grand Vacation, which is clearly an alternative accommodation and we have a 100-year relationship with them, with their brands. And so we’re in the alternative accommodation business that way.

The other way we’re in it, if you think about it, is in the extended stay business. And I think there may be more opportunities in that arena, which is a bridge, that’s not a traditional hotel business or a different stay occasion. And you can think about the spectrum of extended stay that could go even further out relative to the brands that we have. And I’ll leave it at that, we’re always looking at those options.

So, we’re in the alternative accommodations market in a pretty big way if you aggregate all that. What we’re not in, which is what you and I talked about, is home sharing. And the reason that we’re not in it is not that we don’t think it’s a good business, I think it’s a great business. And some of our customers like it use it. And when we talk to them, it’s something that for certain stay occasions they like. But it’s not why they come to us.

Why they come to us is because, and pay us a big premium, is because we deliver high-quality, consistent products, service, amenities, loyalty program, technology that connects all the dots together. And in the end deliver what we hope is a very reliable, high-quality, friendly experience in a way that we just don’t think can be done in that other environment. Again for a certain stay occasion, a value leisure, more extended stay, higher occupancy, stay occasion if that makes sense. But it’s a different value proposition.

The whole strategy of our company, if there’s no other takeaway, we want to be the premium player. We’re not the value player. Even at our lowest price point, like Tru or Hampton, if you look at the average market share of those brands, they’re 120 to 135 percent market share. So, even at those lower price points, we’re getting a 20 or 30, 20 to 35 percent on average premium. So, we think about everything in the context of we want to be the premium player in those segments.

If we deliver at the various price points for the various product types, the best experience, and the best product, the best technology for our customers, they’ll continue to seek us out and pay a premium. We can’t do that, and we believe it is very difficult if not impossible to do it the same way in home sharing, then we’re not interested at the moment participating.

In the other areas that we talked about Hilton Grand vacation, Hilton residence and Waldorf, we can. We can deliver on that promise to our customer, if you will, in a way that we just don’t think we can in home sharing. So, home sharing is the one element, where we are still very much of the mind. That’s not something that we should or need to be doing or frankly when we talk to our customers, they really want us to do.

Ali: Right. We have about a minute or two left. As I mentioned, you’re also very active at the government level. I would be remiss not to ask about the visa wait times to the U.S., and your views on why that needs to change. For those of you who don’t know, if you need a visa to come to the U.S., the wait times in many parts of the world are now incredibly long.

Nassetta: Astronomically.

Ali: Astronomically. And from India, it’s now crossed, in Mumbai, 1,000 days to get an appointment to get a visa to the U.S. And so, obviously, the U.S. is losing out in a huge way on tourism boom that’s going on all around the world. So, from your perspective, what do you think the industry can do?

Nassetta: We’re working very hard on that. I’ve been working on this for most of my career. I can remember during the early days of the Obama years in his first administration, same thing. We had wait times from Brazil, India, China — they were six months, nine months. And we were really losing a lot of travel as a result. And we worked very hard with the administration. To their credit, they have it unearthed and they drove all of the wait times way down in a significant way.

I think we’ve gotten out of whack by no malicious intent honestly. I think that governments broadly and in our government here has had a lot on its plate to deal with. And you didn’t have orders open for the last couple years in a significant way. So, I think those muscles atrophied a bit, but we’re very focused on it.

Starting, I believe, in March I take over as chair of the US Travel Association, the USTA. And it’s one of our primary objectives, we are already, well I’m not chair yet. I’ve been very active. We’re actively engaged at all levels of government to continue to work on that. And I’m optimistic that we will again. Like anything, it just takes focus. It’s mom and apple pie in the sense.

Exports for the country, good for the economy, good for jobs. It just requires to focus and attention, and I think as things work away from Covid and health and border restrictions to more policies that are focused on opening borders. I think we’ll have great success. So one of the most important things I will do in the new year as I take over here, [is] best travel.

Ali: All right. With that, we come to an end. Chris, how was this experience for you so far?

Nassetta: It was great. How was it for everybody there? How was it for you?

Ali: I guess they’re clapping, so they seem to enjoy it.

Nassetta: I can’t see the crowd.

Ali: You can’t see the crowd there. We had to put the lights down because obviously this is being beamed in, but I just-`

Nassetta: Yeah, it’s dark. I see some shadows of the crowd. I’m really sad I can’t be there. I’d loved Dubai and Skift, you guys are terrific. You do such a good job covering me. I always say, Rafat, you can be tough, but you’re fair. You cover [these companies] well and we love the partnership we have. Industry is better for you.

Ali: Thank you. That’s very nice of you to say. Thank you, Chris. appreciate it.

Nassetta: Yeah, great to be here.

Have a confidential tip for Skift? Get in touch

Tags: Christopher Nassetta, hilton, mergers and acquisitions, middle east, Middle East tourism, sgfe2022, skift live

Photo credit: Hilton CEO Christoper Nassetta (left), appearing via a hologram, with Skift founder and CEO Rafat Ali at Skift Global Forum East in Dubai. Skift